Techstars Toronto has revealed the 10 companies that have been selected for its 2020 edition. The selection was made from several countries across the world, and Quidax, a Nigerian cryptocurrency startup, made the list.

Quidax will be joining 9 other teams for the 2020 program which has been rescheduled to start on June 8 because of the Covid-19 pandemic.

As a part of the program, the crypto startup will receive $120,000 in return for 6% common share equity. Mentoring and unlimited access to the Techstars global network will also be given to each participant of the program.

Meet Quidax

Quidax was established in 2016 as a response to exploitations experienced by both founders of the company, Buchi Okoro and Uzo Awili. Buchi was exploited while trying to exchange cryptocurrency for Naira while Awili received payment in crypto and had no means of converting it to Naira.

Figuring that a number of people must be having the same challenges, the duo set up a Whatsapp group through which people bought and sold cryptocurrencies.

Since it started operations in 2016, the startup has grown in operations to allow businesses and individuals to buy and sell cryptocurrency with their local currency while making it possible for fintech operators to offer cryptocurrency services to their customers.

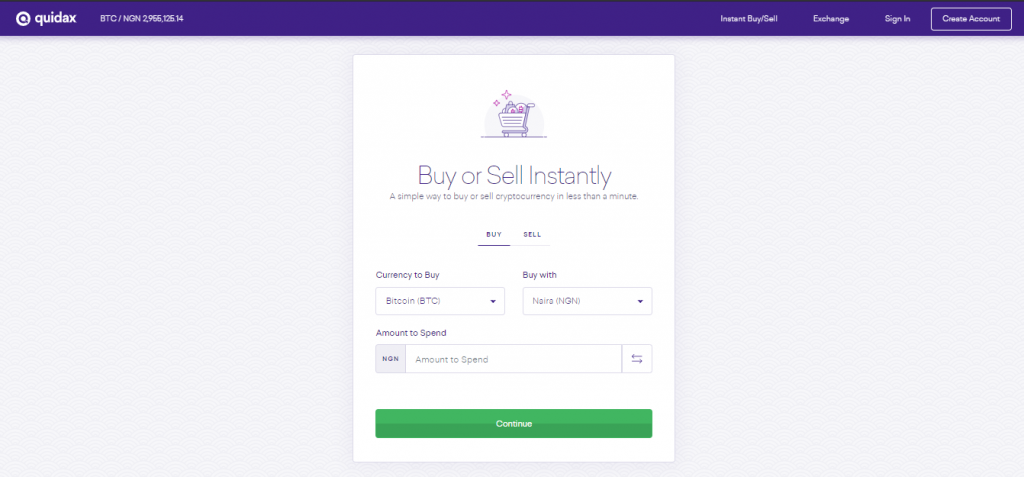

The Quidax Cryptocurrency Platform

Either through its iOS and android app, or through its website, Quidax’s crypto services can be accessed once a user registers and creates an account. The dashboard can be toggled into the light or dark mode, whichever suits the user.

On the Quidax dashboard, users can buy or sell cryptocurrencies as well as deposit funds. The dashboard offers an order-book exchange that allows users to trade Naira to Bitcoin, and other cryptocurrencies.

Cryptocurrencies currently supported by Quidax are Bitcoin (BTC), Ethereum (ETH), Ripple (XRP), Litecoin (LTC), and Tether (USDT).

In August 2019, the startup’s beta app clocked a year and by then certain milestones had been reached. Quidax had processed over $110 million in transaction volume and had served users in 70 countries across 6 continents.

Making transactions on the Quidax platform

Transactions that can be carried out on the Quidax platform are divided into tiers. Each tier has different requirements. The higher the tier, the more stringent the requirements for transactions by the user.

The zeroth tier (Tier 0) allows people to make Naira deposits not more than N20,000. This tier only requires the basic registration details of email and phone number. Once both are verified, transactions not greater than #20,000 can be made but no withdrawals are allowed in this tier.

The first tier (Tier 1) has a higher funding cap of #100,000 and allows no withdrawals as well. This tier requires the user to register with date of birth, address and country.

The second tier (Tier 2) allows users to make deposits of up to #200,000 and make 5 DBTC (DebitCoin) monthly withdrawals. This tier requires Bank Verification number (BVN).

The third tier (Tier 3) allows deposits of up to #10,000,000 and anyone on this tier can make 20 BTC withdrawals every month. The requirement for this tier is an ID verification.

The last and highest tier currently allows deposits of up to #35,000,000 and gives the user 40 BTC withdrawals monthly. It requires that the user provide proof of residence along with other requirements.

Transactions on the platform are done with an affordable charge attached to each. Deposits made through USSD codes and Debit cards carry a charge of 1.4% on the deposit volume. Making fiat withdrawals carry a #100 charge while the charge varies for cryptocurrency withdrawals.

While there is no charge for receiving Bitcoin and other cryptocurrencies, trading fees apply on the platform. The trading fees are split into a 0.2 percent maker fee and 0.3 percent taker fee.

The trail ahead

Part of what stands Quidax apart is the speed with which it makes its local bank settlements. From 12 hours, Quidax now carries settlements in 2 minutes for users.

This, as well as the partnerships made in the fintech and traditional banking sectors, makes it possible for the startup to keep fine-tuning its services.

With its selection to be a part of the Techstars family, more opportunities for strategic partnerships as well as funding base is opening up for the Nigerian crypto startup.

With its African focus, Quidax can move on faster with its plan of expanding into 40 African countries over the next 5 years and powering remittance in and out of Africa.

Part of what lies on the trail ahead is also regulation of the crypto sector by government-authorized agencies. Recall that the crowdfunding sector recently came under a sleuth of regulations by the SEC.

It is expected that the cryptocurrency field will also be regulated as more players and activities come into the field with time.

While the Techstars Toronto selection has been announced, Quidax and the 9 other teams will begin with a soft-start before the program kicks off fully and physically on the 15th of June.