More and more people are employing peer-to-peer (P2P) services like Paga to make everyday payments. From paying rent to buying dinner, P2P services offer Nigerians the convenience of quick and easy transfer of money.

However, because of its relative ease of use, P2P services, unfortunately, also present easy ways for scammers to steal funds. A new Nigerian fintech startup, Middletrust is protecting Nigerians against this type of P2P fraud, using its proprietary escrow technology and processes.

Escrow serves as the neutral middleman that checkmates fraudulent schemes from either buyers and sellers. It updates both parties on any new development as regards the already opened transaction and makes sure everyone keeps to their end of the bargain.

The platform launched full operations in April 2020 and has already processed over N25 million in secured transactions.

Middletrust Platform

The Middletrust platform was simple and easy to navigate. It was both Andriod and Windows-friendly with a direct interface where you can choose to buy or sell on the platform.

The payment platform also allows you to select the type of transaction you want to perform and enter the agreed price. It then shows the calculated fees that will be paid.

For a transaction of N1000, Middletrust charged a fee of N228, which is about 22.8% of the total transaction. However, as the total value of transaction increases the rate of the fees reduces. For example, a fee of N480 (4.8% of total transaction) is charged for the transaction of 10,000 and a fee of N3,000 (3% of total transaction) is charged for a transaction of N100,000.

Asked if he’s not worried his platform might be viewed as elitist since it discourages smaller transactions, cofounder of Middletrust, Efe Ojadua told Technext that the pricing mechanism is fair and it is basically an issue of how much a user is willing to pay for the safety of their hard-earned money.

“The platform does not discourage small transactions. We try to be as transparent as possible while also making sure that we do not run at a loss. The fee charged when using Middletrust includes card processing fee, withdrawal fee, sms & email charges, insurance and a few other charges. We added everything together and came up with the current charge which covers all charges conveniently.”

Efe Ojadua

He also explained that the startup gives the transacting parties the option of splitting the fee equally, to further ease the burden. While filling the transaction form, a user is asked how they would like to pay the trust fee. The options are ‘buyer pays’ ‘seller pays’ or ‘both seller and buyer pays’.

The transaction fees are capped at N8,000 for any single transaction.

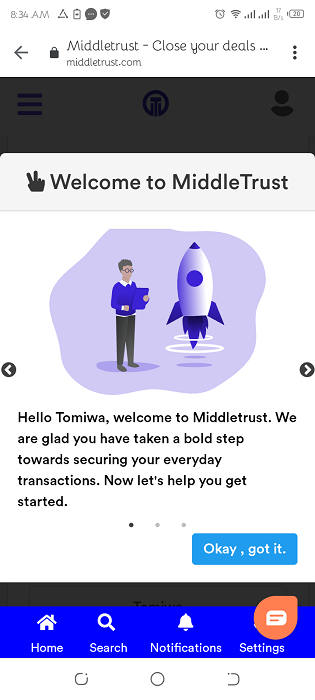

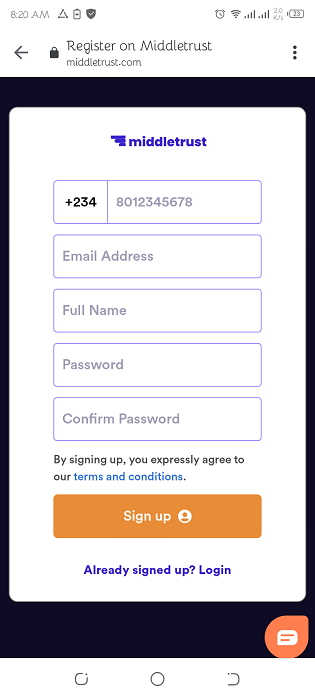

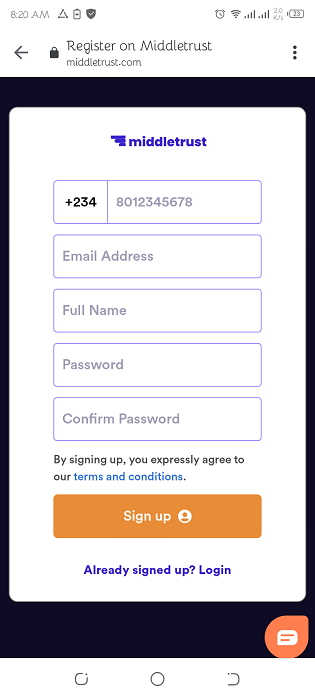

However, you need to have an account before you can process any transaction. You can either sign in using your phone number and password if you have an account or click the sign-up link to create an account.

