The COVID-19 pandemic doesn’t seem to be ending soon and the economic stagnation it has caused is telling. Consequently, some young Nigerians have begun a campaign to compel the Pensions Commission to grant them access to their pension funds.

Just that you know, access to one’s pension funds is supposed to be granted upon retirement. But owing to the COVID-19 induced harsh economic realities, these young Nigerians feel they would be better served by the fund now than at any time in the future.

The conversation was initiated by the co-founder and CEO of Paga, Tayo Oviosu on Twitter.

“It would be nice if National Pension Commission allows Nigerians to get out their pensions now at no penalty or requirement to reach retirement age given the COVID-19 Pandemic,” Tayo said.

I could make much better use of my pension money than leaving it at Stanbic right now.

Tayo Oviosu

The fire he lit quickly caught on and soon, several other young Nigerians who shared the same view were dropping their takes on the matter, with many insisting they would rather have their retirement funds now given the unusual economic situation.

“Right. This would make a whole lot of sense right now. Could make good use of some of those funds,” Precious Nwanganga a health and medical equipment dealer said.

Cobs, another young Nigerian, believes the returns accruable to the pensions savings are too low, to begin with. So there really isn’t much incentive to still keep the money stashed away.

“It’s bad enough that the returns over the last 5 years are sub-optimal compared to government traded instruments,” he said. “Now we have to deal with devaluation and loss of value. Please free our monies.”

Are pension funds readily available to cater to such sudden demands?

