The Nigerian Communication Commission (NCC) has finally amended the pricing of USSD services that caused an uproar among stakeholders last year. According to the regulator, the new pricing was determined after taking into consideration the concerns of stakeholders and consulting with Minister of Communications and Digital Economy.

It added that the new pricing will replace the pricing published on 23rd July 2019 and implementation has started since August 1st.

USSD Uproar

The silent negotiations between the telecom operators and bank operators about Unstructured Supplementary Service Data (USSD) blew open after a message by MTN stating it would begin charging ₦4 for every 20 seconds of USSD access to banking services went viral in 2019.

In response, the office of the Minister of Communications, Dr Isa Pantami, ordered the NCC to suspend the plan.

This followed the trading of blames between the banks and the telcos over the USSD charges. The telcos stated that it was the banks that directed them to bill end users while the banks CEOs denied having knowledge of the telcos charging customers for USSD services.

New Price – From N4.86 to N1.63K

Following the release of the amended pricing determination, the cost of a USSD session of 20 seconds on a mobile network operator is pegged at a flat rate of N1.63. This is a significant drop from the N4.86 maximum charge the regulator initially announced in its initial USSD pricing plan.

According to the NCC, the new cost should form the basis of negotiations between MNOs and other related service providers like Banks using USSD channels.

The document also clarified the main issue of last years USSD dispute adding that Telecom operators must not charge the consumers (end-user-billing) directly for the use of USSD channel for financial services. Instead, it stated that transaction should be between the MNOs and the entity to which the service is provided.

All billings by MNOs for Financial Service using USSD code assigned to FSPs must thereby be implemented via the Corporate Billing model.

While the new price and regulation are seemingly in the interest of regular users of USSD channels, it is also bound to cause some changes among stakeholders in the sector.

Telcos to lose revenue

Before the general uproar, USSD charges (end-user billing) was not new. According to inquiries from various users, TechNext gathered that while MTN has been granting users free access, other telcos have been charging users for access to USSD services.

Some 9mobile users had claimed that the operator charged as much as N20 for each USSD transaction, while Airtel users reported that they have always been charged N15 for each transaction. Oreoluwa, a Glo user claimed that she couldn’t perform USSD transaction without credit on her line while another said Glo charged N5 per session for transactions.

However, with the pricing regulation, most telcos have stopped charging users for USSD transaction. Also, with the price pegged as N1.63 down from N4 the revenue generated by Telcos from USSD will be reduced.

This means that MTN who wanted to charge N4 will be losing more than 50% of its intended revenue. Similarly, other telcos will experience a drop in revenue.

Corporate Billing

With the NCC instructing that all USSD charges should be billed via a corporate billing model, Banks will now have to pay Telcos from the USSD service charge.

Before now, the Banks collect a fee of N50 for bank transactions which would have meant that telcos will receive N4.5 per USSD session payment under corporate billing. This is about 9% of the fee.

However, with the new development on Bank charges and USSD charges, Banks will now have to pay N1.63 from the new N10 fee for transactions less than N5,000, N25 for transfers between N5,000 and N50,000 and N50 for only transaction above N50,000.

This means that the bank will now have to pay 16% of the bank charge for transactions less than N5,000, 6.52% for a transaction between N5,000 and N50,000 and 3.26% for transactions above N50,000.

The new prices shows that Banks will lose more for transaction of N5,000 and lower while it will gain for transactions above N5,000 with the new regulations.

In general what this means is that Banks, just like Telcos, will suffer a drop in revenue generated from USSD.