Signing-up on Middletrust

To sign-up for Middletrust, you will need to provide your phone number, email address, full name and password. However, if you are under 18, the terms say you are not permitted to access the platform. Also, clicking the sign-up button automatically means you agree to the terms and conditions

After signing up, a link to verify your account will be sent to your mail and a code to your phone number. You will first need to verify your email and then enter code when signing in to complete the creation of account.

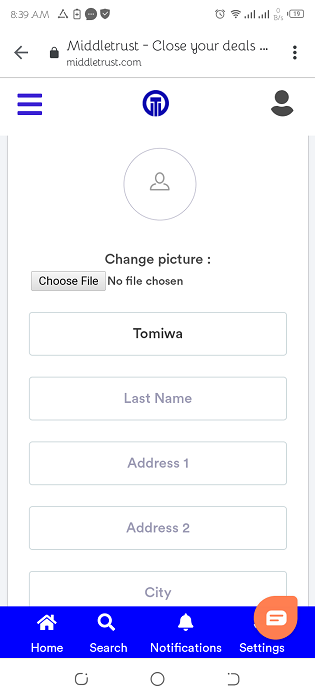

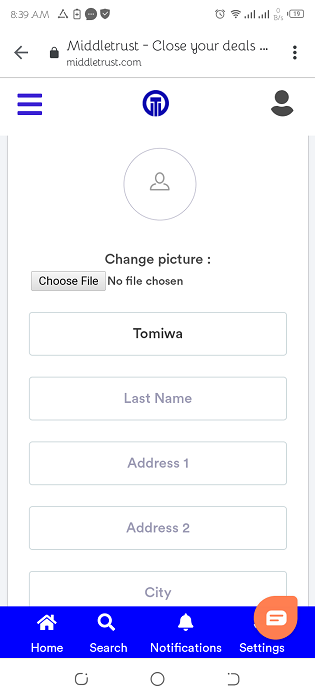

When your account is created, you will need to put in basic information like picture, last name, address, birthday and gender before you can execute transactions.

Note: the verification link may take a few minutes to show up, mine took like 5 minutes

After completing your profile you will have to indicate if you are running on the platform as an individual or a business. Once saved you cannot change the account type. You can then proceed to add a security question as well as a 4 digit pin for transactions.

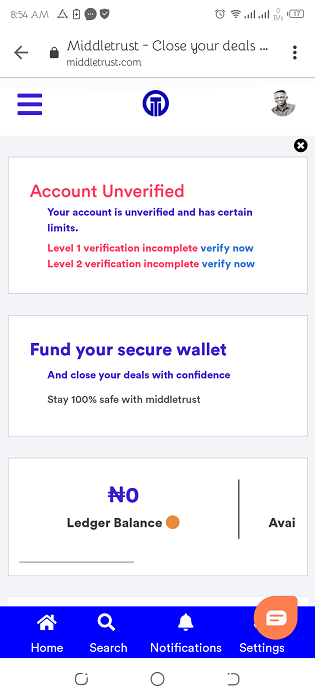

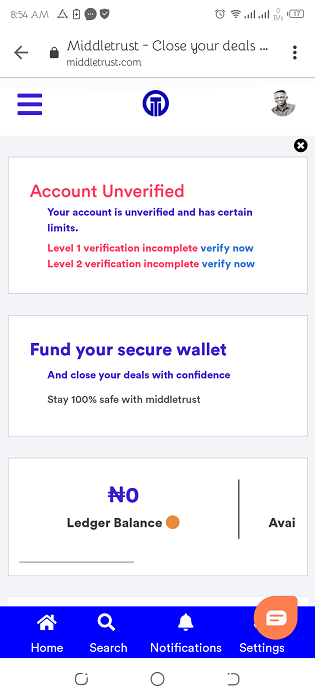

Now you can make transactions on the platform. But the account still has two levels of user authentification. To unlock level 1, you have to provide your Bank Verification Number (BVN) while for level 2 you have to provide a valid ID or a current utility bill.

