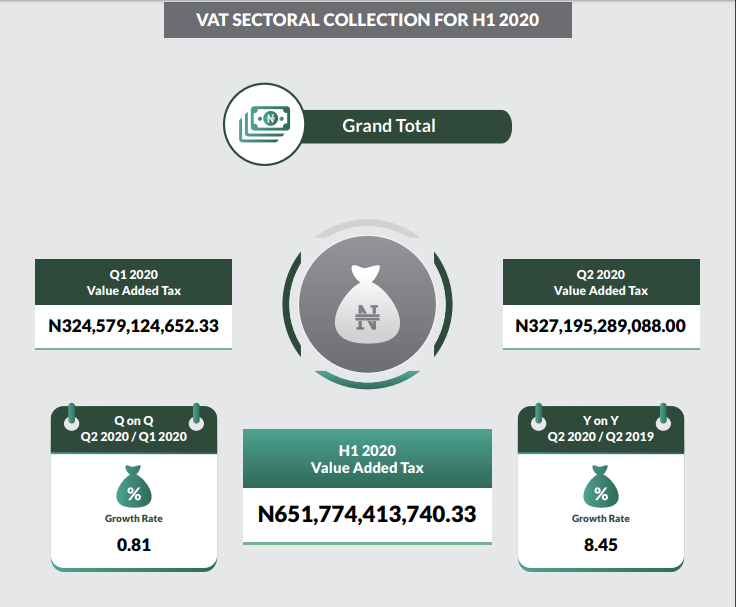

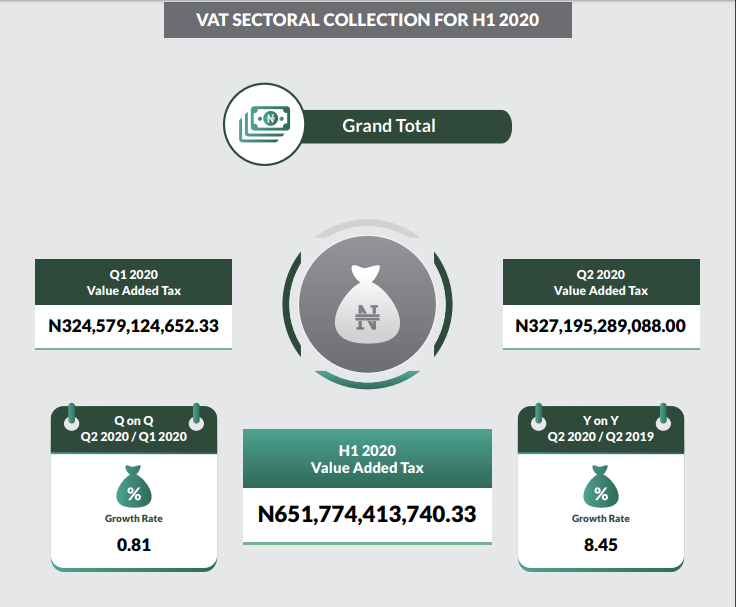

The Federal Government of Nigeria has generated a revenue of N651.77 billion from Value Added Tax (VAT) in the first half of 2020. This represents an 8.45% growth from last years numbers despite the economic downturn caused by the pandemic.

According to the Sectoral distribution of VAT Report for H1 2020 released by the National Bureau of Statistics (NBS), the sum of all the VAT collected in H1 2020 was higher than the N600.98bn generated in H1 2019.

7.5% VAT

The growth in VAT revenue was driven mainly by the increase in the VAT rate from 5% to 7.5 % as implemented in February. The new VAT rate was part of the 2020 financial bill signed by President Muhammadu Buhari earlier this year.

