African e-Commerce giant, Jumia is edging closer to profitability after reporting a record gross profit of €6 million (₦2.6 billion) and loss reduction of about 44% in its financial report for the second quarter of the year.

However, the value of sales by the company dropped for the second quarter in a row. This was caused mainly by the restriction of movements due to pandemic which affected businesses.

Interestingly, Jumia stocks which have risen due to apparent investor confidence that preceded the announcement of the Q2 report crashed despite the huge drop in losses. Jumia shares had risen 183% to price at about $21 in July but have dropped back down to $13.50 at the close of market on 12 August. It currently trades at $13.15.

Suggested Read: 5 Reasons Why Jumia Share Price is Rising and its Prospects for the Next Quarter

Jumia’s inches closer to profitability

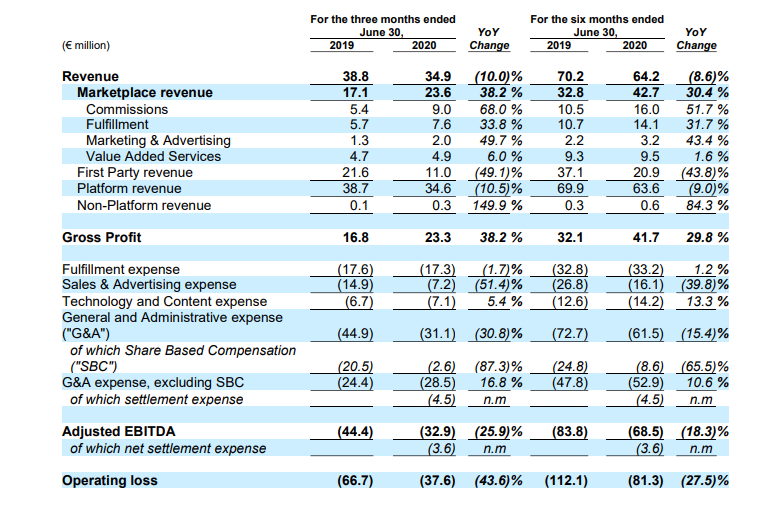

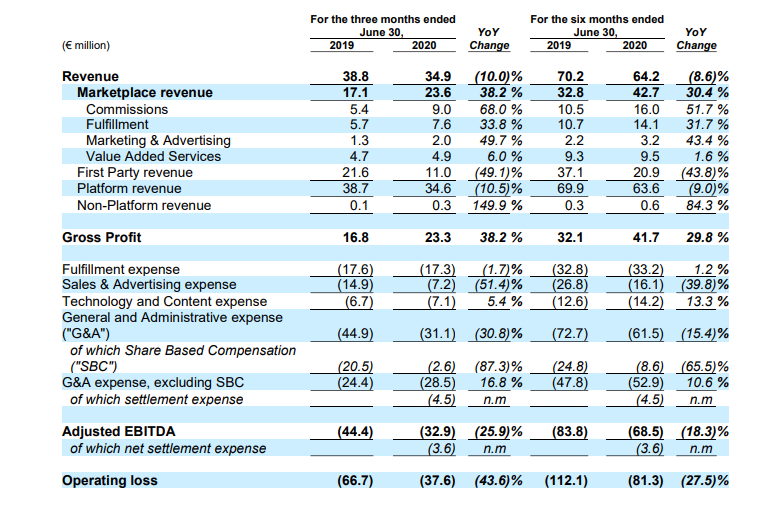

According to the Q2 report, Jumia recorded a gross profit of €23.3 million in the quarter representing an increase of 38% from €16.8 million in the second quarter of 2019.

After fulfilment expenses, the company’s gross profit was at an all-time high of €6 million (₦2.6 billion). This is a significant growth compared to the loss of €0.7 million in Q2 2019 and the €2.5 million gain in the first quarter of this year.

Speaking on the company’s progress, the Co-Chief Executive Officers of Jumia, Jeremy Hodara and Sacha Poignonnec attributed the progress to the efficiency with Sales & Advertising expenses among other things.

“We have made significant progress on our path to profitability in the second quarter of 2020 with Operating loss decreasing 44% year-over-year to €37.6 million. This was achieved thanks to an all-time high Gross Profit after Fulfillment expense of €6.0 million and record levels of marketing efficiency with Sales & Advertising expense decreasing by 51% year-over-year.”

Jeremy Hodara and Sacha Poignonnec, Co-Chief Executive Officers of Jumia.

The report showed that Sales & Advertising expense was €7.2 million, its lowest since 2017. This was a 51% decrease from the same period last year. The company’s 12-month Sales & Advertising expense per Annual Active Consumer also decreased by 38% from €10.8 in Q2 2019 to €6.7 in Q2 2020.

Total operating loss was pegged at €37.6 million, a 44% decrease year-over-year. Similarly, the EBITDA was negative at €32.9 million, a 26% decrease from €44.4 million in Q2 2019, and an 8.2% decrease from €35.6 million in Q1 2020. This represents meaningful progress on the company’s path to profitability.

These numbers also ensured that Jumia continued its recent streak in reduced losses since the turn of 2020.

