The increasing rate of equity investments into African startups may have given the continent the title: land of many opportunities. Partech Partners, a global investment platform for tech and digital companies has detailed all the equity investments that took place in the African tech and digital space in 2019.

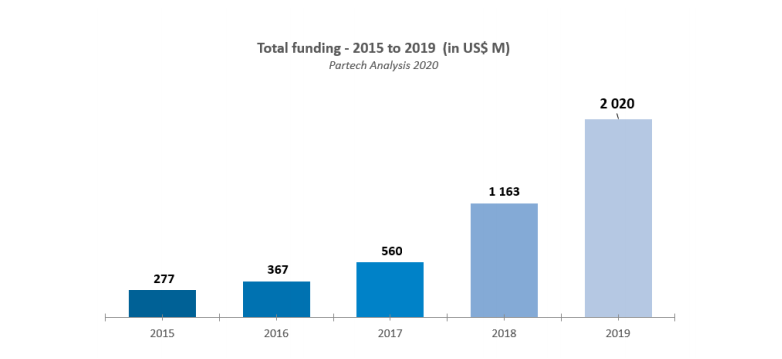

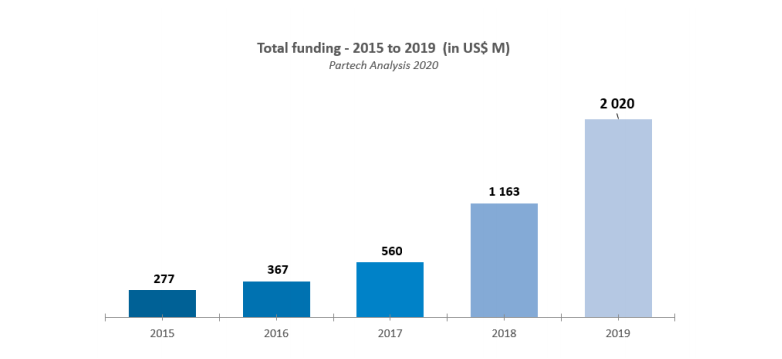

According to the Partech report, a total of 358 unique investors invested more than $2 billion in the African tech space in 2019, with about 70 of them investing more than once.

This indicates a 77% increase from US$ 1.163 billion equity funding that the continent received last year. Note that the investments tallied in Partech’s report are only equity investments beginning from US$ 200,000 and above.

