Financial inclusion is essential for the continued economic growth of any country. However, in the case of Nigeria, about 40.1 million of the country’s 96.4 million adult population are financially excluded.

This might appear surprising in an age where ePayment and eCommerce, among other banking and financial innovations are breaking grounds. However, research has shown that women, youths under 25 years, rural dwellers especially those in the northern part of the country are among the most financially excluded.

Also, sectors that drive the economy in sub-Saharan Africa like agriculture and micro, small and medium-sized enterprise (MSMEs) still runs majorly on cash. This reflects the low level of financial inclusion in the region.

Every year, about 40% of MSMEs in developing countries have an unmet financing need of about $5.2 trillion. This misnomer is especially concentrated in Sub-Saharan Africa where 97% of the 44 million MSMEs in the region are micro-business which includes smallholder farmers.

MasterCard in a just-released report titled: Pay on Demand: The digital path to financial inclusion in Africa, shared insights as to how Pay on Demand method could be a driving force in Nigeria and Africa at large.

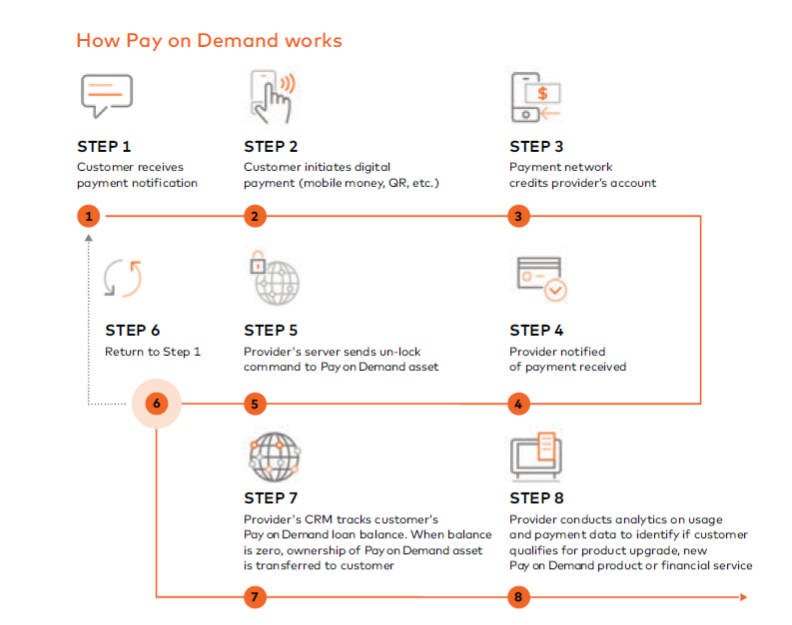

Pay on Demand Model

Pay on Demand business models are emerging quickly around Africa. A company like M-Kopa, for instance, adopts the model to provide its clients with the ability to pay for what they use in small installments.

Thus, an average family can afford electricity powered by solar energy, clean water, or education because the method enables easy payment when they want it and in sizes they can afford.

Pay on Demand provides a way to reach the underserved population and help them towards financial inclusion by providing access to products that improve livelihoods.

Also, by adopting this customer-centric approach, consumers and small businesses would participate more in the digital economy. On the whole, it would further drive financial inclusion in the sub-Saharan region.

Financial Inclusion in Nigeria

In 2012, Nigeria launched a National Financial Inclusion Strategy with the aim of reducing the country’s high financial exclusion rate from 46.3% to 20%. However, by 2018 the overall financial exclusion in the country was still high. This forced a review of the strategy.

Currently, the Central Bank of Nigeria (CBN) is working towards its set target of 80% financial inclusion in 2020. However, the slow rate of financial inclusion over the last few years calls for a new strategy to drive its adoption.

Mastercard, in its recent report, has made a compelling case for the use of Pay on Demand solution in driving financial inclusion. Reviewing the Mastercard’s report, I shortlisted 5 ways leveraging Pay on Demand can help Nigeria reach its 80% financial inclusion target by the end of this year.

