Besides the popular fintech platforms like Piggyvest, Cowrywise, and Page Financials that give Nigerians the opportunity to save and make their money work for them, Investnow is another fintech platform that provides premium financial services.

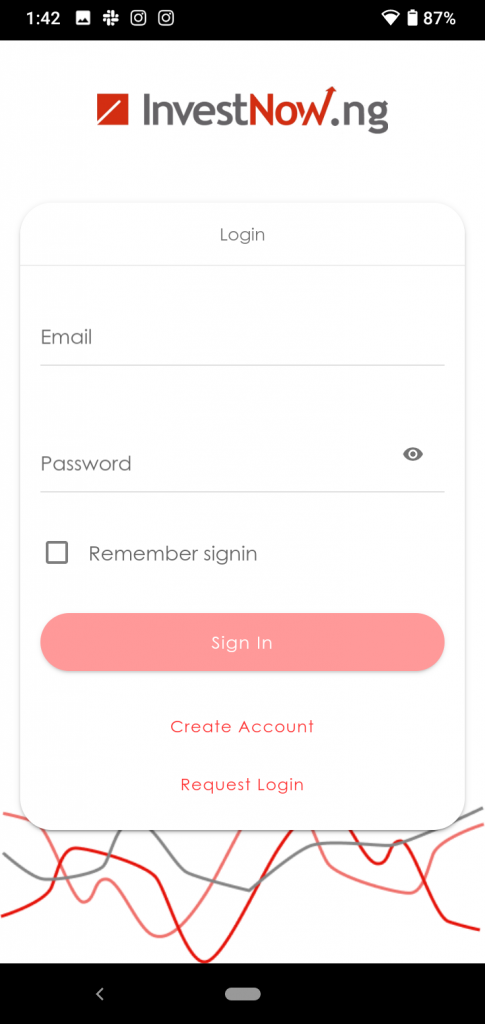

The startup and its services can be accessed from the web app, android or iOS app. I downloaded the android app and registered with the appropriate KYC details. It is important to note that a number of people had issues while opening an account on the app.

While registering, the sign-in portal appeared to be on a timer and would close after some minutes had passed. This means that details such as the BVN, mail, and other registration details have to be ready when the sign-in page is opened.

After the registration, the account is verified in two stages. The first which is the email verification is required in order to set a password for the account. I had to settle for a Google-generated password after different combinations were rejected. If you are considering using the app, you might have to try a number of password combinations before the system makes a pick.

The second verification is where the user tops up the account with money from a bank account. Until this step is completed, no investment can be carried out on the dashboard.

