You no longer need cash to make payments. GoMoney is a fintech app designed to help take care of and manage users expenses. It was launched in Nigeria by the GoMoney team in November 2019. I checked out the app, and here is what I found.

Create account with phone number

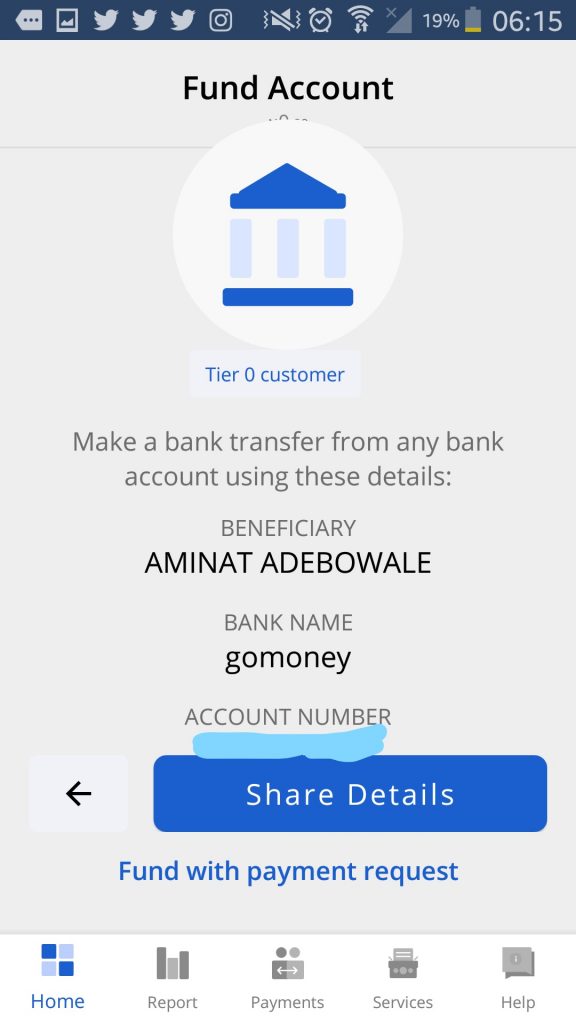

After installing and setting up the mobile app on my phone, a tier 0 account was opened for me using the details I had earlier provided. The mobile number I had registered with was used to create the goMoney account number.

This is a good thing because it eliminates the need to have to remember another account number, especially since it is the last 10 digits of the mobile number. Upgrading to a full account is done when you upload your BVN and a photo that you can be identified with.

From this account, you can immediately do one of four things: fund the account, request money from people, pay your bills, or split payments with someone.

GoMoney financial services

GoMoney provides some of the basic services provided by banks. You can receive money into your account and make transactions from it. You can have a virtual or physical card with which you can make transactions.

GoMoney gives you the features of a bank account and eliminates the hassle of failed transactions, unfair charges and unnecessary paperwork.

You can fund your account by sharing your bank details from the app with your contacts on Whatsapp, Twitter, Slack, or another form that is preferable for you.

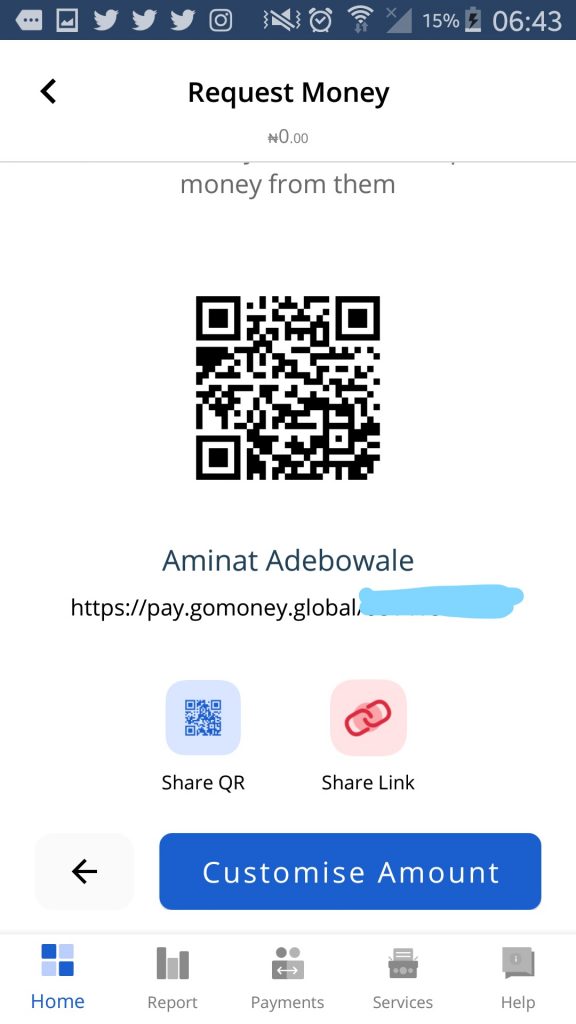

You can send a request for funds to any one of your contacts who has a GoMoney account. The app will peruse your phone contacts and filter out the numbers that have an account with it. You can also share a QR code or request a link that is unique to your account with anyone who wants to make a transfer to you.

