BabyBliss, a Nigerian retail and eCommerce platform has merged with Kenya’s MumsVillage to form Bliss Group, a Pan-African mother and baby care community and eCommerce platform.

The merger is a consolidated move by both companies to enter new markets. BabyBliss will be adding its experience in deep retail and e-commerce in Nigeria while MumsVillage brings its knowledge of building online communities and creating content for pregnant women and mothers.

Speaking on the development, the Group CEO, Isis Nyong’o Madison, expressed delight on the successful merger. She added that the new group will be dedicated to meeting the changing needs of women in Africa.

“I’m excited to lead this new entity into meeting the changing needs of African women and showing that they are indeed a market that cannot be ignored. Bliss Group will leverage on our networks, learnings and reach to convert the financial opportunity that exists into reality by delivering not just greater shareholder value for our investors but looking to build a real powerhouse with women at the helm.”

Isis Nyong’o Madison, Group CEO

With the merger, both companies will combine their operations in Kenya and Nigeria to increase the range and quality of baby products and service, and establish a larger distribution network to service the over 300,000 women in both markets. They will also form a strategic brand presence with enhanced scale and efficiency.

By combining to become Bliss group, the over $5 million mothers and baby market in Nigeria and $2 billion in Kenya is now open to the firm. The Bliss Group Company will be co-headquartered in Kenya and Nigeria.

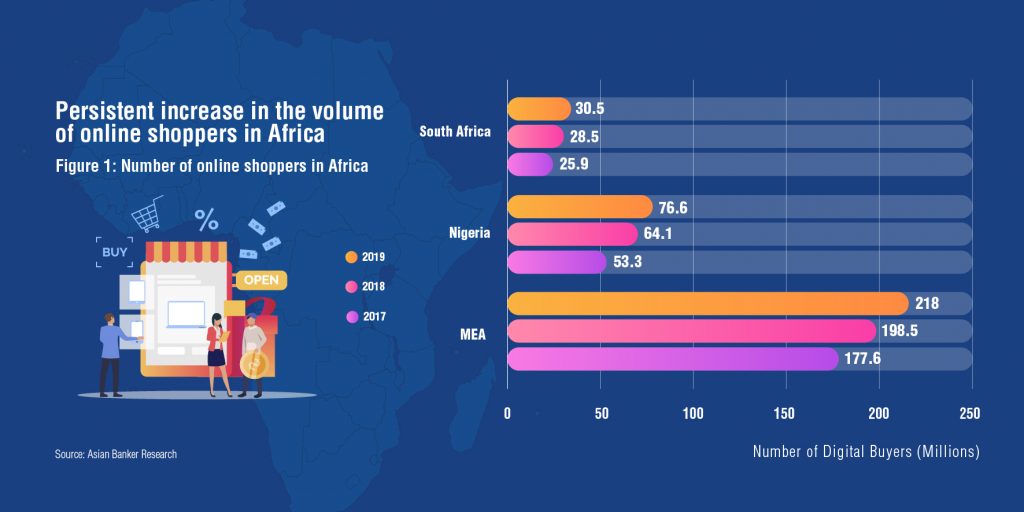

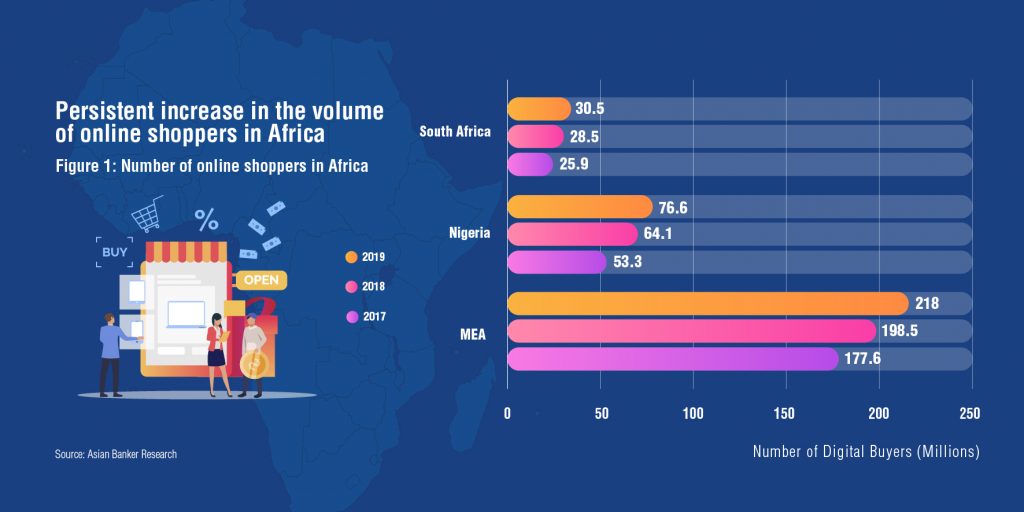

The E-commerce market in Nigeria and Kenya is estimated to grow by 25% annually

5 Points to Note when Planning a Merger

Like the Bliss Group merger which aims to expand into new markets, mergers can be done for several reasons. Some include saving on production costs, increase in capital, improving products, acquiring new technical knowledge and resources. Other benefits include the generation of cost synergies (administration) and improved geographical or demographic coverage.