Dropping Value of Sales

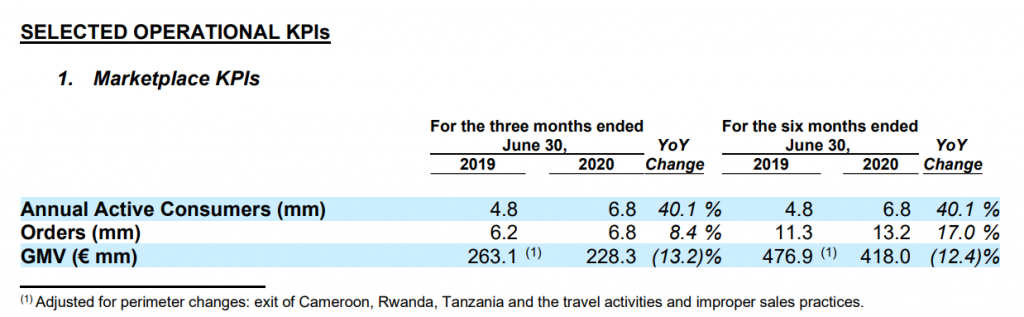

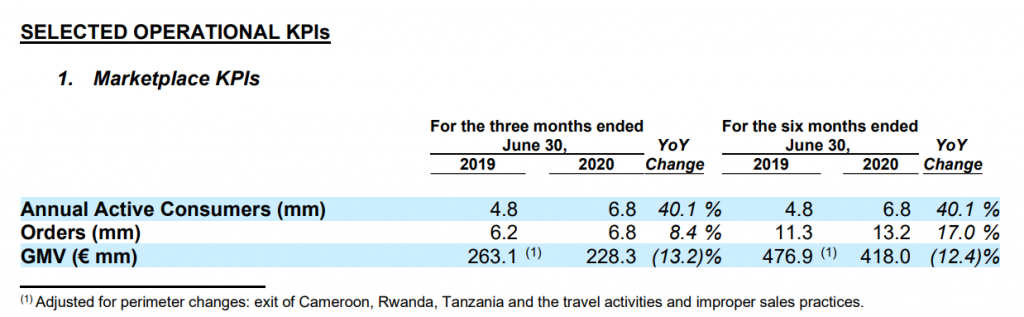

The number of Jumia active consumers reached 6.8 million in the second quarter of 2020, up 40% compared to the second quarter of 2019. Orders also reached 6.8 million up 8%.

However, the total value of Jumia’s sales (GMV) was €228 million, 13% lower than €263 million Q2 2019, but a significant improvement from €190 million in Q1 2020.

Pulling out of markets like Cameroun, Rwanda and Tanzania could have been one of the reasons why Jumia’s value of sales reduced but it also helped drive expenses down. The reduction of its promotional intensity and consumer incentives for products like electronics and mobile phones could have also played a part.

Generally, Jumia reported that the pandemic and the lockdown did not reveal many changes in consumer behaviour besides an increase in hygiene products.

It added that the orders, though smaller in volume, had more value. In Q2 2019, Fast Moving Consumer Goods (FMCG) constituted 41% while phones and electronics accounted for 59% of Jumia’s orders.

In Q2 2020, however, this figure has shifted as FMCGs now constitute 57% of the company’s orders while phones and electronics account for about 43%. This shows that the company’s focus has shifted to everyday goods like hygiene products and groceries.

JumiaPay

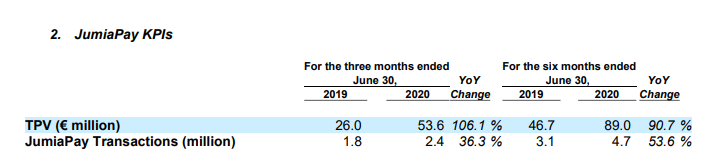

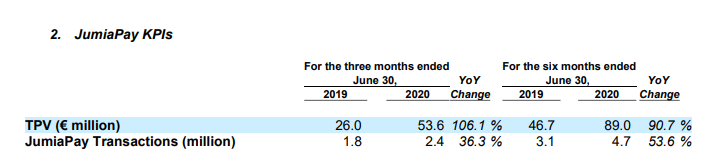

Jumia’s payment platform, JumiaPay has benefitted from the effects of the pandemic. The platform processed 2.4 million transactions valued at €5.3 million in Q2 2020. This is a 36% increase from the same period last year when it processed 1.8 million transactions worth €2.6 million.

The report also shows an increase in JumiaPay on the e-commerce platform as customers placed 35.6% of their orders with JumiaPay in Q2 2020, a 28.3% increase from orders placed Q2 2019.

In total, about 6.8 million orders (including returns and cancellations) were placed on JumiaPay during the quarter

Expectation for Next Quarter

Highlighting expectations for the next quarter, Jumia revealed that it is uncertain about its business and financial outlook for 2020 due to the pandemic.

However, it added that it expects the effects of the business mix rebalancing to continue to play out over the course of 2020. It further added that it expects continued GMV softness over the course of 2020, with better Orders and Annual Active Consumers growth on a year-over-year basis.

On the bright side, the report reiterated Jumia’s commitment to reducing the adjusted EBITDA loss in absolute terms in 2020 compared to 2019. It also harbours plans to monetise JumiaPay and its logistics sector for the future.