Facebook, in its Q1 2020 report, announced that it generated $17.74 billion in revenue. The result bested the $17.3 billion revenue estimated by analysts, following the outbreak of the pandemic.

The revenue generated shows an 18% increase from the numbers recorded during the same time last year. This shows that advertising demand was strong before the crisis.

Following the release of the Q1 2020 report, Facebook shares rose by about 10% in after-hours trading. This was probably as a result of optimism brought by the announcement that business was steady after the company suffered a steep decline in advertisement sale in March.

“After the initial steep decrease in advertising revenue in March, we have seen signs of stability,”

Extract Facebook statement

Facebook reported an earning per share of $1.71, this is below the $1.75 in earnings per share expected by analysts. However, the shares closed at $194.19 in New York after the 10% spike.

Over 1.73 billion daily users

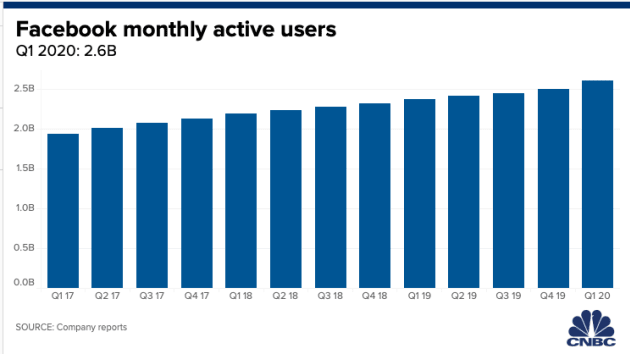

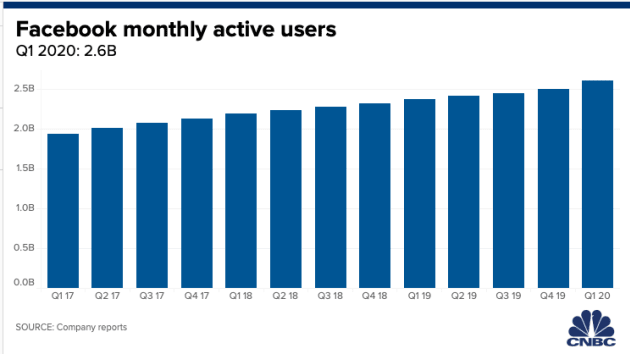

With the stay at home in effect due to Covid-19, the number of daily users on Facebook’s platforms has increased significantly. According to the report, daily users on Facebook’s platforms including Instagram and WhatsApp averaged about 2.36 billion, this is a 4.4% increase from the numbers recorded in December.

Facebook’s core social platform now registers about 1.73 billion daily users, a 7% increase from the 1.66 billion reported in December 2019. Also, Facebook and Instagram live streams are now seeing about 800 million daily active users.

Because no one is planning physical events right now, live streaming has become the primary venue for many events

Mark Zuckerberg, CEO Facebook

However, the increasing number of users may not have a significant impact on Facebook revenue because voice messaging and direct messaging which are on the increase are not areas where the company makes significant revenue.

$297 million in Other Revenue

Apart from advertisement, Facebook generated about $297 million in “other” revenue during the first quarter. This is a significant 80% increase from revenue generated during the same period last year.

According to Facebook CFO, David Wehner, the sales increase was driven by Oculus products. Other revenues, includes sales generated from Oculus virtual reality headsets and the Portal video-chatting devices.

Reduction in 2020 expenditure

Due to the shelter in place caused by the outbreak, Facebook is forecasting that its capital expenditures for 2020 will be in the range of $14 billion to $16 billion. This is down from the $17 billion to $19 billion original projection pre-COVID. According to Wehner, the reductions will be deferred to 2021.

Shelter-in-place orders are delaying construction projects, including data centres, temporarily lowering Facebook’s capital expenditure. Given the strong engagement growth and related demands on our infrastructure, this year’s Capex reduction should be viewed as a deferral into 2021 rather than savings

David Wehner, the CFO of Facebook

Also, the company reported its cash and cash equivalents at about $60.29 billion. It forecasts total expenses to fall between $52 billion and $56 billion for the year, down from the previous speculation of between $54 billion to $59 billion.

However, Facebook is still expecting expenses to grow due to revenue weakness, which will probably cut into operating profit margins in the year. According to Wehner, the company is not immune to the crisis and is still cautious on the outlook for business in the second quarter.

“We know economists are calling broadly for a GDP contraction in Q2 that’s pretty substantial globally. We know that advertising tends to be very sensitive to the macroeconomic climate. We really have a very cautious outlook on how things are going to develop.” Wehner said

In summary, despite the steep decline in business in March, Facebook results still show optimism as is evident in the response of investors to the release.

Although the coming months still show the possibility of a drop in sales, Facebooks cash reserves and recent investments show that investors have little to worry about.