Nigerians have kicked against the Federal Government’s decision mandating all persons holding accounts in various financial institutions including banks and insurance companies to complete and submit a Self Certification Form.

The Federal Government made the announcement via its official twitter handle.

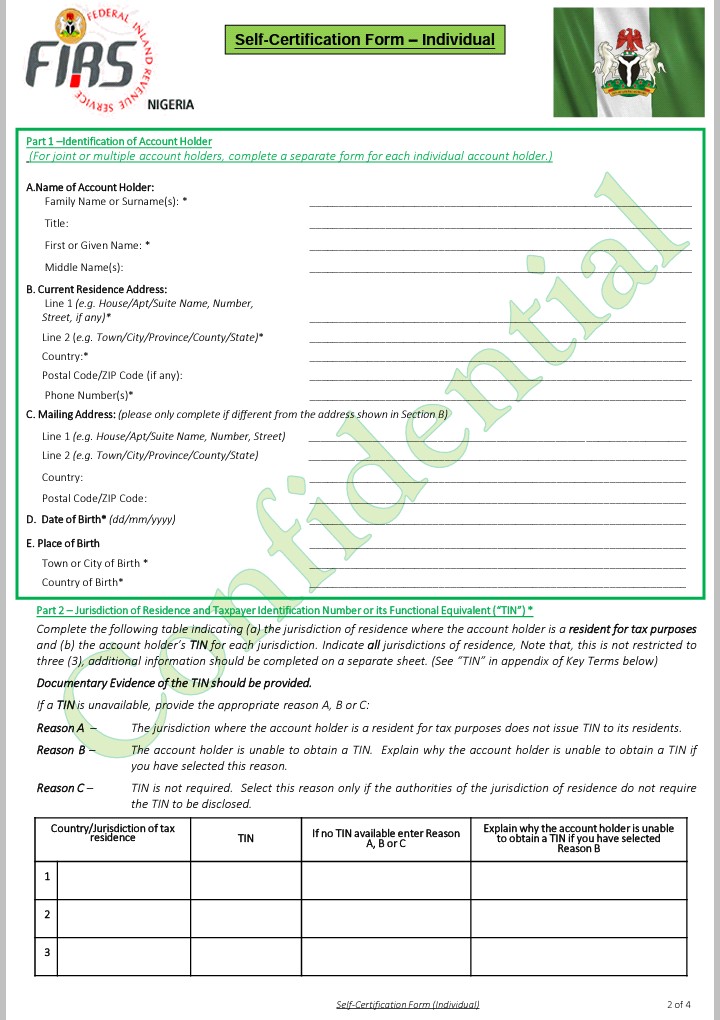

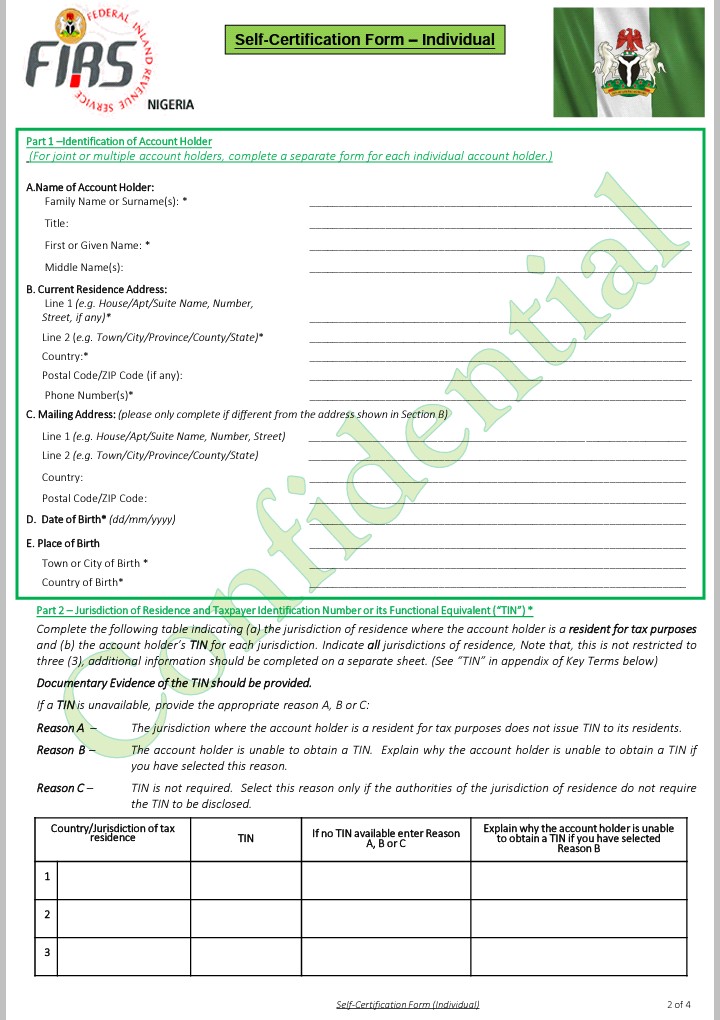

According to the government, “persons holding accounts in different financial institutions is (sic) required to complete and submit the form to each one of the institutions. The forms are required by the relevant financial institutions to carry out due diligence procedures in line with the Income Tax Regulations 2019.”

The self certification form is in 3 categories: – Form for Entity – For Controlling Person (Individuals having a controlling interest in a legal person, trustee, etc) – Form for individuals.

FG statement

Both individuals and corporate entities will be required to fill and submit the Self Certification Form to every financial institution where they operate an account.

