Established in 2020, Rise Capital is a Nigerian financial services startup. Founded by Eleanya Eke, and co-founded by Bosun Olanrewaju and Tony Odiba, the startup recently got selected for the Techstars Western Union accelerator program.

Solving the problem of stock and real estate investment

Investing in stocks or real estate is complicated for some Nigerians, and becomes more so for those who want to invest in Dollars. The persistent devaluation of the naira against the dollar makes it better to consider investing in stable currencies such as the US dollar.

The problem presents itself in the need for a platform to make the investments with as little confusion as possible. Prospective investors also need to be able to keep an eye on the investment and learn how to keep growing it. Being able to invest with a relatively small amount would be a plus, of course.

The problems mentioned above are what Eleanya Eke set out to solve through Rise Capital.

Overview

The startup launched in February 2020 with an app called Rise Vest. Currently, I have split the startup’s offerings to 2. They are the dollar investment and wealth management, and financial literacy services.

Services

Rise Capital’s online platform which people can invest from is called RiseVest. It is available as an android and iOS app that can be installed from the respective app stores.

A verified user can invest in US stocks, US real estate, Eurobond or create a plan that is a mix of all three.

After funding the wallet from the bank account and card has been added to an account, RiseVest’s team helps users to invest following specifications of the plan they create.

I set up an account to see how the app works and found the onboarding process to be simple. Before you can fund your wallet and make investments, you have to upload your BVN as well as any document that can serve as a legal means of identification.