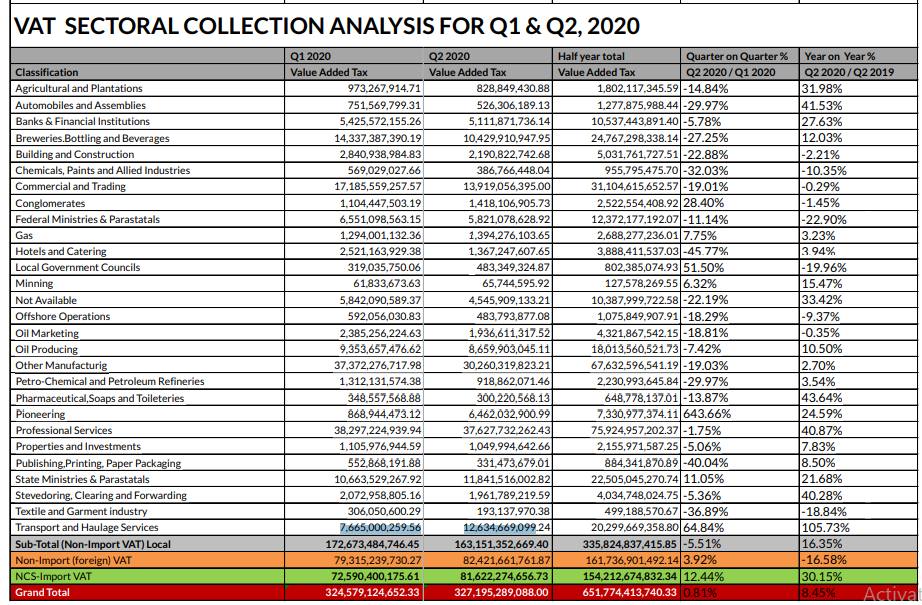

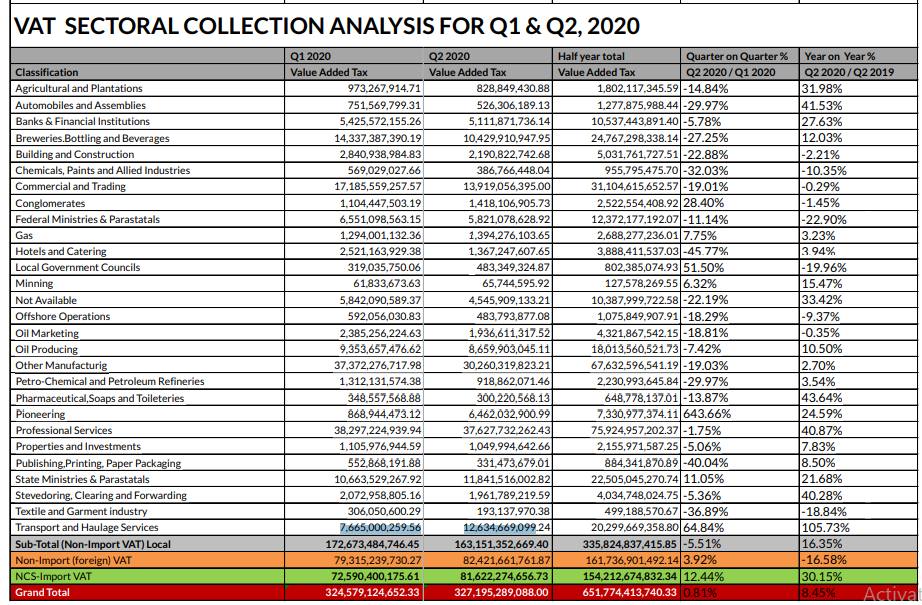

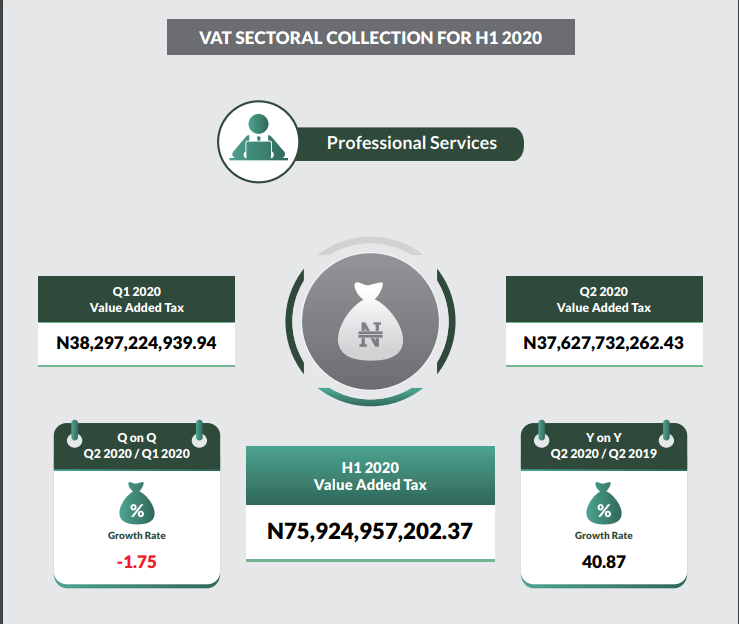

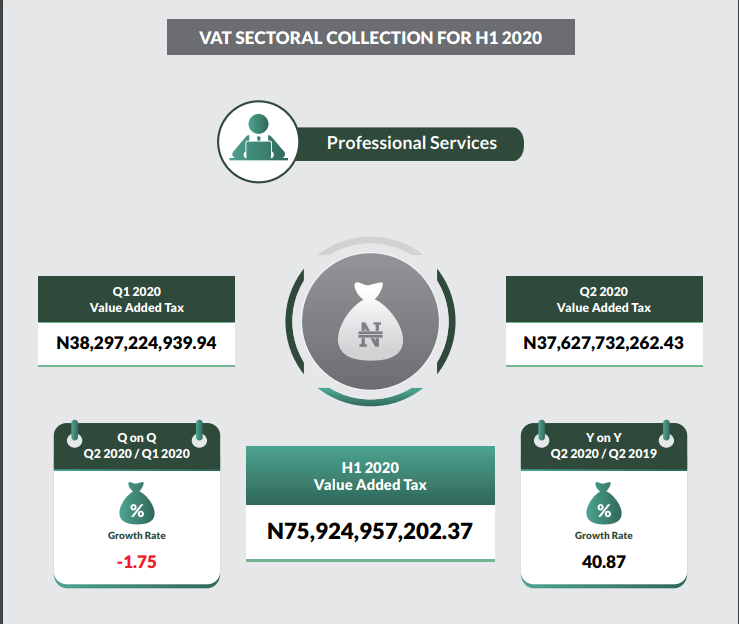

The 50% increase in VAT helped the FG shore its losses caused by the current pandemic. The report shows that professional services generated the highest amount of VAT with N75.92 billion, up from 53.89 billion it generated in the same period in 2019.

The manufacturing sector followed with VAT of N67.63 billion while the commercial and trading sector generated N31.10 billion. Mining generated the least VAT with just N127.57 million. It was closely followed by textile and garment industry and pharmaceutical, soaps and toiletries with N499.19 million and N648.78 million generated respectively.

The Oil sector and Oil related sectors generated a VAT of N25.64 billion

Out of the total VAT generated in H1 2020, non-import VAT (locally) generated N335.82 billion while non-import VAT (foreign) was lower at N161.74.

Sluggish second quarter

Although the total VAT generated in Q2 was 0.81% higher than Q1, VAT generated across most sectors dropped in the second quarter. The VAT contributed by Banks & Financial Institutions dropped from 5.42 billion to 5.11 billion.

Similarly, the VAT generated from the Building and Construction sector dropped from 2.84 billion to 2.19 billion. However, sectors like Transport and haulage services saw a 64.84% increase in VAT collection in the second quarter of the year, rising from 7.66 billion to 12.63 billion.

Effect of COVID-19 Pandemic

The impact of the lockdown and COVID-19 pandemic also reflected in the report as the revenue generated from some sectors such as the hospitality and publishing sectors dropped significantly.

The hotels and catering sector which was diminished by the lockdown dropped the most in Q2, dropping to N1.367 billion from N2.521 billion, representing a decline of 45.77%. Similarly, Publishing, printing and paper packaging dropped 40.04% to N331.47 million from N552.86 million.

In summary, the growth of VAT revenue year on year shows that the increase in VAT rate was a good decision by the government. It also shows that government revenue through VAT in coming quarters could significantly increase as the economy recovers from the effect of the pandemic.