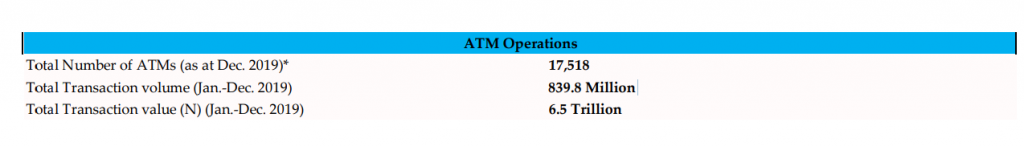

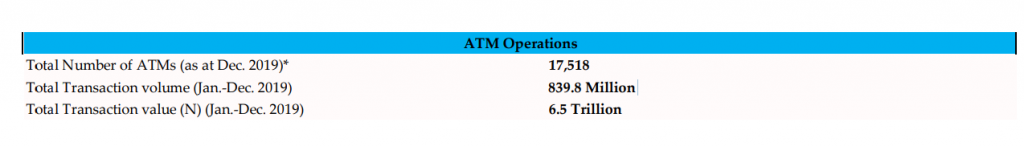

The number of active ATMs in Nigeria dropped to 17,518 in December, 2019. This is a loss of about 1,213 from the 18,731 ATMs recorded in March 2019, according to data from by the Nigeria Interbank Settlement System (NIBSS).

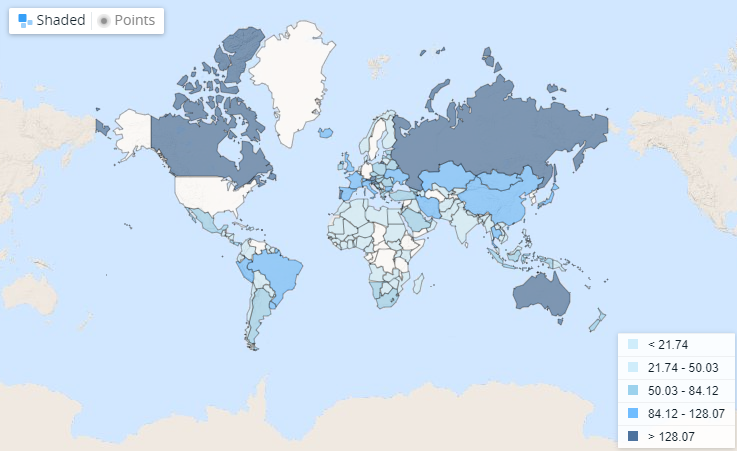

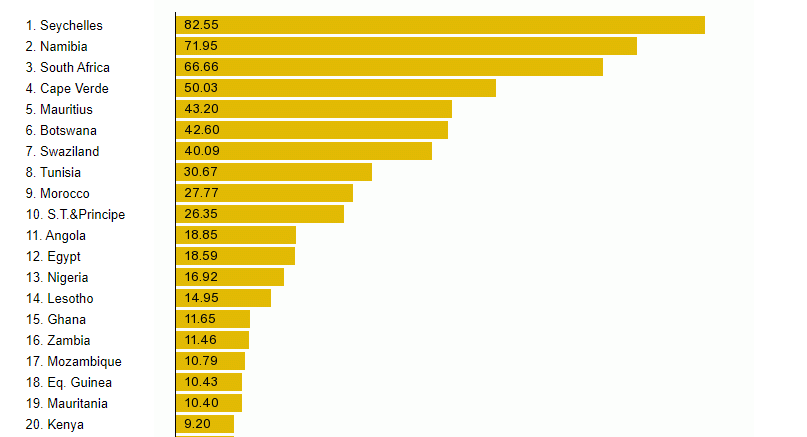

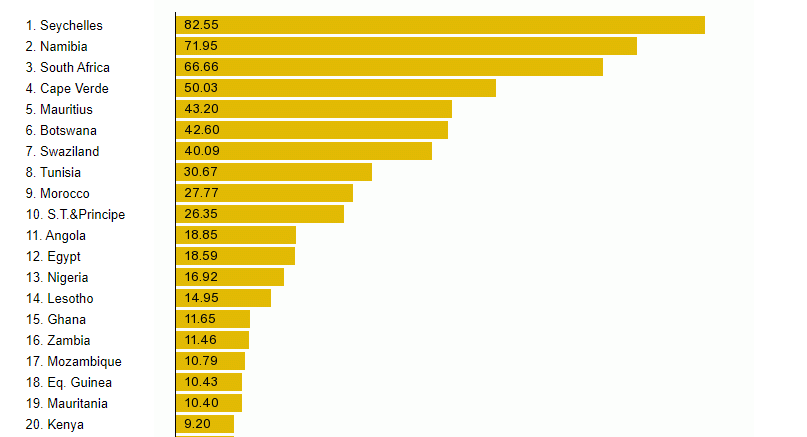

With the population of Nigeria above 200 million, the country’s ATM per Capita (number of Automatic Teller Machines per 100,000 Adults) as at December 2019 fell to about 8.75. This is down from the 16.92 ATM per Capita recorded by the WorldBank in 2018.