Users could still pay

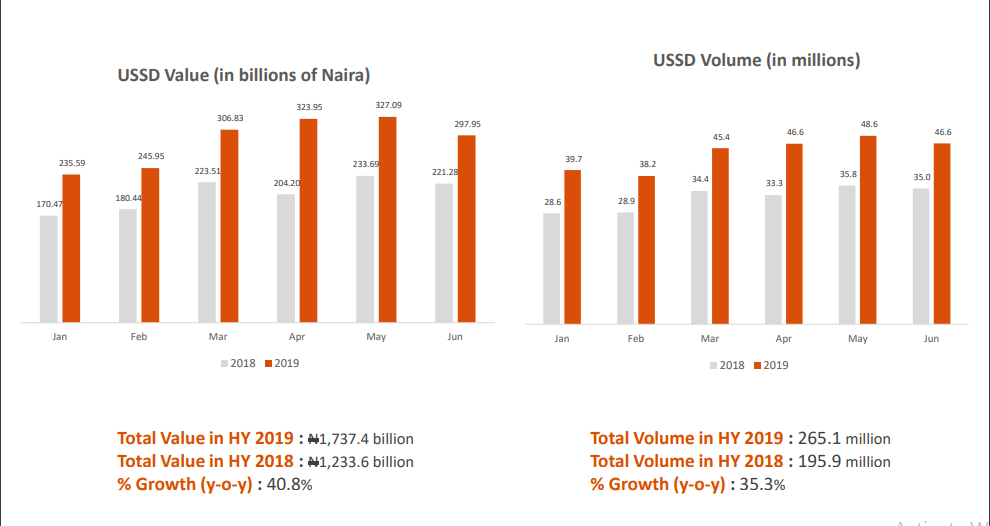

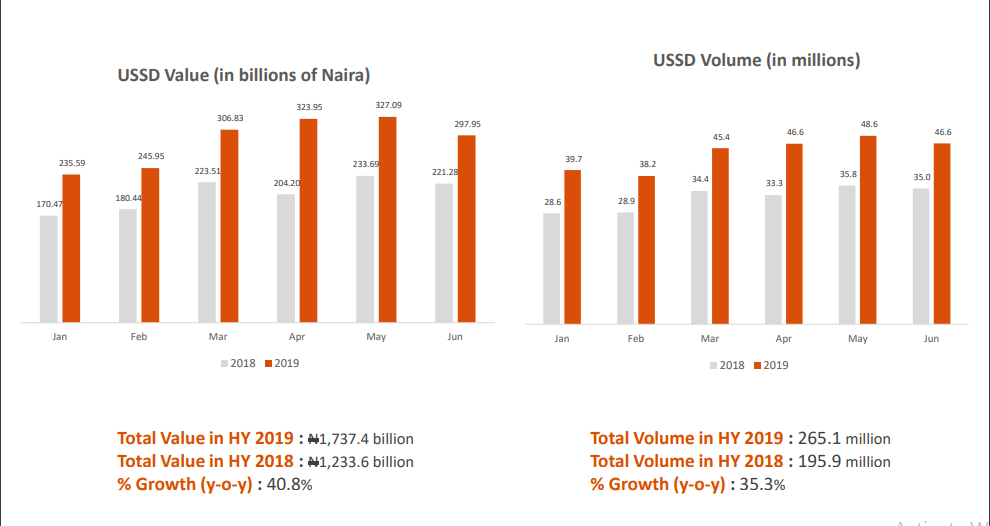

Banks make billions of naira from general USSD transactions every year. In the first half of 2019 alone, GTBank made about N1,737.4 billion from about 265.1 million USSD transactions.

However, going by the new regulation, about N1.06 billion will be generatable by banks from USSD charges alone at the rate of N4 for the first half of 2019. But at the rate of N1.63, only about N432.1 million will be generatable. This means about N627.9 million will be lost.

Although the estimated losses would be borne mostly by Telcos, Banks could also share in the loss during negotiation. With the loss running into hundreds of millions, there is a possibility that the banks could find other ways to make users pay through charges like service and maintenance charges.

Tinuke, a business woman told TechNext that her bank collect extra charges service charges due to large amount of alert message she receives due to her business.

Banks owe over 17 billion

Following the suspension of end-user billing, the Executive Vice Chairman of the NCC, Prof. Umar Garba Danbatta revealed that commercial banks in the country owe telecom companies over N17 billion in USSD charges.

While this revelation shows a reluctance by Banks to pay the USSD charges, the new regulations empower Telcos to cut them off if they fail to pay. The regulator also threatened a possible withdrawal of the USSD shortcode.

Refusal to pay for services provided or to negotiate in good faith will result in the discontinuation of the provision of the service, the possible withdrawal of the USSD shortcode by the Commission and/ or imposition of regulatory sanctions in line with the NCA, 2003

In summary, the new regulation is a piece of very good news for consumers but not so good for Telcos and Banks in Terms of revenue generated from the service. However, there is a possibility that the banks could find other ways to make users pay for the drop in revenue especially through service and maintenance charges.