Only 10% of Nigerian MSME’s believe that Artificial Intelligence (AI) and the Internet of Things (IoT) will have the most impact on their businesses in the next 3 years.

This is according to a survey carried out by global audit and business consulting company, Price Waterhouse Coopers (PWC).

The survey report tagged PwC’s MSME Survey 2020- Building to last was conducted between August and September 2019. Its aim was to investigate and shed more light on the current issues affecting MSMEs in Nigeria.

This highlights the factors impeding business growth in Nigeria from the perspectives of the business owners.

The survey examined 1,629 key decision-makers and CEOs in the MSME sector. The businesses they run have annual sales turnover of at least N5 million. The businesses were spread across 29 states of the country with all geographical zones covered.

According to the report, business owners in Nigeria don’t have much regard for tech enablers like Artificial Intelligence and the Internet of Things. Only about 16 of the 1,629 business owners surveyed consider them potential business disruptors. At least not for the next three years.

It won’t be expressly wrong to conclude many Nigerians still consider the concepts of AI and IoT as little more than science fiction. Several others consider it a technology which aims to replace human intelligence and intuition with a kind of ‘synthetic’ computer intelligence.

There have been several initiatives aimed at improving the adoption of Artificial Intelligence, Machine Learning and Data Science in Nigeria. For instance, Data Science Nigeria (DSN) launched the first-ever AI Text Book for Nigerian students in November last year. The body also runs AI boot camps on a yearly basis.

MSME’s still rely on family and friends for funding

According to the PWC survey, many Nigerian MSME’s consider friends and family the most popular source of financing. About 48% of them rely on the people closest to them for funding.

Only 16% of them rely on professional credit providers for their funding.

This is not very surprising especially considering the numerous hurdles small businesses have to overcome just to land bank loans. From insane collateral requirements to insurmountable interest rates, the cards are stacked high up against small businesses.

It, therefore, isn’t uncommon to see business owners resort to rich families and supportive friends come in as angel investors when they are in real need of funding. This is quite advantageous because the process for acquiring such financing is pretty straightforward. There is usually no need for collaterals and interests rates can be pretty low and sometimes zero.

Also, the repayment plan could be quite flexible and last over a longer period.

However, friends and family may not have the amount of money that is required to really grow the business. Thus, a business owner might not achieve much with such funds, while finding himself in debt nonetheless.

Internet for business insights vs professional service providers

22% of MSMEs in Nigeria get their business insights from the internet, the media and research publications. This is against 16% who get theirs from professional service providers instead. This isn’t surprising when you consider the cost of hiring a business consultant.

These consultants charge fees running into several millions. Such amount many MSME’s can’t really afford. If there are alternatives, they would quickly go for it.

