PC sale across the world reached a new high during the third quarter after the initial steep decline in the first quarter owing to the pandemic.

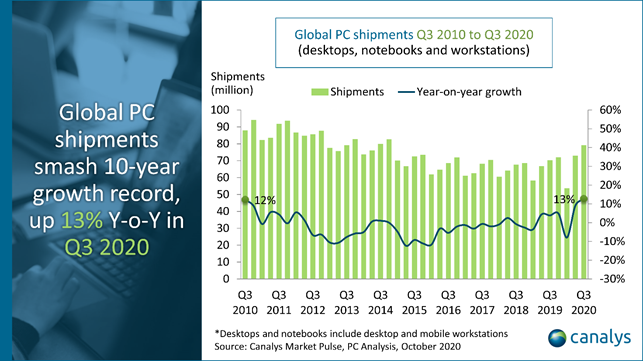

Recently released data by Canalys shows the global PC market reached 79.2 million units in Q3 2020. This is a 12.7% increase from a year ago, making it the highest growth the market has seen in the past 10 years.

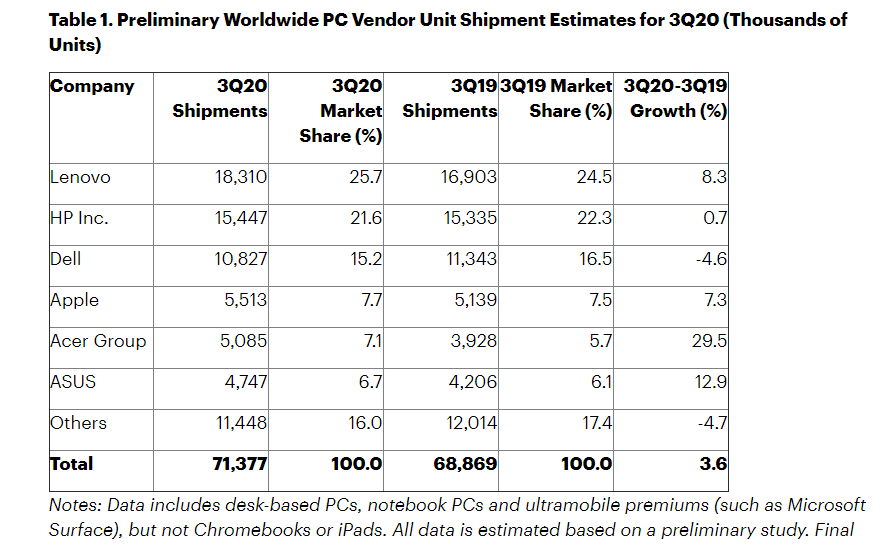

Similarly, Gartner also reported huge growth in the quarter. However, the numbers reported were lower than Canalys. According to Gartner, Global PC shipment 71.4 million units, representing an increase of about 3.6% year on year instead.

In comparison, IDC analysts found that PC shipments totaled 81.3 million units worldwide during the third quarter, an increase of 14.6% year on year.

The reports show that huge growth was propelled by the COVID-19 crisis. According to Mikako Kitagawa, research director at Gartner, the pandemic brought in the strongest consumer PC demand in the past five years.

“PC supply chain disruptions tied to the COVID-19 pandemic have been largely resolved. The business PC market had a more cautious dynamic this quarter. Businesses have continued to buy PCs for remote work, but the focus has shifted from urgent device procurement towards cost optimization.”

Mikako Kitagawa, research director at Gartner

Suggested read: HP Records Highest Gain in Market Share as Global PC Shipment Rises by 2.8% in Q2 2020

Lenovo, HP, Dell remain top vendors

Gartner’s list of top vendors was led by Lenovo with a growth of 8.3%, to record about 18.3 million PC shipments during the quarter. HP follows with a growth of just 0.7% to get 15.4 million.

Dell comes in third with a shipment of over 10.8 million but suffered a decline of 4.6%. Apple and Acer complete the top 5 rankings with a growth of 7.3 and 29.5% respectively.

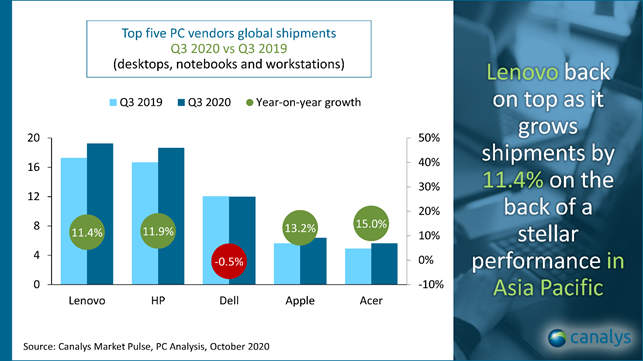

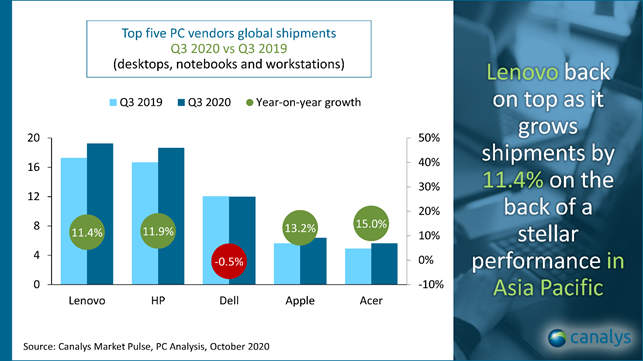

Canalys and IDC also reported a similar ranking and trend. Lenovo, HP, Apple and Acer all recorded growth above 10% while Dell suffered a decline of 0.5% during the quarter, according to Canalys.

While IDC reported that Lenovo carried 23.7% of the global market with more than 11% growth, HP has 23% of the market to take the second spot. With Dell, Apple and Acer rounding up the top five vendors.

Across most vendors, desktop and desktop workstations saw a decline. Canalys reported that while shipments of notebooks and mobile workstations grew 28.3% year-on-year, desktop and desktop workstations saw shipments shrink by 26.0%.

Lenovo experienced a decline in desktop shipments, but the decline was not as steep as those experienced by HP and Dell

Suggested read: Avoid crashing Your PC – Here are 5 Ways You Can Manage Millions of Tabs on Your Browser

Africa records 0.5% growth

The PC market in Africa and the rest of the EMEA region remained relatively flat in Q3, with just 0.4% YoY growth to 19.5 million units.

However, consumer demand for PCs was strong due to the sales of aggressively priced notebooks for children and students as well as high-end gaming machines to support the entertainment needs of families.

In the US market, PC sales were particularly strong during the quarter with an 11.4% growth year over year. This is the first time in ten years that the region has seen double-digit growth.

The Asia Pacific on the other hand showed moderate growth of 3.3% from the same quarter last year. According to Gartner, the positive increase across regions indicate a consistent recovery after a significant decline earlier in 2020.

In summary, after a weak Q1, the recovery in Q2 continued into Q3 this year, even growing on top of a strong market the previous year. All the reports reviewed show a consensus that Global PC shipments reached a record high during the quarter.

IDC’s Jitesh Ubrani noted that if the market not been hampered by component shortages, shipments would have soared even higher during the third quarter as market appetite was unsatiated.