Filling the Digital Divide

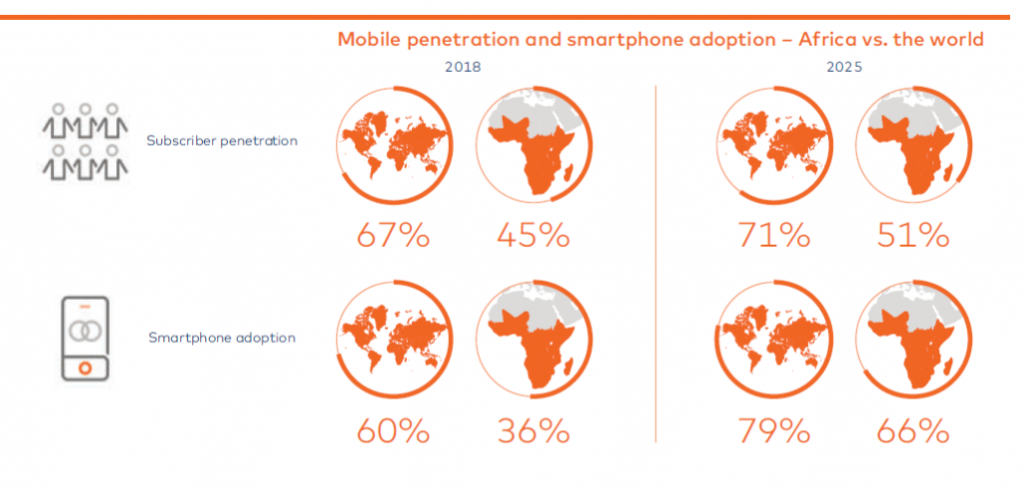

Sub-Saharan Africa (SSA) falls short of the global average in ownership of mobile phones. About 45% of people in sub-Saharan Africa (SSA) own a mobile phone but only 23%, around 239 million people use mobile internet on a regular basis.

Across the world, 60 out of every 100 persons own a smartphone but in SSA, only 36 out of every 100 own a smartphone.

Mobile devices have become the most viable instruments for driving inclusion ever since prepaid plans have enabled individuals to recharge for as low as N36.50.

Bridging the digital divide by providing access to affordable smart devices has proven to be a way of connecting people to the digital world. This promotes financial inclusion.

However, many Nigerians especially the underserved populace have erratic income patterns that won’t allow them to afford a one-time purchase for low-cost smartphones.

Device financing using a Pay on Demand means consumers get to pay small amounts of money regularly. This can unlock the benefits of smartphone access for multitudes of people. With IoT enabled Pay on Demand, the devices act as collateral so that the lenders feel more comfortable extending credit.

Providing access to daily needs using cashless payment methods

Pay on Demand creates an option for the financially underserved to have access to daily needs they probably wouldn’t have been able to afford. By providing access to fundamental everyday needs using cashless methods, they can be steered towards financial inclusion.

In the solar home industry, this model has improved affordability and access to off-grid electricity for underserved communities. In SSA, between January and June 2019, about 4.11 million solar lanterns, multilight and solar home systems, along with 730,000 off-grid solar appliances were sold.

Based on the lease-to-own model, a consumer who cannot afford to pay for an asset outrightly can still own them by making small daily payments using a Pay on Demand scheme. A consumer pays until they directly own the asset, or until they stop needing it, and the asset is returned to the provider.

Providing access to affordable Internet services

The rate of mobile phone adoption in SSA has made it one of the major vehicles of inclusion and development in the region. The number of smartphone connections in the region reached 302 million in 2018 and is expected to rise to nearly 700 million by 2025.

However, there are still barriers hindering the potential of internet access in the region. One of them is the fact that Africa has slower internet than other regions.

Also, the percentage of 4G adoption in the SSA in 2018 stood at 7%, which is very small compared to the global average of 44%. Currently, Nigeria’s broadband penetration stands at 38%.

The high cost of expanding internet infrastructure, high cost of 4G-enabled devices and government delays in assigning 4G spectrum are some of the factors responsible for unreliable internet connection.

Apart from speed, affordability and availability of internet access is also a major problem. The cost of 1GB of data for an average Nigerian is about 3% of the average monthly salary. Although this is affordable for urban dwellers it can still be much for rural dwellers. Adopting a Pay on Demand model can help them get connected.

Leveraging Mobile Money

Mobile money has proven to be an effective way to include many of the 1.7 billion unbanked adults globally, especially in Africa. This is because despite the problems impeding financial expansion, Mobile money has gathered over 866 million registered accounts across 90 countries.