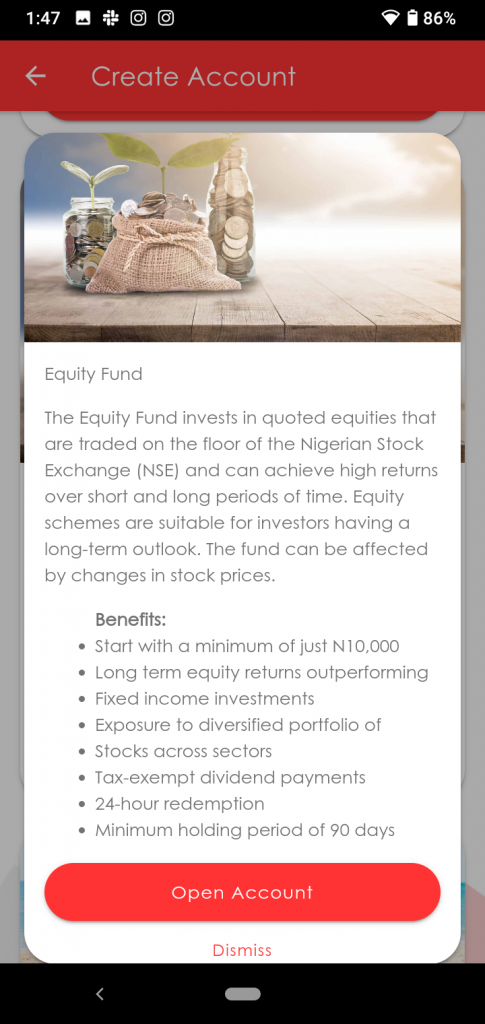

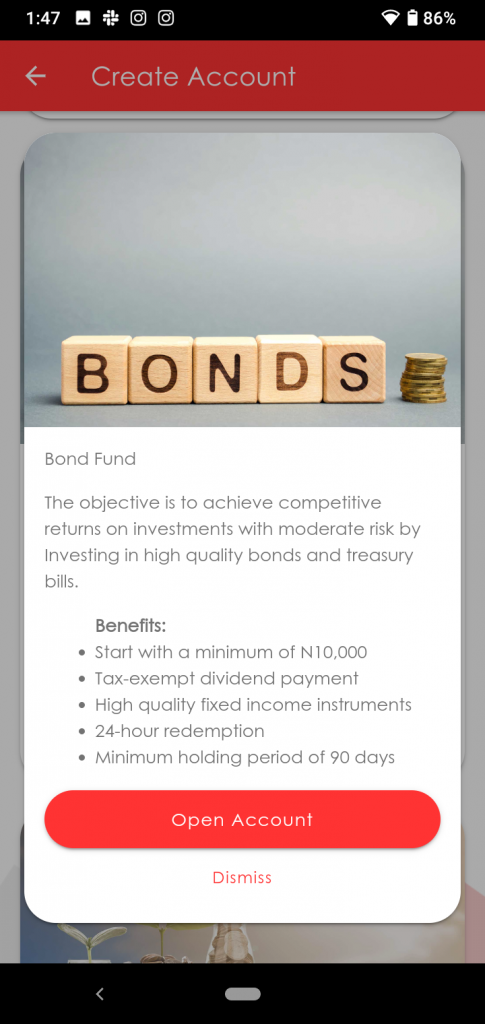

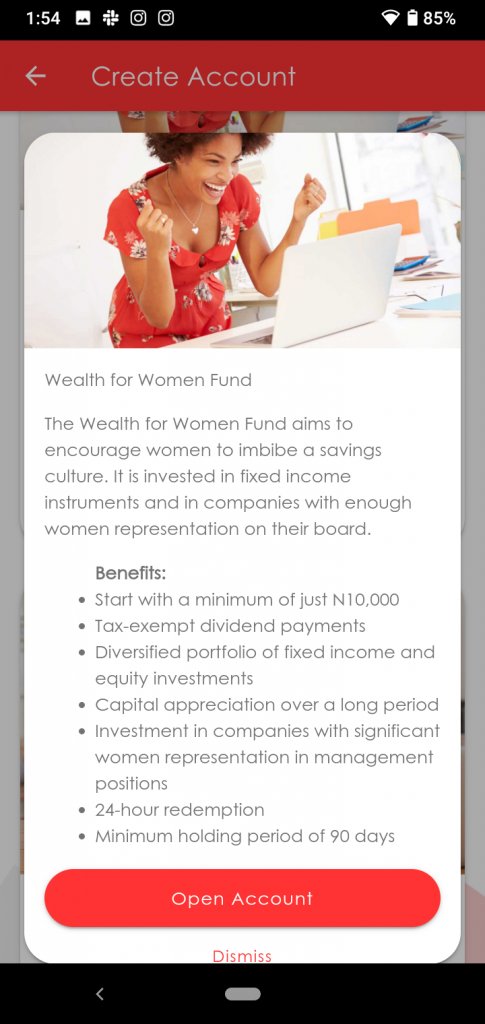

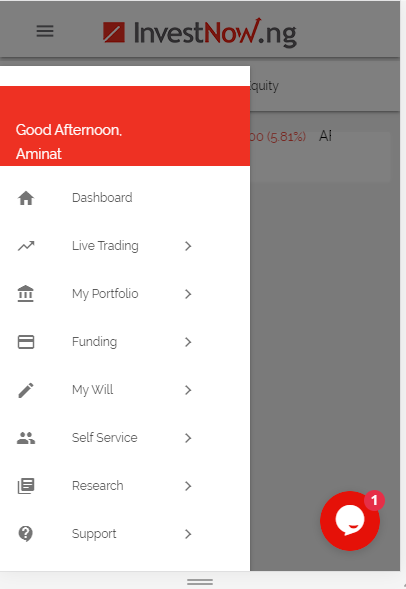

On the dashboard, there are different investment options for people at different stages. Short term investment plans include the Money Market Fund, Bonds, and Wealth for Women Fund. Long term investments on the platform include Balanced Fund and Equity Fund.

The Returns On Investment are varied on each investment type.

- Balanced Fund: 4.01% Year To Date

- Bond Fund: 8.82% Year To Date

- Equity Fund: 7.48% Year To Date

- Money Market Fund: 6.31% annum (Returns can be withdrawn quarterly)

- Eurobond Fund: 6.98% Year To Date

- Wealth for Women Fund: 2.33% Year To Date

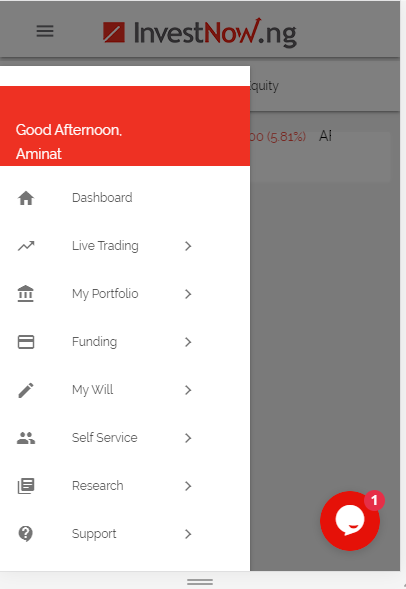

The investment features on the platform are similar to those on other platforms like Piggyvest and Cowrywise. One way it differentiates itself from competitors is by offering additional services besides investment. Users can draw up wills, create heritage trust funds for children, manage finances and trace unpaid dividends.

The platform provides a robust service and seeks to be a one-stop app for fintech transactions. It is not straightforward to use, however, and can be confusing to a first-time user. While creating an account, each type of fund came with the option ‘Create an account,’ this made it seem like one had to create separate accounts in order to use the different services.

When making payments through the bank, only 5 banks are currently supported. If your bank is not included, the other option is to pay using your card details.

If you are looking for an investment app with diverse options and the returns on investment listed above work for you, then InvestNow is a good choice.