Going by the government’s statement, defaulters of this directive will be sanctioned through fines or may have their financial assets frozen.

Nigerians slam the Self Certification Form

Nigerians have shown their dissatisfaction with the government’s Self-certification decision which, according to many of them, defeats the whole essence of obtaining Bank Verification Numbers (BVN) in the first place.

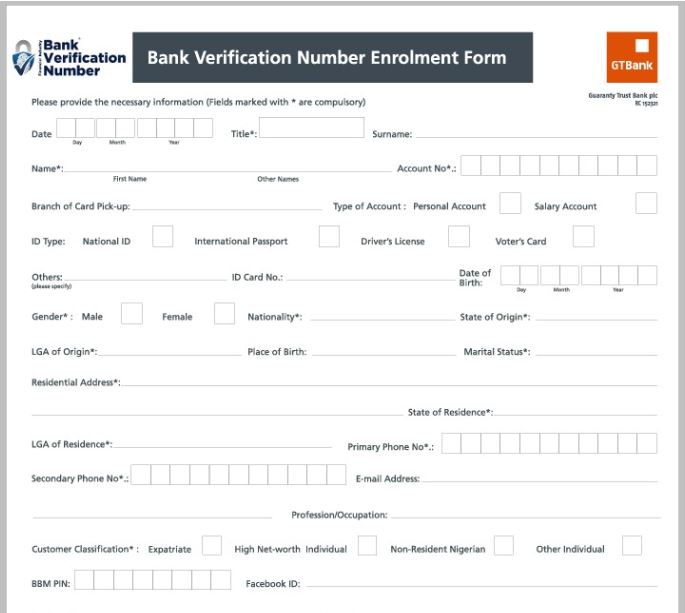

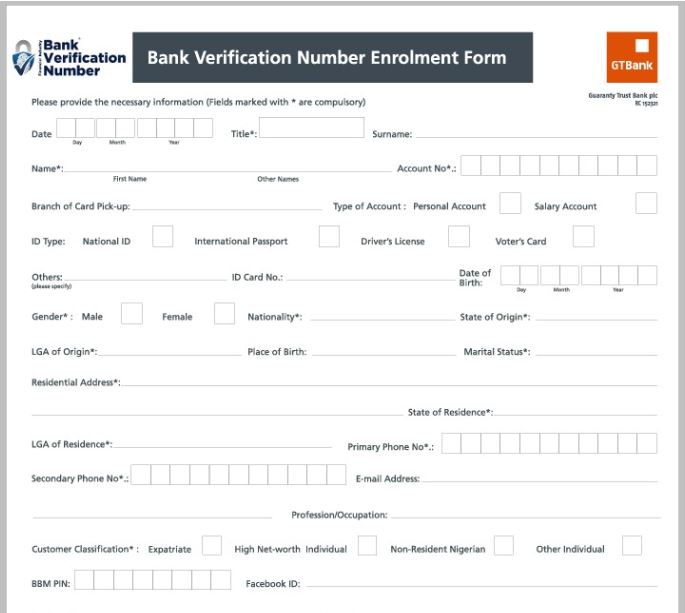

The BVN policy was introduced by the Central Bank of Nigeria (CBN) in February 2014. It involved collecting bank customers’ personal details and capturing their fingerprint and facial image.

It was done to uniquely verify the identities of account holders in Nigeria and link all their accounts with different financial institutions. This perhaps explains why many Nigerians do not see the need for the Self-certification forms which have been introduced.

Although that is one factor, Nigerians have also highlighted the inconvenience associated with having to be physically present at their financial institutions to complete the forms.

A twitter user, Wale Adetona said the government shouldn’t expect people to go out of their way and schedule just to fill the Self-certification forms after already getting their BVN in a similarly stressful manner.

Two other twitter users, Dipo Awojide and Nathan agreed with Wale’s stance.

Some Nigerians have also cited the current situation of the COVID-19 pandemic as a factor to be considered by the government. They stated that more Nigerians will be at risk of contracting the virus when so many people converge across different banks to fill the forms.

Self-certification Form vs BVN Enrolment Form

While the BVN enrolment form requires bank customers to fill in their personal details including National Identification Number (NIN), the Self-certification form does not require an identification number.

On the Self-certification forms, Nigerians are required to fill in their personal details as well as Tax Identification Number (TIN) for each country or jurisdiction of residence. This is according to a document obtained by TechNext.

This suggests that Nigerians living outside Nigeria will also be required to fill and submit the form. There are millions of diaspora banking accounts across financial institutions in the country. These accounts appear to also be targeted by the new policy.

The BVN registration did not capture taxpayer information. This may be the principal reason why the government has introduced the Self Certification form to ensure individuals and corporations comply with the Income Tax (Common Reporting Standards) Regulations 2019 published last year.

Summary

Going by the extent of backlash against the Self Certification Form introduced, it is evident that many people believe that the BVN is sufficient for financial institutions to verify taxpayer information.

For convenience, Nigerians would also prefer if the soft copy of the forms could be completed virtually rather than having to be physically present at the banks or insurance firms.

Although the government has stated that defaulters will be sanctioned, it has not yet given substantial information on the specific penalties for those who disregard the order or how its sanctions will be implemented.

The Federal Government and Federal Inland Revenue Service (FIRS) has pulled down the notice and apologized to Nigerians for the ‘misleading’ information.

According to the FIRS, the notice does not apply to everybody as it only applies to reportable persons. A reportable person is any individual identified by a financial institution in one country as being resident for tax purposes in another country.