Ojadua Efe explained that the levels of authentification and verifications are intended to discourage fraudulent individuals.

We discourage individuals with fraudulent intents with a rather strict identity verification process in line with the CBN KYC/AML policy. All registered users are expected to verify the identity using the BVN, a government issued ID card and a proof of address (usually a utility bill)

Ojadua Efe, co-founder of Middletrust

Making Transactions with Middletrust

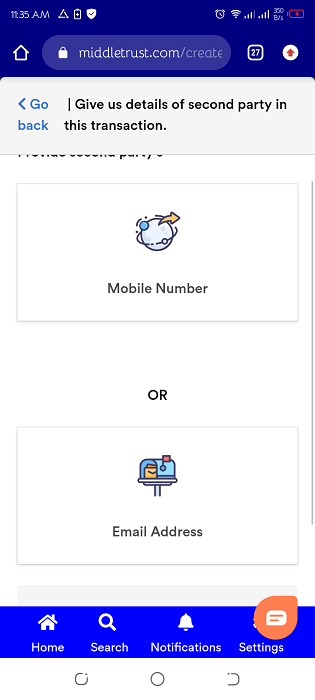

Once you have created an account, you can initiate a transaction either from the home page or by creating a transaction link on your personal dashboard. Middletrust has about 8 different types of transactions to suit your needs.

When you select your desired type of transaction, you can then proceed to enter either the phone number or email of the second party to initiate the transaction. However, if the person is not on Middletrust you cannot complete the transaction. The platform allows you to send a link to invite the person you want to transact with unto the platform.

Asked why users cant transact with unregistered buyers or sellers, Ojadua explained that it was required because whoever the user is transacting with also has to undergo all the verification process.

The co-founder further explained how the company’s whole escrow process of handling transaction works.

“A typical transaction that covers a seller and a buyer would require one of the transacting parties to set up a contract on Middletrust which can be done by filling a form. Let’s say the buyer opts to create the contract. With the information we collect from the form, we generate a contract which is sent to the seller. After the seller reviews the contract, he can decide whether to accept or reject the contract. If he accepts, he is expected to fulfil his end of the bargain”

Efe Ojadua

Asked when the seller will receive payment for the transaction, Ojadua revealed that only after the seller has delivered what was ordered will he be entitled to receive the payment.

He added that the startup leaves the final approval of payment to the buyer. Ojadua explained that this was because the company believes that only the buyer can decide if he has received what was ordered and if he finds the goods satisfactory in line with what was agreed and stated in the Middletrust contract.

This means that Middletrust holds the payment of the transaction until the buyer accents that he as received the agreed goods ordered.

Asked what happens in a scenario where both parties are unsatisfied with the agreement, Mr Efe said both have the option of raising a contract dispute which is resolved usually within 24 hours.

He added that the startup has a strategic partnership with a Lagos based law firm that helps with the enforcement of contract terms.

“We believe that if you accept a Middletrust contract after reviewing the terms, you should do what you have agreed to do and if you try to wriggle out of a deal without the express permission of the counterparty, we’ll seek redress of the issue in the court of law.”

Ojadua Efe

In a situation where disputes on a particular transaction are tricky and the company couldn’t come to a clear conclusion, the startup has a strategic partnership with one of Nigeria’s top insurance companies, Sovereign Trust Insurance plc to cover the cost of the transactions. According to Ojadua, Middletrust has N10,000,000 Insurance on transactions.

Summary

Midddletrust is providing the much-needed security Nigerians crave when shopping online. The high probability of being scammed has made a good number of people reluctant to buy from strange or unknown vendors.

The startup now has over 200 users and counting. With the platform growing customers confidence by eliminating all transaction-related risks, more Nigerians will welcome it as an alternative to “payment before delivery and payment on delivery” methods which have lots of uncertainties.