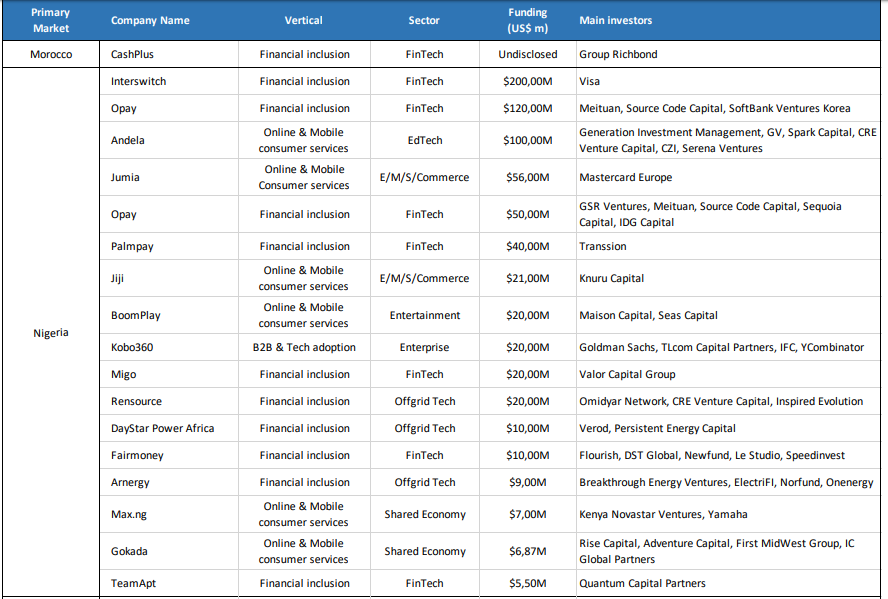

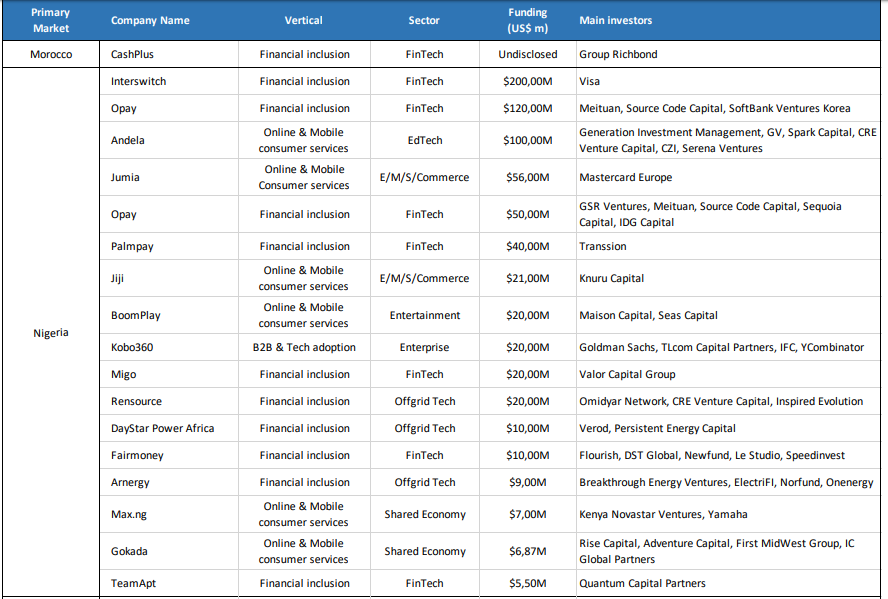

Nigeria remains a choice destination

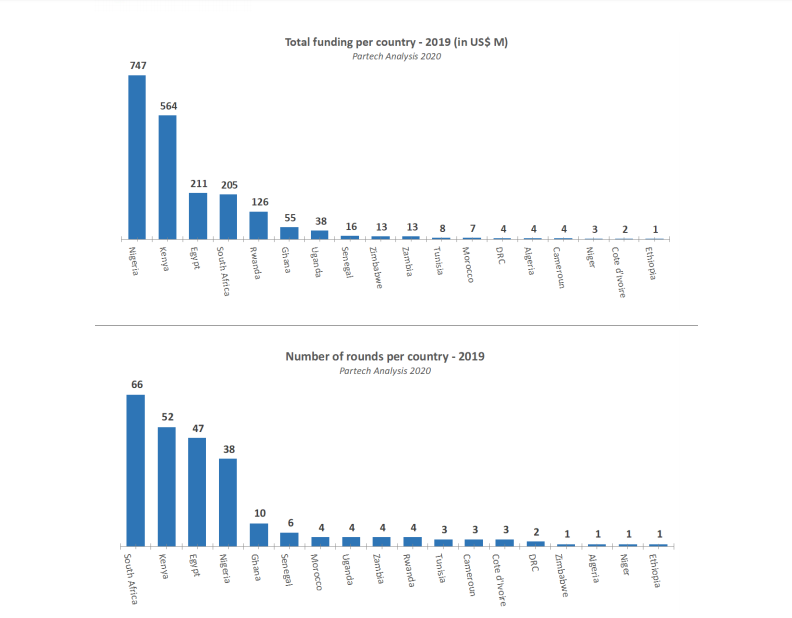

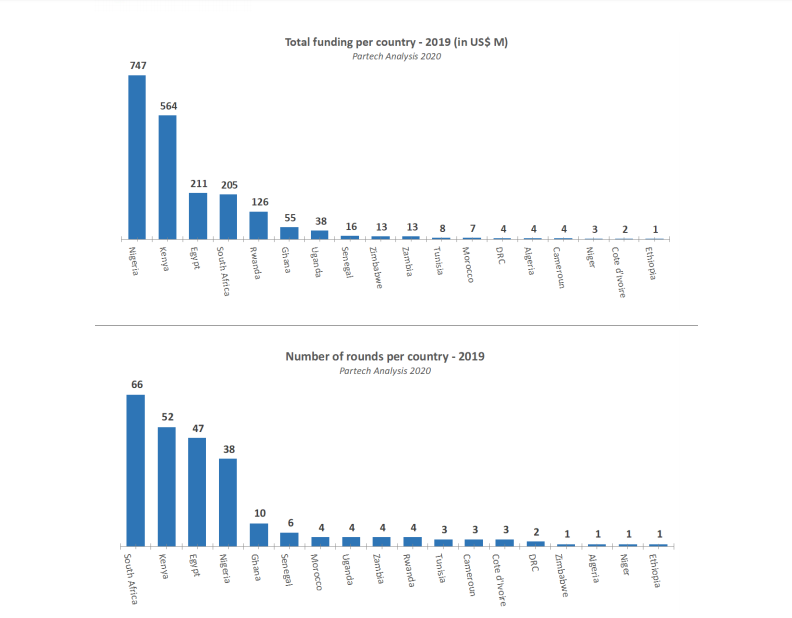

In all, 18 African countries attracted unique equity investments in 2019. However, Nigerian startups enjoyed the largest share with a whopping 37% of all investments into the continent. According to Partech, 16 Nigerian startups took part in 38 disclosed deals in 17 rounds.

Disclosed and undisclosed venture capital investments into tech startups in the country amounted to US$ 747 million, making it the country’s record equity investment so far.

Source: Partech

In all, Nigerian startups raised the highest number of equity funding, followed by Kenya with $564 million. Egypt was next with $211 million followed by South Africa with $205 million. South Africa had the highest number of deals (66 deals), followed by Kenya (52 deals), and Egypt (47 deals).

While South African startups enjoyed equity funding of up to $205 million in 66 deals, it however indicates an 18% drop from the equity investment of the previous year, according to Partech.

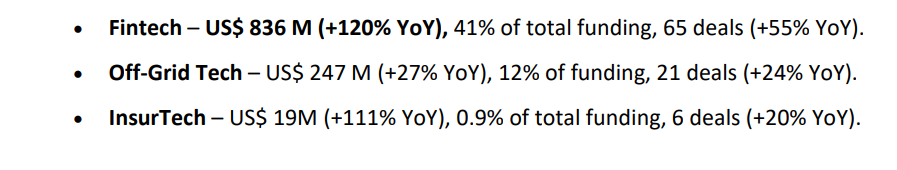

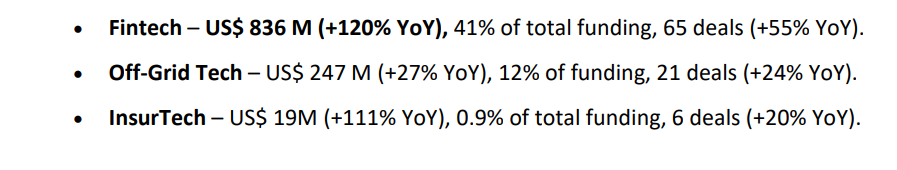

Fintech still rules

The fintech sector attracted the largest share of investments, recording a staggering 54.5% of the total equity funding on the continent. The investments were made across three sub-sectors; Insurtech, Fintech, and Off-Grid tech, all totalling US$1.1 billion.

The Online and Mobile Consumer services sector saw a 160% YoY increase in equity investment with a total of US$ 593 million invested in the sector. 87 transactions were made in that sector.

The Healthtech sector got a moderate 9.3% of the total US$ 2.02 billion funding.

Towards gender balance

Of all the deals that were reached in 2019, 17% were completed by female founded startups. This brings the number of deals to 43, resulting in a 72% YoY increase.

From the total funds raised, $264 million was raised by this class of female-led startups, resulting in a 35% YoY increase. The deals spanned 22 seed transactions, 16 Series A transactions, 4 Series B transactions, and 1 Growth stage transaction.

With the density of equity investments made in the African startups so far, the focus is gradually shifting away from attracting investors and moving to creating value and giving investors desired results and returns on their investments.