Other findings

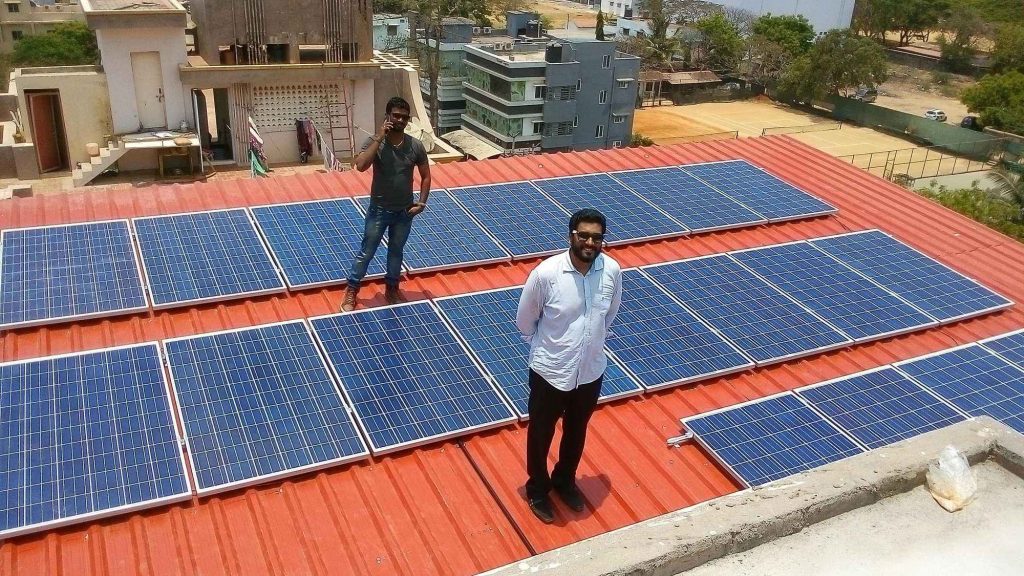

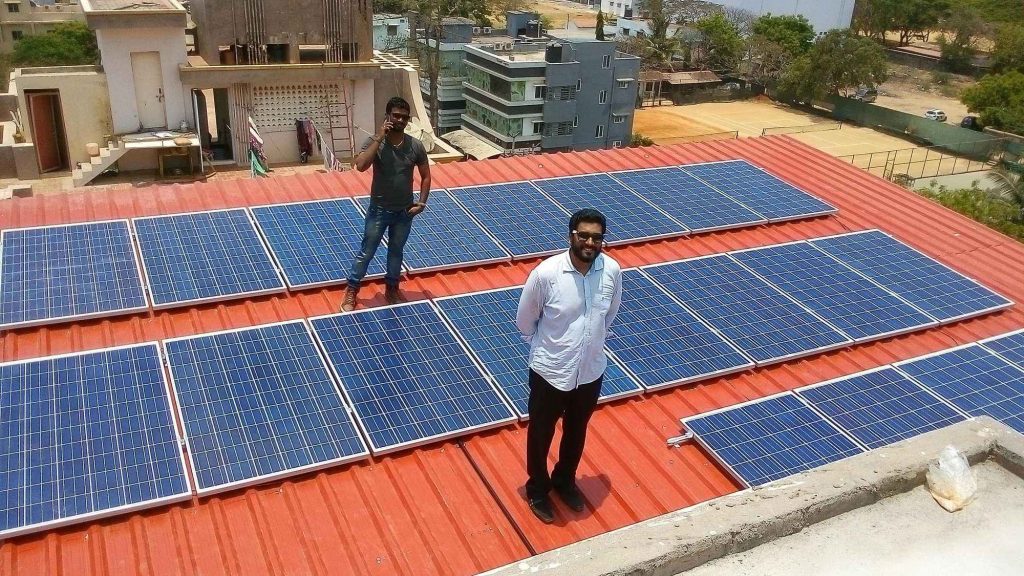

Nigeria’s power sector has always been one of the most debilitating sectors of the nation’s economy. the ills bedevilling the sector, from power generation to transmission and distribution has been well-documented.

Sadly, despite the trillions of Naira pumped into the sector, the country is yet to achieve stable power.

Nowhere is the unavoidable effects of such a shortcoming more pronounced than with Micro, Small and Medium Scale Enterprises (MSMEs) in the country. According to a survey of MSME’s in Nigeria carried out by global audit and business consulting company, PWC, electricity remains the highest expense incurred by business owners.

According to the PWC survey report, 21% of the business owners said electricity constitutes their highest operational cost. Asides the mind-boggling electricity bills presented by their distribution companies, the epileptic supply of power they have already paid for meant they had to seek alternative sources.

With the country still struggling to catch up with solar sources, fuel and diesel-powered generating plants remain the more favourable options.

The entrepreneurs also identified obtaining finance as their most pressing problem as 22% of them claim that was their biggest problem. This is quite typical of young and emerging businesses in Nigeria.

Finding customers is the next most worrying problem with 16% noting this as their most demanding problem. The third most critical challenge is the infrastructural deficit.