The Nigerian Senate is set to commence investigations regarding the excessive charges by commercial banks on customers’ accounts. The decision was reached after a motion by former Minister of Interior, Senator Patrick Abba Moro at the plenary yesterday.

Following several complaints by Nigerians over being continually overcharged by banks, the Senate has implored the Central Bank of Nigeria (CBN) to monitor banks’ compliance with the guideline on charges which has been reviewed downwards.

Suggested read: CBN Reduces ATM Withdrawal and Electronic Transfer Fees in New Bank Charge Guide

While speaking at the plenary, Senator Moro highlighted that banks make extra deductions on Automated Teller Machine ATM withdrawals, debit/credit card renewals, electronic transfers, SMS alerts as well as account maintenance.

He stressed that some banks in the country charge up to N52.50 for intra-bank transfer, N93.13 in account maintenance fees and peg their maximum ATM cash withdrawals at N40,000.

“Nigerian banks in a bid to further extort customers have set most of their ATM machines to dispense cash below the maximum sum of N40,000 that ATMs are programmed to dispense per transaction,” Moro said.

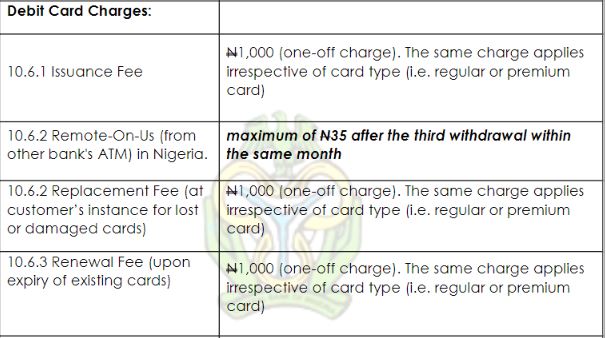

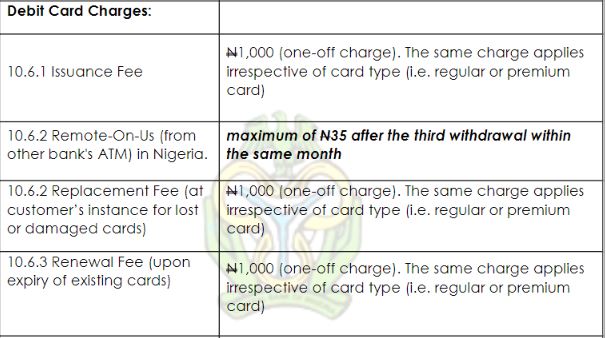

He explained that this ploy by banks forces customers to withdraw smaller amounts per transaction and incur the added cost of N65 after their third transaction via other banks’ ATMs. He also mentioned how banks’ refusal to give back ATM cards stuck in their machines means customers have to pay N1000 ATM renewal fee every time such happens.

Nigerians Paying N30 Extra On Inter-Bank ATM Withdrawals

According to the 2019 CBN Guide to Charges by Banks implemented on 1st January 2020, banks are mandated to charge a maximum of N35 after the third withdrawal within the same month by a customer using another bank’s ATM.

But apparently some banks are still charging customers N30 extra at N65, which is almost double the amount stipulated by the CBN. This means that for such banks, if a customer transacts via another bank’s ATM 6 times within the same month, the bank charges a total of N195 instead of N105 for the 4th, 5th and 6th transactions.

Customers therefore lose N30 to the banks on every ATM transaction carried out after the third one in the same month.

Additional Fees on Electronic Transfers and Card Maintenance

Going by the 2019 CBN guide, customers are to be charged N10 for electronic transfers below N5,000, N25 for N5,001 – N50,000 and N50 for amounts above N50,000. Customers also pay 7.5% VAT on each transfer.

According to Moro, there are banks still charging customers the previous N50 electronic transfer fee despite the CBN review.

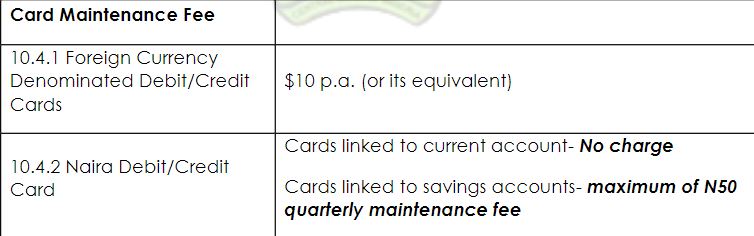

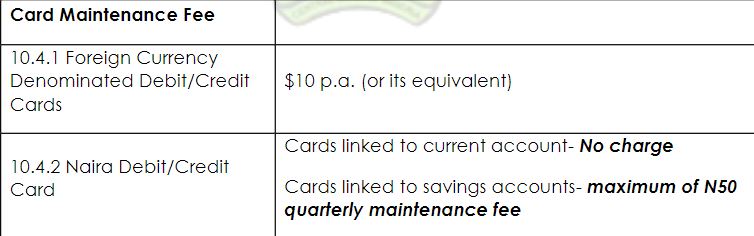

Also, the debit/credit card maintenance fee stands at N50 charge for each quarter, not per month. Banks are therefore expected to charge a maximum of N200 card maintenance fee on a debit/credit card annually.

However, some banks are still flouting the CBN directive by charging customers N50 monthly in card maintenance fees.

This implies that certain banks’ customers are still paying N600 annually, N400 more than they should pay for card maintenance.

Data from the Nigeria Inter-Bank Settlement System (NIBSS) show that as of March 2018, there were 38 million active ATM cards in the country. Bank customers should therefore be paying about N633 million to banks as card maintenance per month totalling N7.6 billion in a year.

Non-Compliant Banks Should Be Sanctioned

The CBN guide clearly states that “financial Institutions are to note that any breach of the provisions of this Guide carries a penalty of N2,000,000 per infraction or as may be determined by the CBN from time to time.”

Banks which are found guilty of contravening the CBN guide should be sanctioned as stated. The CBN had also maintained that banks which fail to comply with the directive will be fined N2 million daily until the directive is complied with.

Apart from over-the-top charges on electronic transfers, ATM withdrawals and debit/credit card maintenance, Nigerian bank account holders have also accused banks of extortion through charging multiple stamp duties beyond what is payable.

Going forward, it is therefore imperative that banks found to be flouting the CBN directive are duly penalised so as to ensure that average Nigerians don’t bear the brunt of their misdeeds.