Voyance, a Lagos-based data science company is launching a fraud monitoring platform that uses aggregated data from fintechs within Africa to protect them from fraudsters.

According to Voyance, Sigma uses a fraud graph database that helps fintech companies block known fraudsters from performing activities on their platforms. It also added that the platform is starting in Nigeria.

Blocking Fraudsters

Leveraging on its experience of building innovative solutions designed to enable companies to extract value from their data, Voyance developed Sigma to be a historical database of fraudulent users operated by an industry alliance.

According to Voyance, about 80% of fraudulent transactions are performed by the same fraudsters. It added that fraud results in high amount and monetary losses for fintechs and there is currently no way for companies to block known fraudsters from their platform.

A fraudster can use the same identifiers (card, BVN, phone number ) fraudulently with different companies because these companies are usually not aware of the status of that user as a fraudster and that’s why, this is critical.

This is why Sigma which is a data-driven fraud infrastructure product with the purpose of collecting and sharing profiles of bad actors and fraudsters, is important.

How Sigma Works?

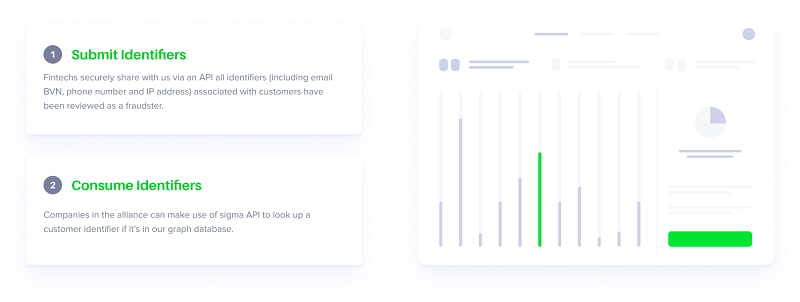

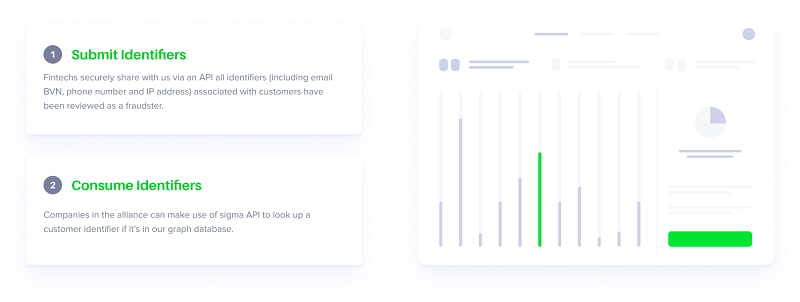

The Sigma platform leverages on the database of known fraudsters collated from its alliance of companies to protect them. Companies in the alliance submit known identifiers like BVN and phone numbers into the graph database. The companies can then use the database to check for known fraudsters who want to perform transactions on their platform and block them.

According to Voyance, All data submitted to the graph database are anonymised.

For example, if a fintech in the Sigma alliance fills the graph database with the identifier of a fraudulent user on its platform. The database saves the data anonymously.

However, if the same fraudster tries to perform an activity with the same details with another fintech in the Sigma alliance, it will be blocked automatically. Also, new identifiers related to the recent attempt of the flagged fraudster will be automatically backfilled into the database.

With the increasing frequency of fraud attacks and baits especially on social platforms, a method to blacklist known fraudsters will come as a relief not only to fintech companies but also to their users.