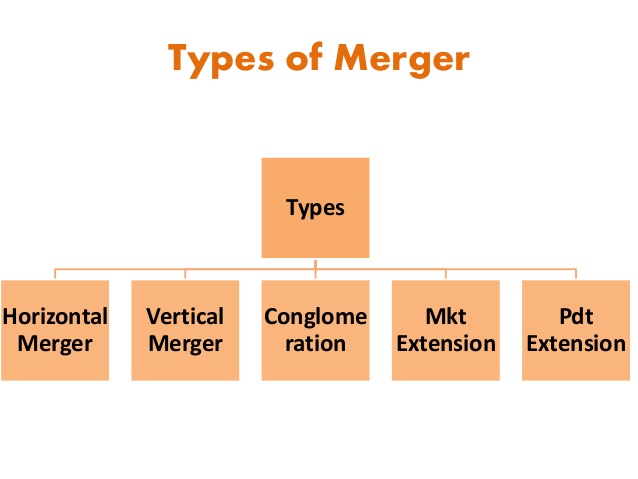

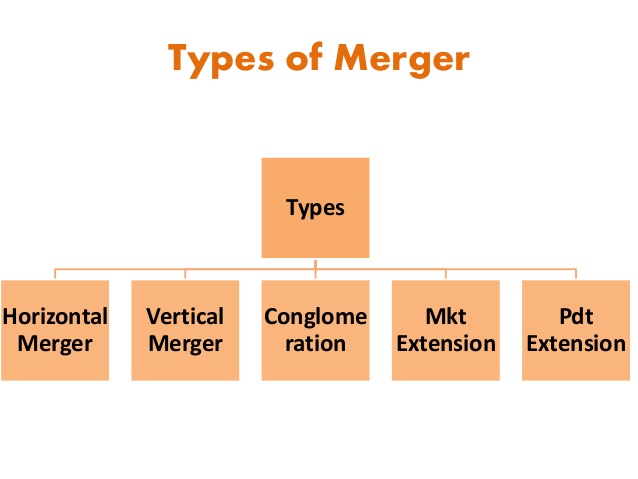

A merger is a voluntary combining of two relatively equal companies that decide to legally become one entity.

There are five distinct types of mergers, each of which serves a unique purpose. a conglomerate merger is the combination of two companies that are involved in unrelated business activities. This merger mostly happens when shareholders are going to profit from the deal.

A product extension is a merger that involves two companies that complement each other in the same industry. They will have some overlap in their product development process, marketing strategies, technology and research practices.

Other mergers include Market extensions like that of Bliss Group, Horizontal merger which is between two competitors and Vertical merger which is between companies who operate at different stages of a production chain.

Although mergers can be very beneficial, they sometimes fail. Here are some things you can do to make sure your merger is set up for success.

In-depth Research on merger partner

Before deciding to merge with another business, in-depth research (history, property leases, debt details) on the other company is important to reduce the chance of taking on liabilities. The research will also help you better understand what the business offers and why it’s a good fit to merge.

Research gives you insight into the earning power of your potential merger partner

Evaluating financials of especially if its a big corporation is not easy, so it’s advisable to seek the help of experienced attorneys and accountants.

Deal with uncertainties and inequalities early

while deliberating about a merger, it’s important to deal directly with possible inequalities early into the negotiations. If the benefits seem one-sided or unsatisfactory it’s better to work things out with the help of the attorneys to avoid unpleasant issues in the future.

Apart from financial considerations, it’s advisable to work out differences in workplace culture, corporate ethos and management styles. Since both companies may be falling under one new management, it’s good to decide on who will adjust and how much to avoid issues during the transition.

Prepare for lack of Productivity and up-front expenses

While you might be focused on the many benefits of a merger, you also need to be conscious of the fact that the profits would not come immediately. It’s good to prepare for an initial lack of productivity and other workplace issues during the transition.

Also, you must be prepared to incur an up-front cost for things like severance payments and possible relocation. Another major consideration is that it may take some time before you actually start saving.

Customer Service and Staff management

Mergers often take a lot of time, attention and deliberation. This makes some businesses complacent with their customer service during the period. This can be very damaging especially in a case where the merger doesn’t work out.

Also, it’s important to carry your staff along. Although it’s common for workers to leave after a merger, it’s important to keep them updated and motivated to take the company to the next level.

Develop an exit strategy

While this may not be something you want to consider while planning a merger, it is good to keep all the angles covered. Developing an exit strategy just in case things go south is very important as it keeps your company safe.

The rate of failure for mergers is high. So it’s better to play it safe.

We earlier reported that one of the best ways for startups to avoid the current devaluation of the naira is to expand into other markets. With this merger, Bliss Group merger may be taking the right step to profitability. So if you have a business and you are looking for a merger to expand into new markets, endeavour to tick all the points listed above to increase your chances of success.