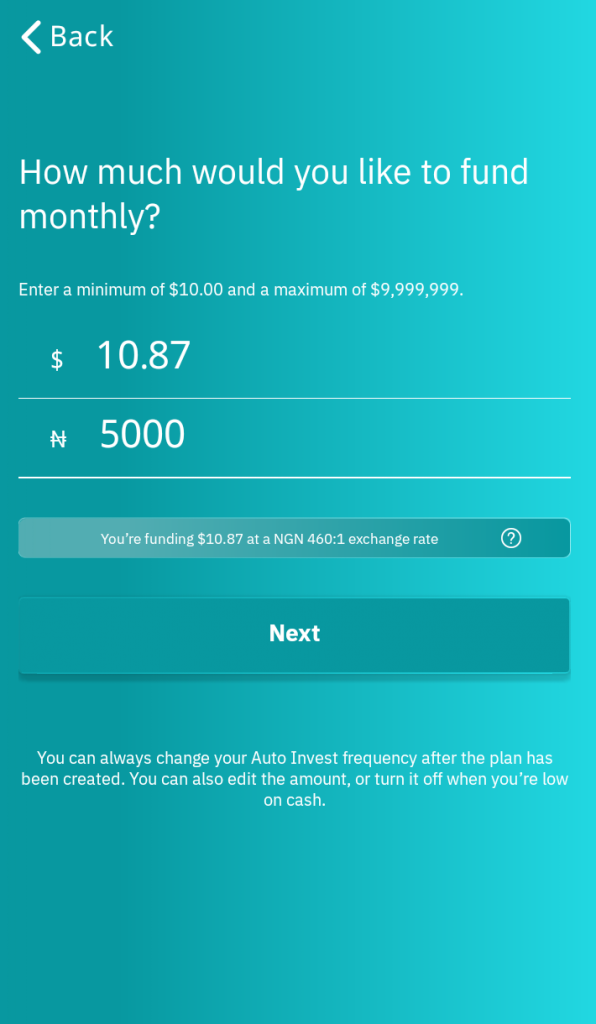

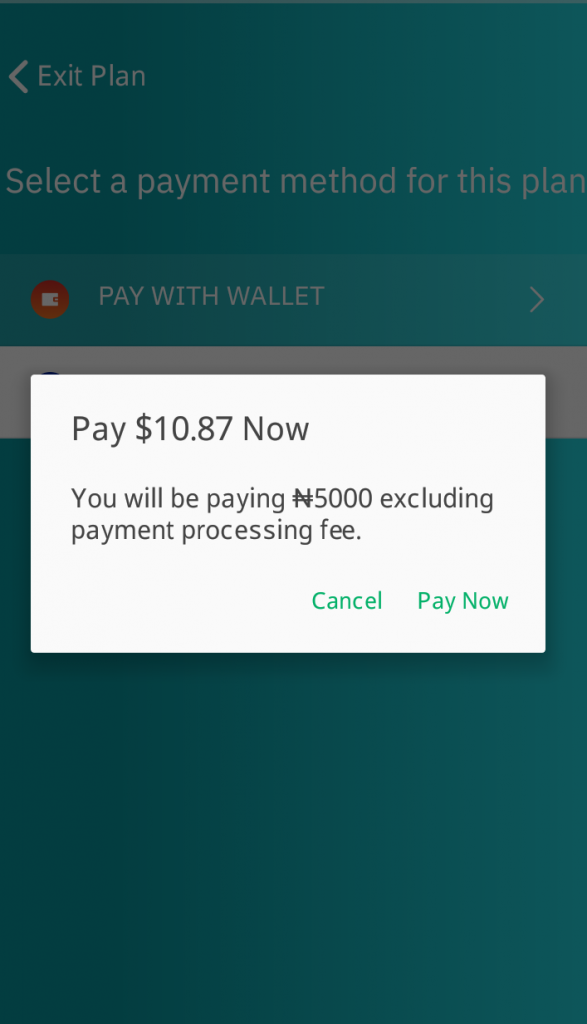

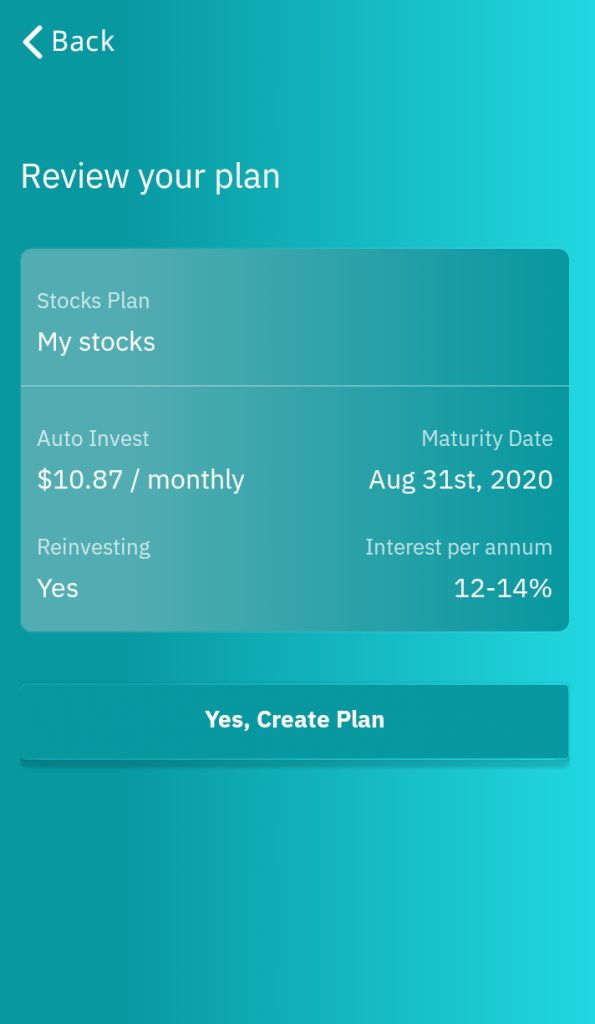

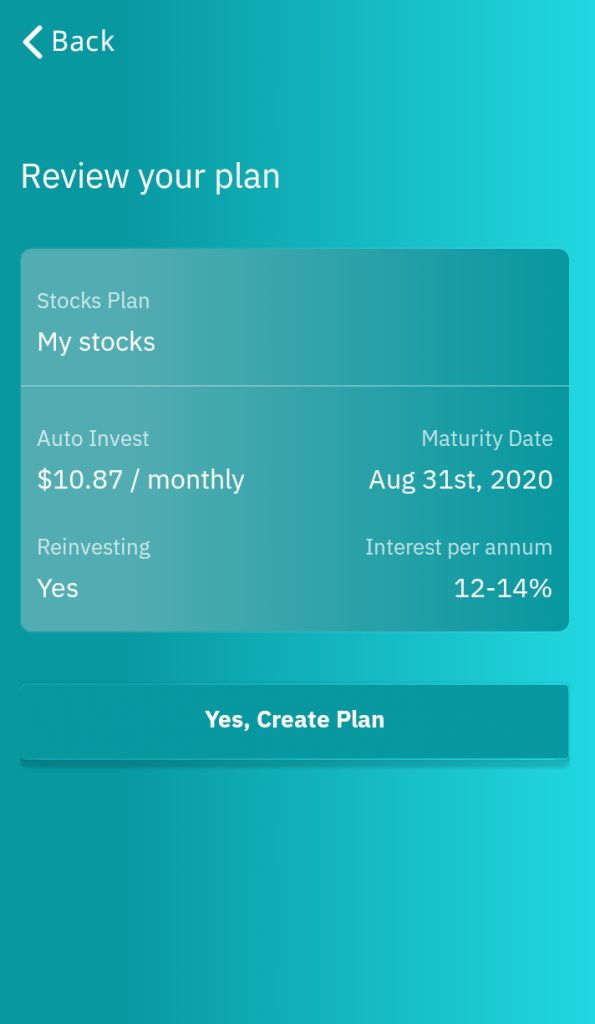

By selecting the ‘Plan’ option, I was able to add an investment plan, select the ‘Stocks’ option and proceed to add details of the transaction. As at the time I used the app, the dollar was being sold at N460 exchange rate and I chose to buy $10.87 for N5,000. The minimum amount that can be invested with is $10.

You will also be debited for payment processing.

You can set your account up to automatically make withdrawals from your bank account and add it to your Risevest wallet. From there, your money is invested in the plan that you choose with help from Risevest’s investment team. You can also choose to invest once, weekly or at any frequency that works for you.

Investments can be monitored from the Updates option. Updates are also sent concerning each transaction that has been carried out through the account.

The startup organizes offline and online activities for its community of investors. The community is built around a Telegram group, Zoom webinars, and offline meetings.

Competition, Funding History

From the time it was established till date, Rise Capital has raised about $62,000 from angel investors. These angel investors include the Future Africa Fund, Kola Aina, and some family and friends.

There are other fintech startups that offer people access to foreign investment in Nigeria. They include Trove Finance, Wealth.ng and Chaka.

A major difference between Risevest and some of these competitors is that it helps users to invest in the stocks while the others do not. Also, unlike Wealth.ng, there are actually foreign stocks that are available for investment on Risevest.