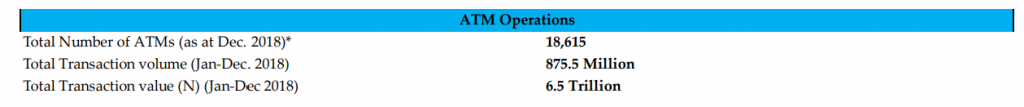

Volume of ATM transaction dropped in 2018

Similar to the number of ATM, the volume of ATM transactions in December 2019 also dropped to 839.8 Million. This is a drop of 35.7 million from the 875.5 million recorded in 2018.

The value of ATM transaction remained unchanged at N6.5 trillion in 2019 from what was recorded in 2018.

Nigeria ranked 13th in Africa in 2018

Compared to other African countries, Nigeria was the 13th country with the highest ATM per capita in 2018. The Island nation of Seychelles ranked highest with 82.55 ATMs per Capita. Namibia followed closely with 71.95 ATMs per Capita.

A major tech hub like South Africa ranked 3rd with 66.66 ATMs per Capita, Kenya ranked 20 with 9.2 ATMs per Capita.

The impact of Mergers and Acquisition..

The drop in the number of ATMs in the country can be traced to several factors. Joseph Maleghemi, an ATM Engineer, explained that the drop could be due to recent the mergers and acquisition of some major banks.

One thing that could have caused the drop is that lots of banks got acquired or merged. In one instance, the acquired bank used to own the highest number of ATMs in Nigeria. After the merger, the bank may have cut back cost by reducing the number of ATM in a particular location

Joseph Maleghemi, an ATM engineer

He explained that after mergers banks may have reduced the numbers of ATMs that were available in many populated locations.

The Boom of digital Banking

Another factor is that the boom of internet banking. The use of mobile platforms may have significantly affected the need for the ATM.

Joseph opined that the reason people use ATMs a lot in the past was that they had to withdraw money, make transfers, and carry out other transactions such as airtime recharge. Now, you can easily transfer money from your phone, you can pay for whatever you want to buy using the POS at points of the transaction.

With online banking, not a lot of people want to carry cash around anymore especially those that are internet service. Its the same way the banking hall has seen a reduction in the number of people that walk in to withdraw money.

Joseph Maleghemi, Financial IT Expert

High Maintenance cost

ATMs are expensive to procure and expensive to maintain, and therefore Nigerian banks are not encouraged to deploy so much. An IT expert explained that maintaining an ATM could cost hundreds of thousands of Naira.

“To maintain an ATM machine is not cheap, a button(FDK keys) at the sides of an ATM cost about N80 thousand each. That’s why you find some ATM button is not working when you visit the bank,” he added.

“The Keypad you use to enter pin and codes alone costs N380,000 in 2016. Imagine how much it is now. If people are just using ATM to withdraw money why will I want to buy more.”

Speaking on how to push ATM penetration in the country, Joseph explained that Nigerian companies need to start building ATMs.

We need companies in Nigeria that build ATMs. What companies in Nigeria do is buy the parts and couple it in the country, the same way they couple vehicles. This makes it very expensive.

Joseph Maleghemi, Financial IT Expert

He added that with the ban on the importation of several things, it is very difficult to get some of those parts especially now that naira has been significantly devalued.

“Back in 2016 when $1 was N200 3.5 -5 million looking at the current exchange of about N460, an ATM can cost between 16-20 million depending on the class. he clarified

He also pointed to the fact that banks are no longer making reasonable returns from owning ATMs:

“This cost is centred for banks even though they bring in profit. This more so because the profits made from ATMs have reduced back then banks used to charge N100 for transfer and N65 after 3 withdrawals now it has reduced as withdrawals is now N35 after 3 withdrawals and transfer now cost as low as N10 for transfer below N5,000.”

This means much of bank profits have been cut off, which makes investing in ATM unfavourable. This is why banks trying to cut of cost centres reducing their ATMs.

Joseph pointed out that is why the government and banks are trying to improve financial inclusion in such a way that you will be able to have access to banking via your phone and barely need to visit the ATM for physical cash.

As long as we keep importing ATMs it will be difficult to increase its numbers, he added.

In conclusion, if the factors listed above remain the same ATM penetration in Nigeria may not see any significant increase.