Africa’s e-Commerce giant, Jumia, just suffered its lowest plunge on the New York Stock Exchange.

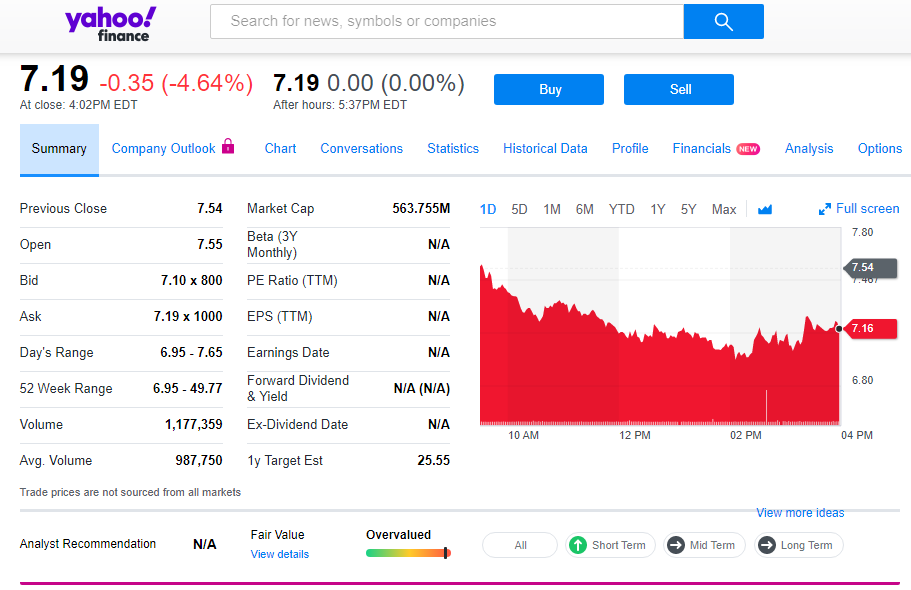

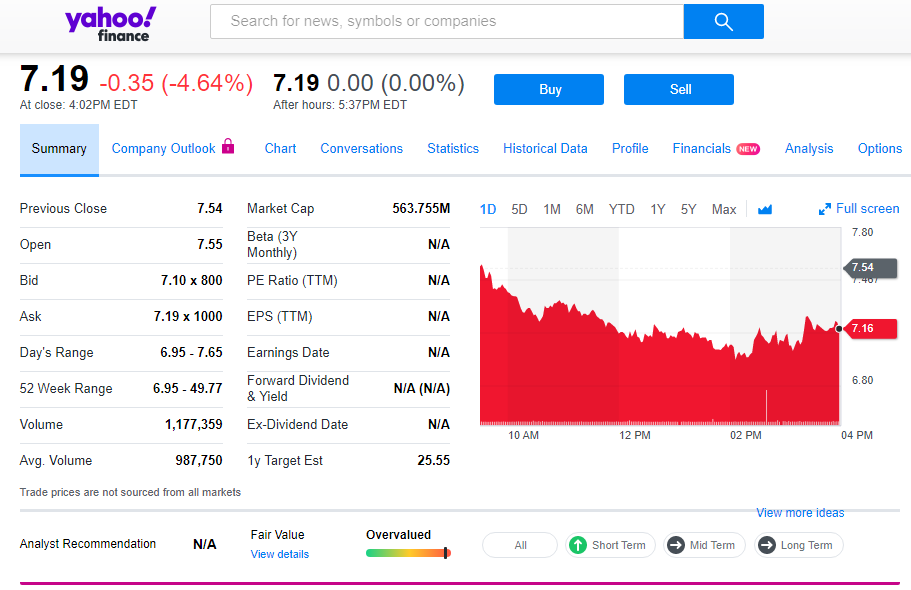

Early on Thursday, Jumia’s shares began at $7.54, then by 2pm, the shares fell to $6.98 which is the e-Commerce company’s all time low so far.

Before the close of the day however, the shares picked up a bit to close at 35 cents down from the opening value at $7.19.

Post IPO lockup period expires

Before Jumia’s public listing, a number of people had purchased equity as major shareholders during the initial public offering (IPO) .

This set of people are prevented from being able to sell off their shares for a specified period of time – this is the IPO Lockup provision.

After the expiration of the lockup period, Jumia did not have a major stock sell and so , naturally, their shares took a hit.

Before and after IPO: the Jumia tale

In April earlier this year, Jumia made waves by being the first African tech startup to list in the New York Stock Exchange (NYSE). This move caused the company’s shares to bloom by over 70%.

When it listed, its share price was $14.50. This increased to a record $46.99, the highest for Jumia’s shares so far.

However, Jumia has experienced major lows in recent times. The latest being the significant drop in shares, a result of its shareholders not making a big stock sell after the lockup expiry period.

In addition, there have been speculations that major investors may drop Jumia.

Recently, the company was accused of fraud in its SEC filing and also made a public statement to admit that its staff had employed less than standard methods in some of their dealings.

In its second quarter revenue growth report, the company recorded more losses this year than last year: 67.8 million euros as compared to last year’s 42.3 million euros.

The tale is not all sad however. Jumia increased its customer base to 4.8 million as compared to last year’s number of 3.2 million over the same quarter.

It’s yet unclear if a turnaround is in sight but we hope that Africa’s first tech startup company to list on the NYSE works out problems.