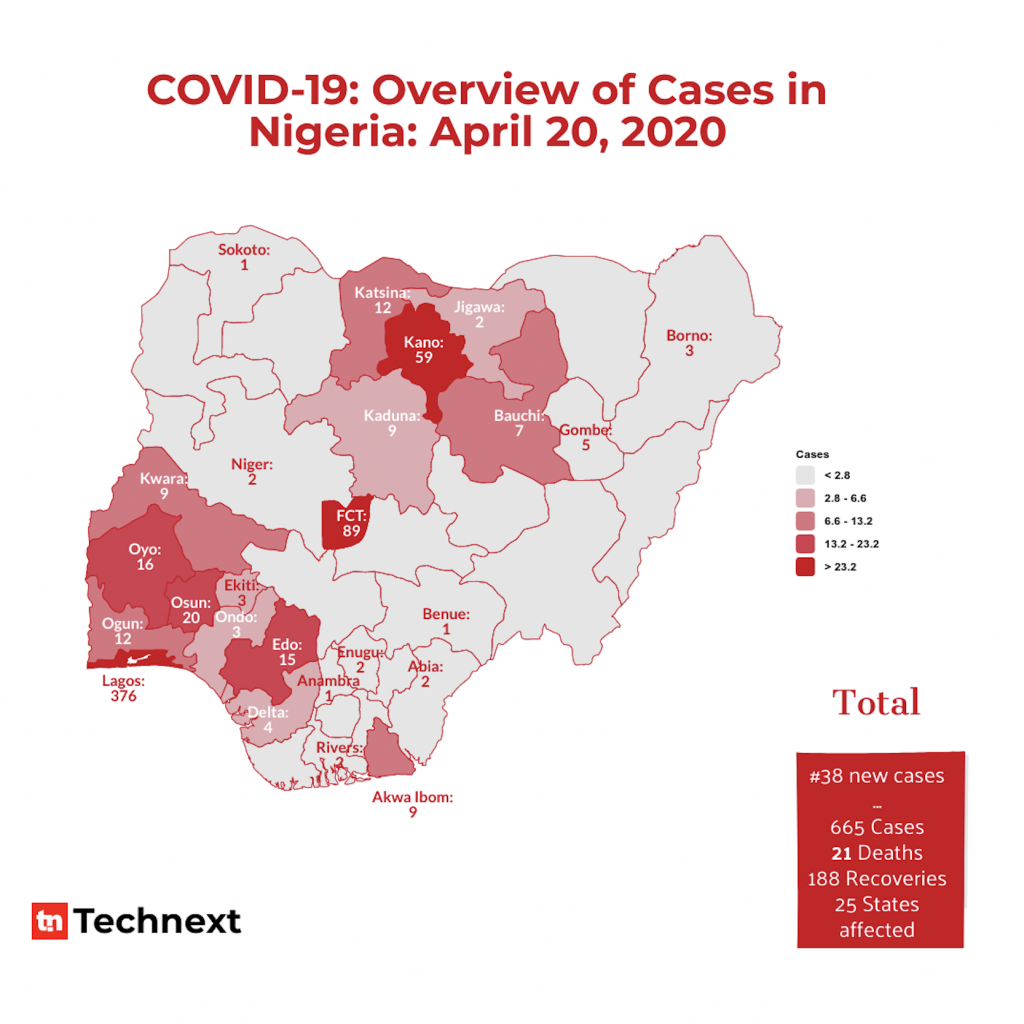

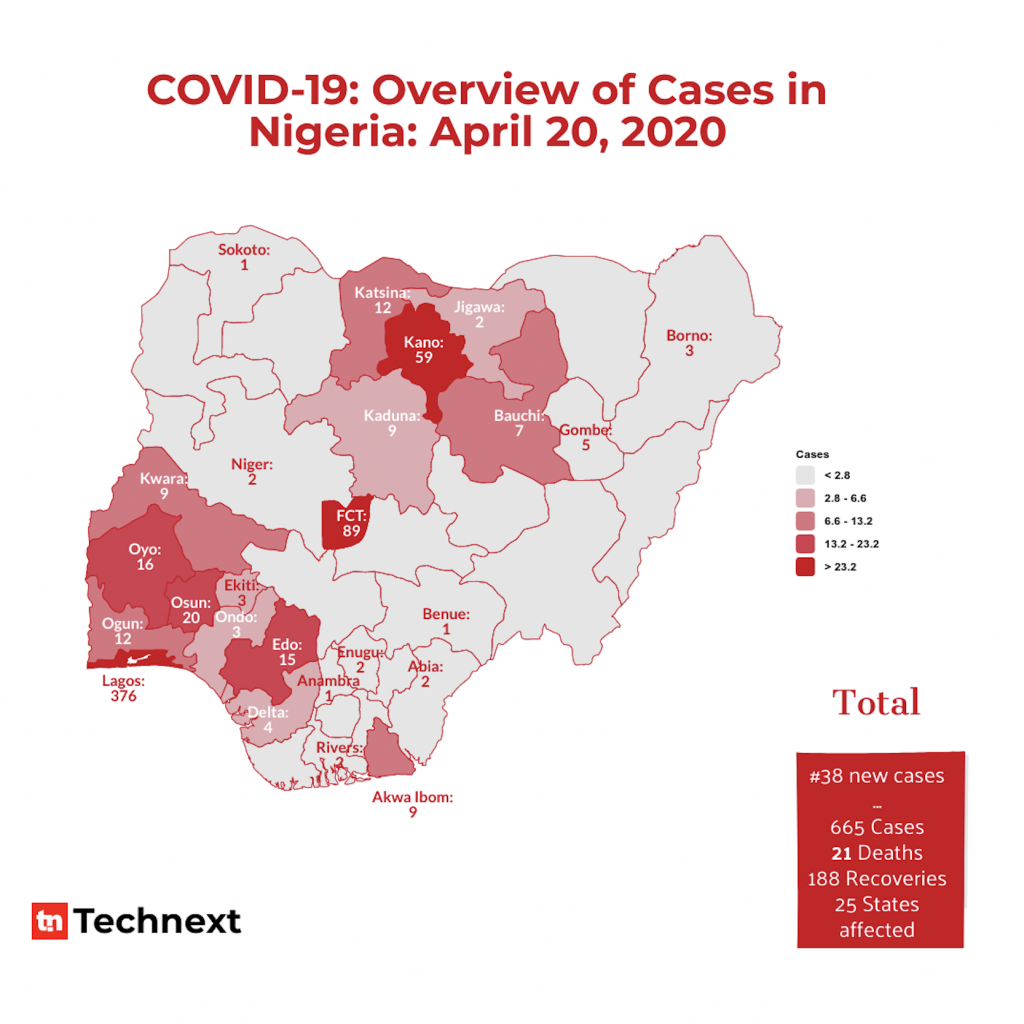

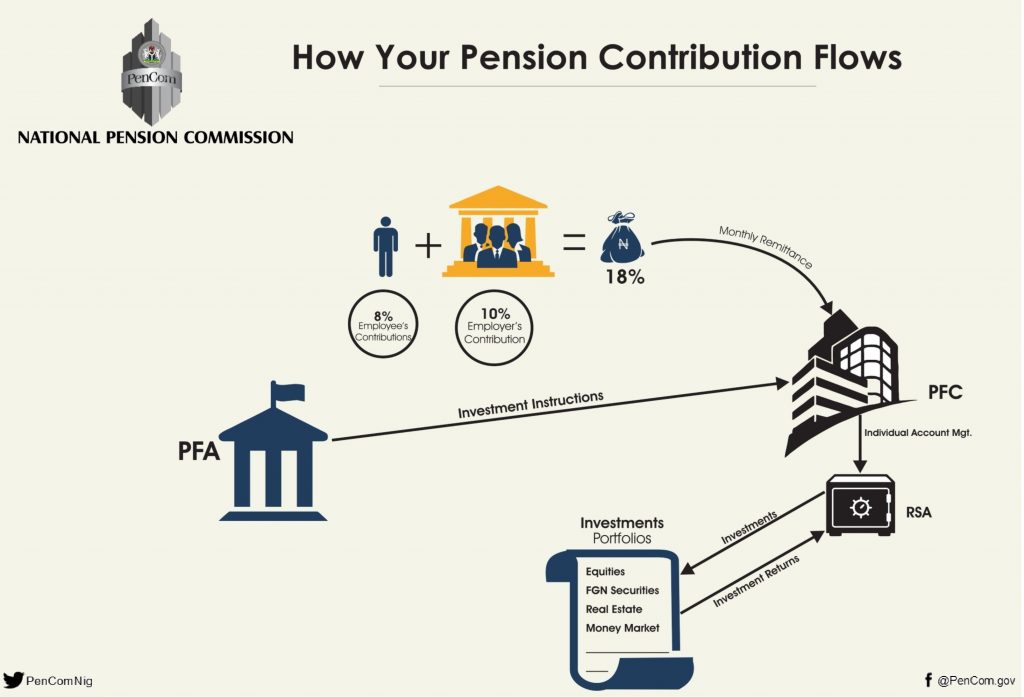

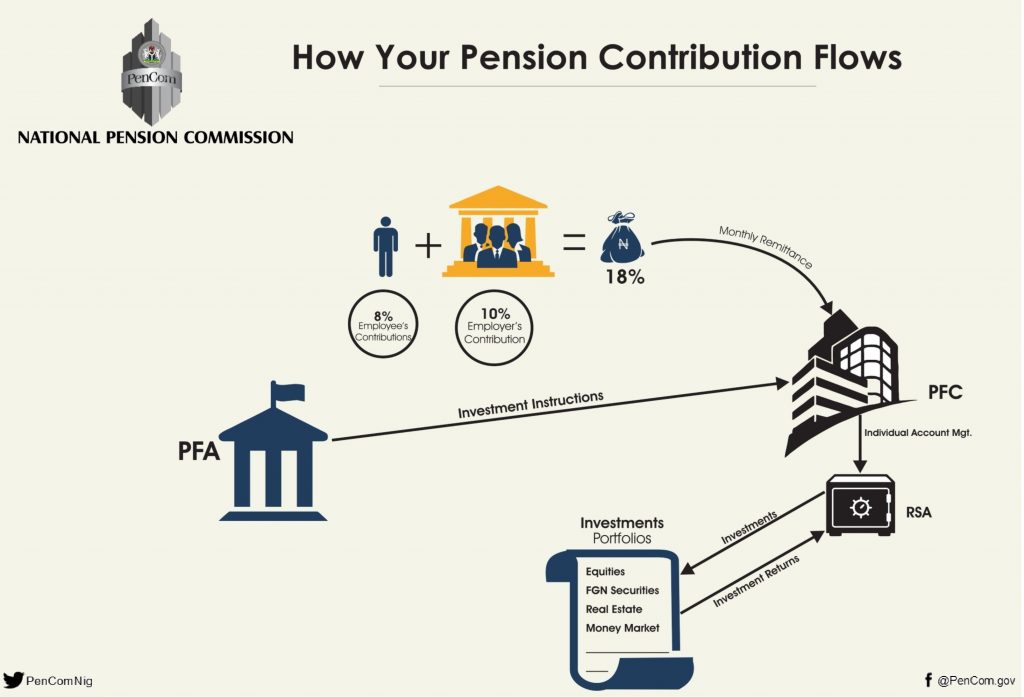

However, some people pointed out that most of the pension funds aren’t available because most have gone to the FG in the form of loans. A data analyst, Ugo Alfred, for instance, thinks most of the money has gone into loans, treasury bills, bonds and other such instruments.

Most of the pension funds are not actually available, FG borrowed from it, PFA’s bought Treasury bills and bonds with it because it is not normal deposit you can withdraw anytime. Technically most of the money isn’t there.

Ugo Alfred

A behavioural psychologist simply identified as Azodo thinks Ugo Alfred is right, insisting that the pension funds administrators would be unable to make funds available if many people come demanding at the same time.

“I think it is based on the assumption that the actual money is sitting somewhere,” he said. “I might be wrong but I don’t think they can fully account for the money if a good number of people want to take a portion of their funds all at once.”

Their fears may be founded because the Federal Government of Nigeria had borrowed significantly recently. In January of 2019, the FG was reported to have borrowed more than N6 trillion of the then N8.5 trillion pension fund. That meant nearly 73%.

In January of 2020, pension fund grew to N10.2 trillion. But with the FG borrowing an additional N2 trillion. The amount borrowed may be narrowed to about 71% of the nation’s total pension fund.

How PFA’s are responding

If the Pension Commission were to grant Mr Oviosu’s request, there may not be enough money to fulfil demand when they start rolling in with full force. This is because there’s probably less than 30% of those funds available.

However, Pension Funds Administrators (PFA) are responding, and quite positively too. Stanbic, Mr Oviosu’s PFA for instance, reached out to him in the hopes of scheduling a meeting and addressing the matter.