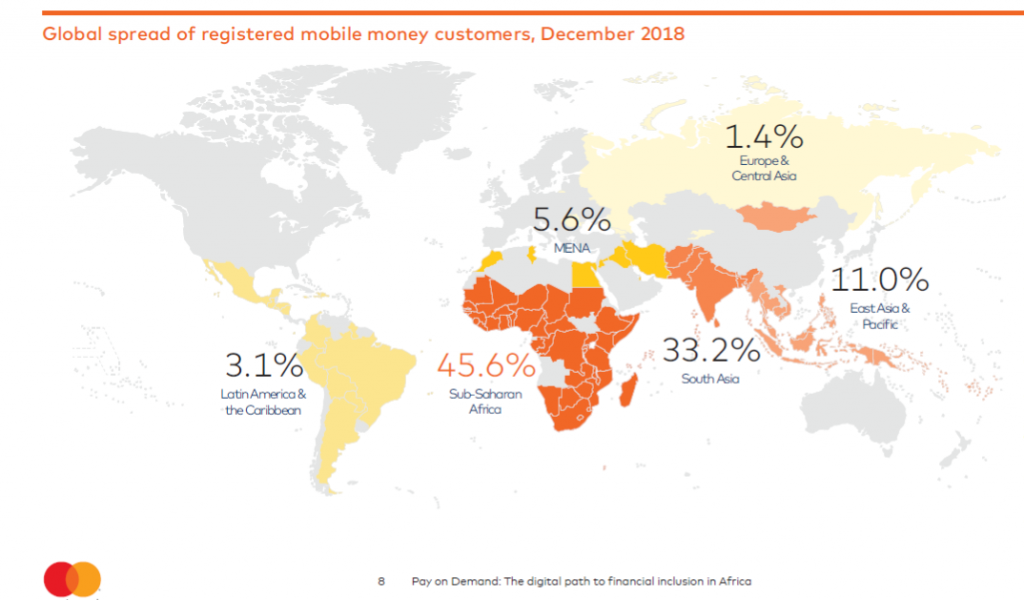

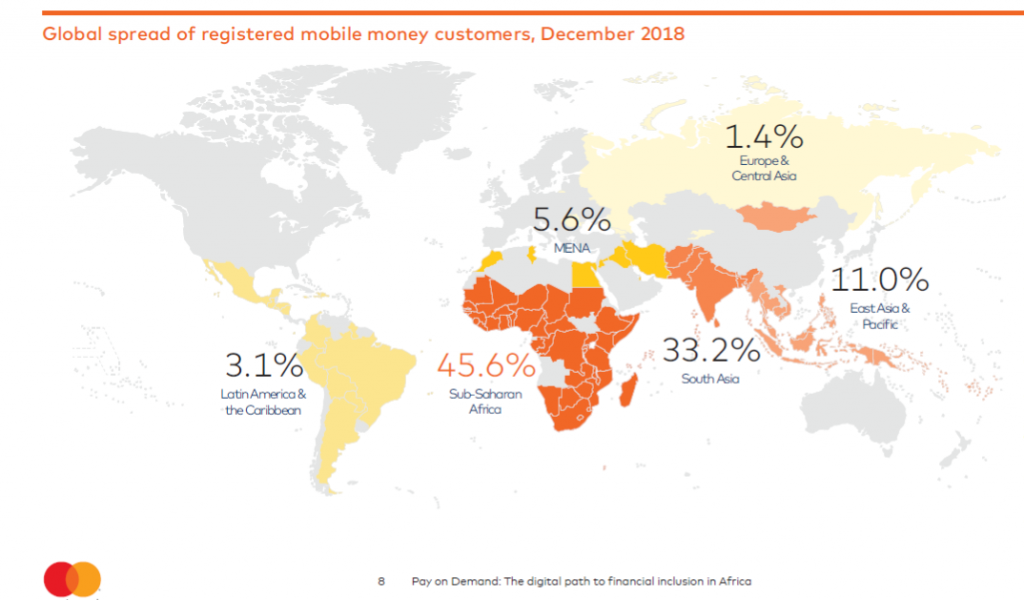

Sub-Saharan Africa has the highest number of Mobile Money customers in the world, with 45.6%.

In Nigeria, mobile money adoption stands at 6% according to the Global Findex. However, Mobile money has emerged as a proven catalyst to drive financial inclusion in countries like Kenya and Zimbabwe.

To effectively leverage mobile money, adequate policies need to be created. Both the government as well as the private sector would play major roles.

Creating and Leveraging Financial Data

Most people who dwell outside urban areas in Nigeria are forced to approach private money lenders for their credit needs. This is because rural parts of Nigeria don’t have credit agencies that can provide them with lending facilities.

Pay on Demand creates a model that converts unsecured lending into secured lending. The model provides a significant source of credit history. The financial data generated by Mobile Network Operators (MNOs) can provide information about the credit-worthiness of individuals and businesses. This will lead to better financial services including loans and insurance.

In Summary

Driving financial inclusion depends to a great extent on digital inclusion. Therefore, all financial stakeholders including governments, MNOs, small businesses, payment service providers, device manufacturers and financiers must participate collaboratively to make the Pay on Demand model a tool for driving financial inclusion.