Suggested read: Startup Review: Wealth.ng Could Help you Invest in Stocks but it Lacks Foreign Investment Options

General Observations

From my user experience, making investments with Risevest is easy and intuitive. However, the exchange rate has at different times being a source of controversy for some of its users.

A reviewer on Google, Ralph Lawrence complained that Rise’s dollar exchange rate is too high while wondering if its another source of revenue generation for the startup. “How can you sell dollars at 366 when it’s 360?” he asked. “Investing at higher exchanges means you’re not making money but paying Rise a premium for dollar rates.”

James Ogbonna felt the same about the exchange rate being used by Rise Capital, saying “the parallel market rate today is N375 to USD but [uncle] Rise wants to collect N425.”

The dollar rates fluctuate according to the market, however, and the exchange rate changes with time.

Another con of the app is that it crashes on a number of android phones. At least 19 of the feedback received on the Playstore for RiseVest reported that the app crashed at different intervals. Personally, I was able to successfully use the app until I tried to make payment by adding a Nigerian bank card when the app crashed.

“Your app keeps crashing. Seems like it’s not suited to all android versions. please adjust this,” Olayimika Adejumo said on Playstore.

In summary…

For the people who can operate the app fully on their devices, Risevest fulfils its promise of helping them access and invest in stocks in the US.

However, the limitations that arise when the app crashes makes it useless for some percentage of the people who actually want to use the app. Also, a bit of transparency regarding the dollar exchange rates may help to put the mind of the local man at ease and assure against the feeling of extortion.