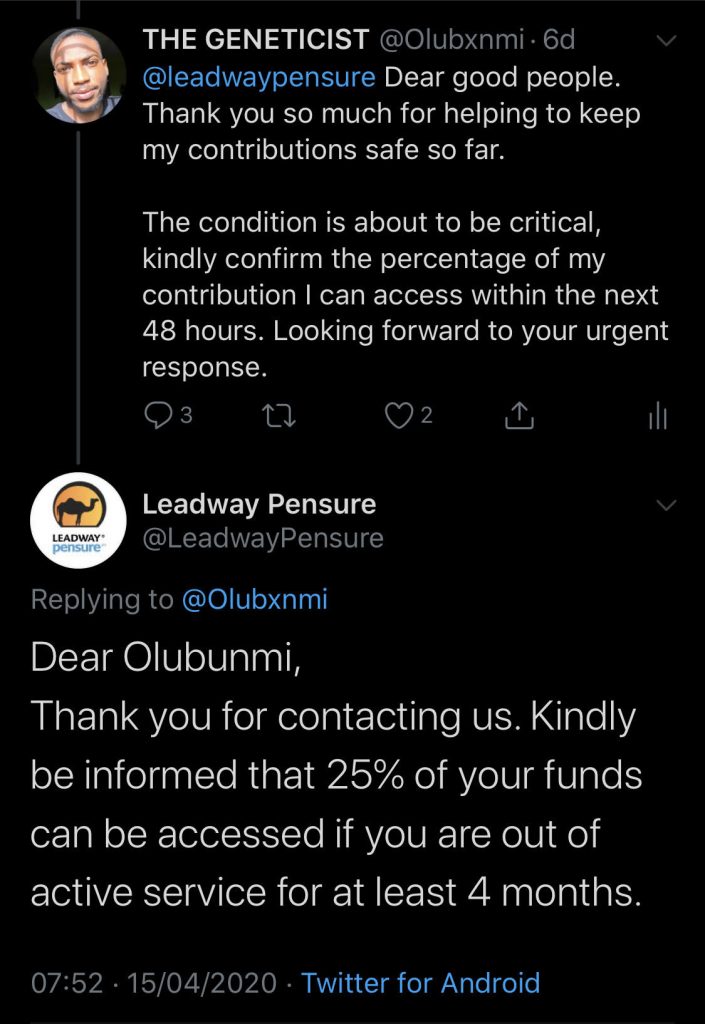

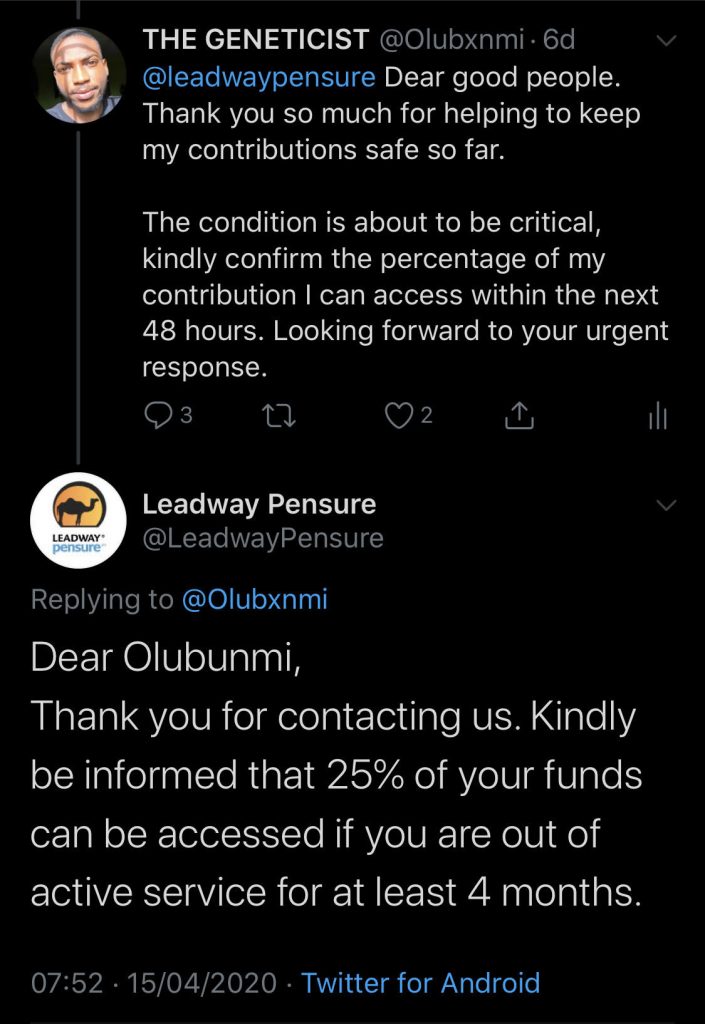

Leadway Pensions, a foremost Pensions manager in Nigeria, reached out to its customer who voiced the same concerns, notifying him that he could get 25% of his pension fund now. The PFA, however, reminded him that he has to be out of employment for at least the past 4 months to qualify for it.

Pension funds are only supposed to be fully accessed upon retirement, usually after the age of 50.

In the end…

People need all the money they can get at this time. For some, it is a matter of survival. Why stash away money for your old age when you face a risk not making it to your old age? For others, it is to support dying businesses. For others still, it is just a means of preparing themselves for what is to come.

The only uncertainty is if the supply end of the equation may be up to the task.