KudaBank (“Kuda”), Nigeria’s only digital bank fully licensed by the Central Bank of Nigeria, announces the launch of ‘Kuda for Web’ – providing enhanced functionality to its suite of online banking services.

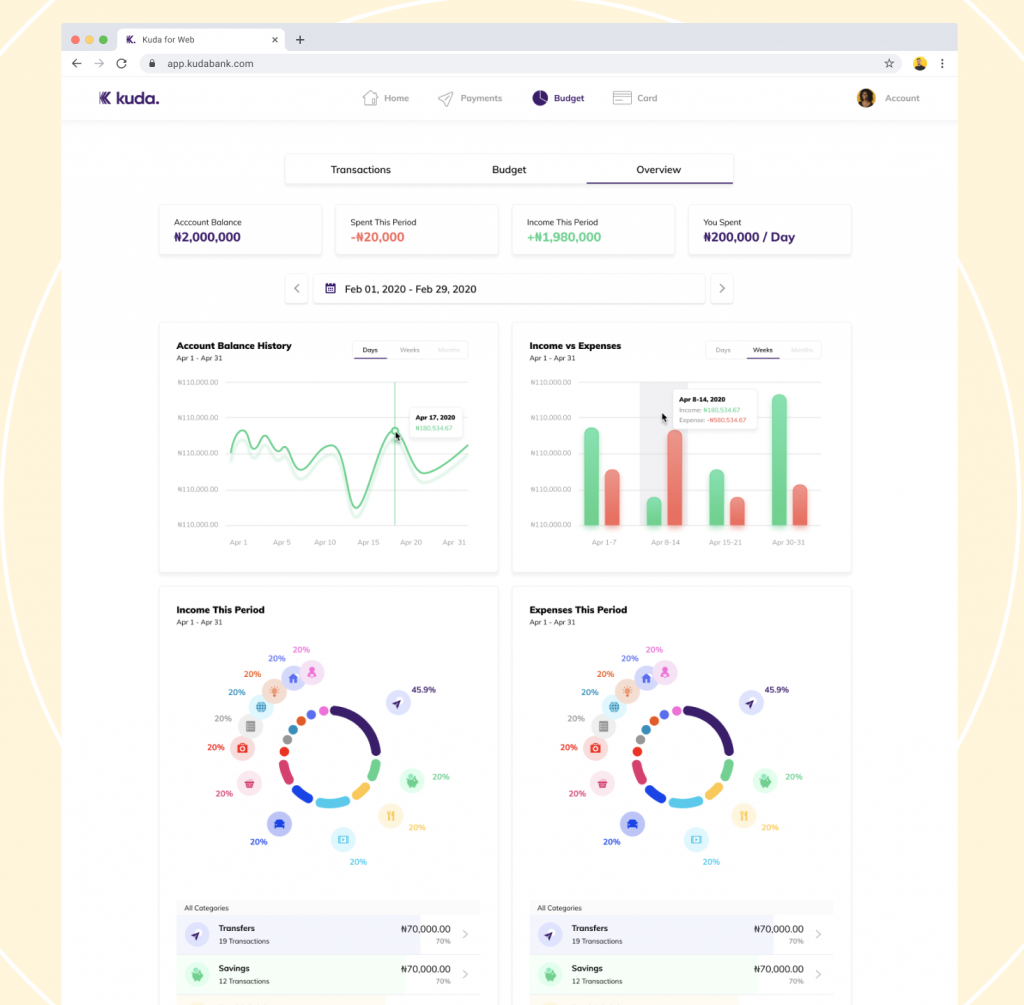

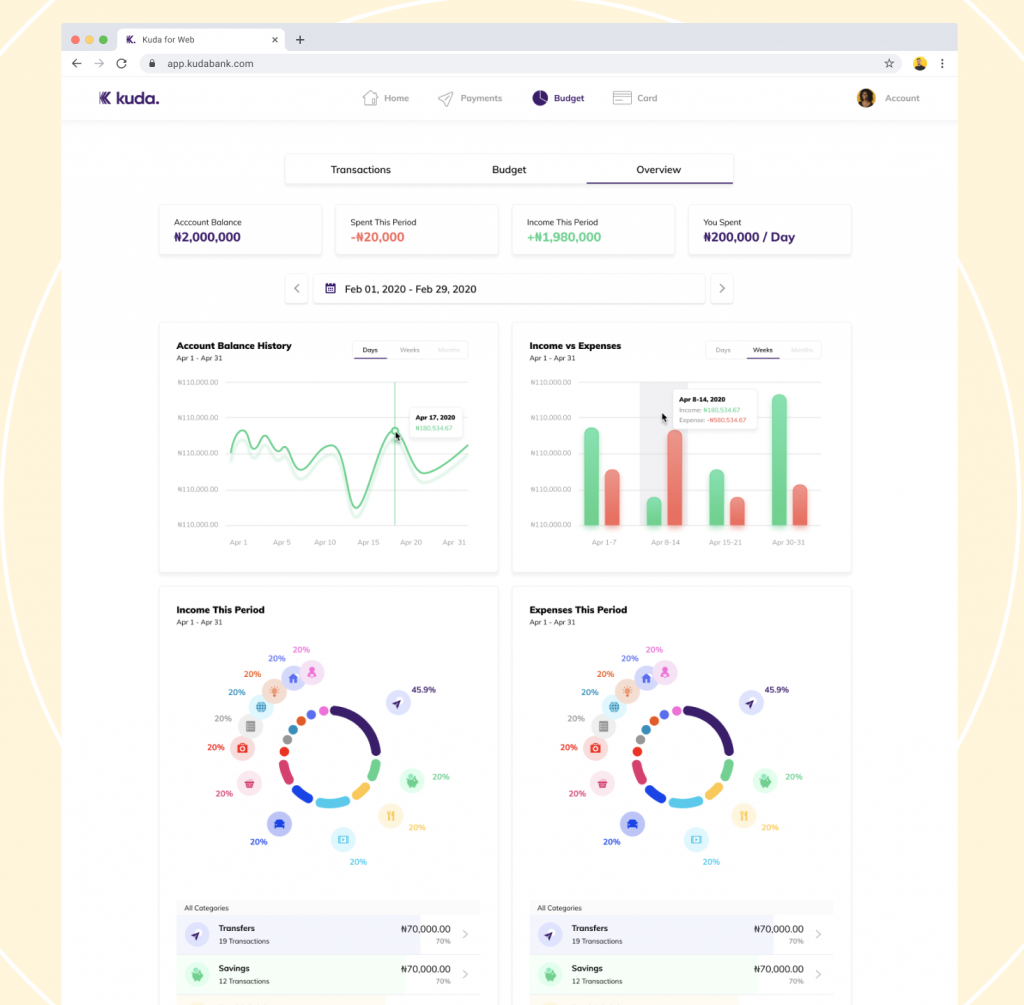

Kuda for Web is now available to all existing users and allows them to see their money like never before. User-friendly graphs and charts give customers a detailed view of their finances, beyond merely withdrawals and deposits – into specific timeframes and transaction categories. In turn, this will allow more efficient budgeting by Kuda customers.

The enhanced offering is a natural complement to Kuda’s suite of free banking services. The company’s purpose is to provide affordable banking to the underbanked. The extension of this is making personal finance user-friendly and educating users about where their money goes. This encourages the right financial planning decisions to be made.

Previously, access to Kuda’s full banking services was available exclusively through its apps for Android phones and the iPhone. The launch of Kuda for Web allows users to access their account across a wider range of devices. Kuda for Web is compatible with all web browsers and contains all the features customers are used to having on their Kuda smartphone app.

The launch adds to Kuda’s suite of services that allow Nigerians to have a current account, save money automatically and earn up to 15% annual interest without the burden of bank charges.

Speaking on the development, Babs Ogundeyi, CEO of Kuda, said Kuda for Web is a natural extension of the bank’s drive to provide affordable banking to the underbanked.

“The natural extension to our purpose of providing affordable banking to the underbanked, is helping customers see their money in a user-friendly way, so they can understand and plan their finances. Kuda for Web’s features will help customers make better use of their hard-earned money.

Babs Ogundeyi

“60% of Nigeria’s population does not have access to a bank account due to being priced out by fees or minimum deposits. Even those who are banked can find the experience frustrating. We want to change all of this and make banking with Kuda both easy, and free.”