If you like apps with an extra lovely user interface all round, this may not be for you. The user interface is not consistently great. In a bid to fit certain parts into one segment of the screen, some buttons encroach into the text space on the app. However, it is not so mixed up that you will not see what you need to see.

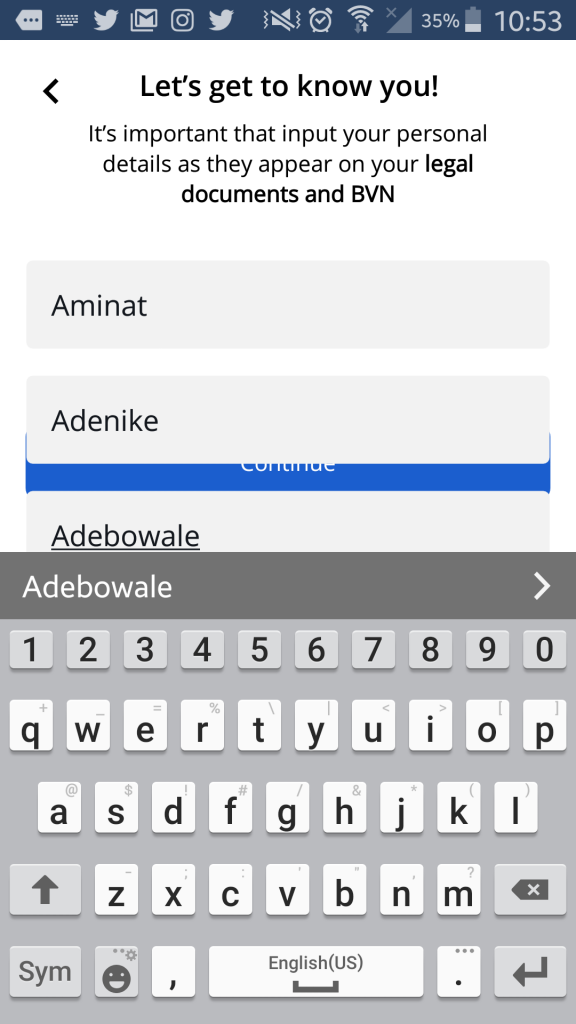

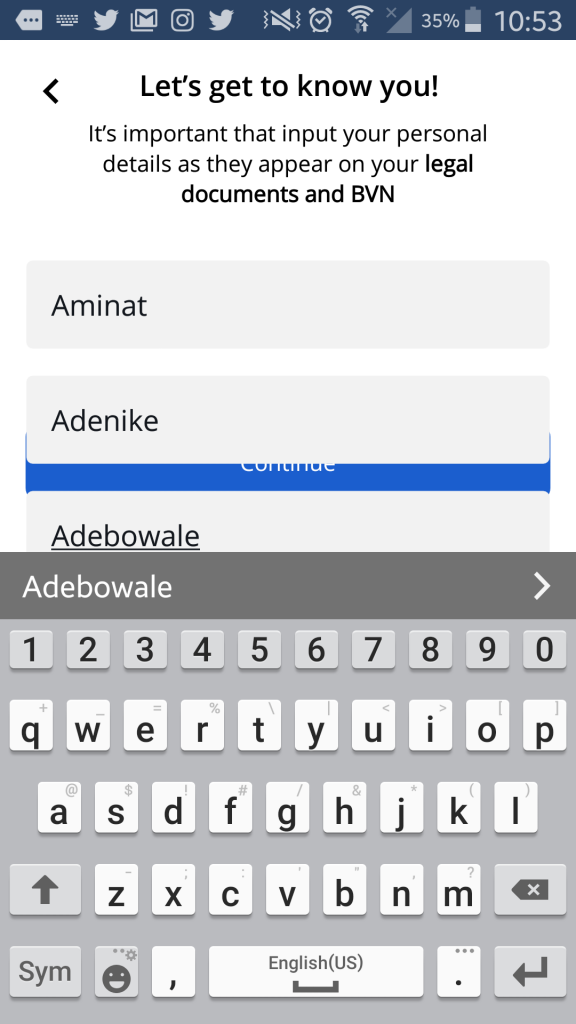

From my experience with the app as a user, the forms were tacky to get around. Some fields are obscured by the phone keyboard when you start filling them and the forms are static which means that you cannot scroll up or down when you need to. You have to click the ‘back’ arrow on the phone to take the keyboard off the screen before you can navigate to where you want to go next.

GoMoney is essentially a payments app. From your account, you can make payment for airtime, payTV subscriptions, internet bundles, and electricity. Payments can be scheduled based on if they occur once or they are recurring.

You can also create your own group by adding people you know who use GoMoney. When you do that, you can split bills with them and the app sends a reminder until they provide the amount that is required from them.

In place of the text notifications that most banks charge for, GoMoney allows you to enable push notifications for financial activities you want to stay abreast of.

If you are looking for a digital banking app that provides the necessary banking solutions like sending and receiving money, tracking money, then you should check out GoMoney. Its transaction costs are also lower than what banks charge. It costs N7 to transfer to banks from the app and you have the added option of splitting bills with your group.