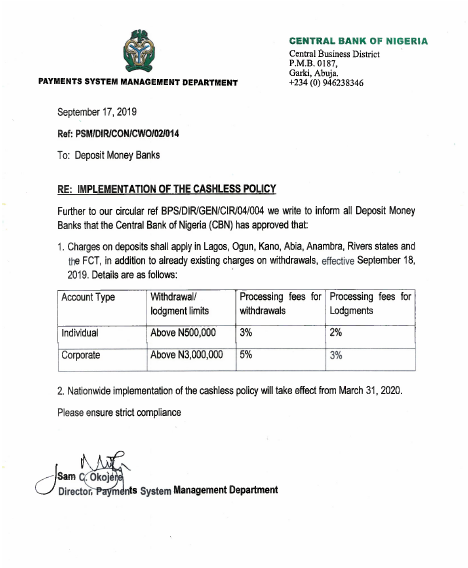

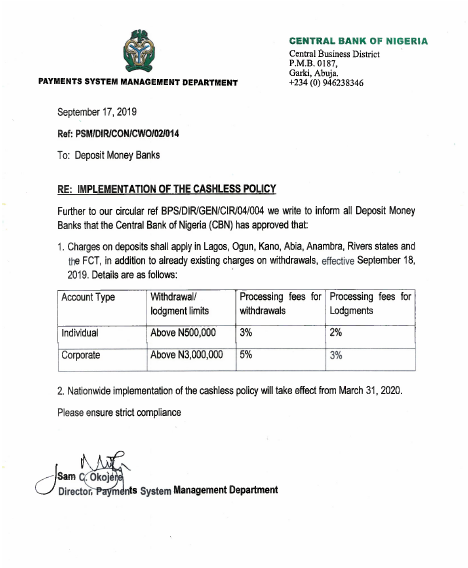

The Central Bank of Nigeria has released a circular that approves additional charges for cash deposits and withdrawals above 500,000 for individual accounts and 3 million for corporate accounts.

Effective Wednesday, September 18, all cash deposits and withdrawals to deposit money banks (DMBs) will attract additional charges of 2% and 3% charges for transactions above N500,000 for individual accounts. 3% and 5% will be charged on transactions above N3 million for corporate accounts.

The CBN explained that the new charges on cash-based transactions in banks are aimed at reducing (not eliminating) the amount of physical cash circulating in the economy while encouraging more electronic-based transactions (payments for goods, services, transfers).

However, the statement signed by Sam Okojere, Director of Payments System Management Department, revealed that the new charges currently apply only in Lagos, Ogun, Kano, Abia, Anambra, Rivers states and the Federal Capital Territory.

To further promote a cashless economy and enhance the collection of applicable government revenues, the CBN also announced a downward review of the Merchant Service Charge (MSC) from 0.75 per cent capped at N1,200 to 0.50 per cent capped at N1,000.

Impact of CBN’s cashless policy

The new charges approved are part of the cash-less policy CBN introduced in 2012 to curb excesses in the handling of cash in the country. The plan of the commission was to use the policy to drive the modernisation of payment systems, reduce the cost of banking services and drive financial inclusion by providing more efficient transaction options.

The policy started with a pilot run in Lagos with a goal of general implementation by the year 2020.

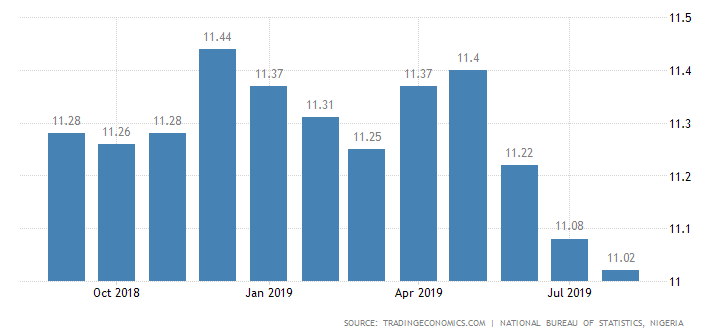

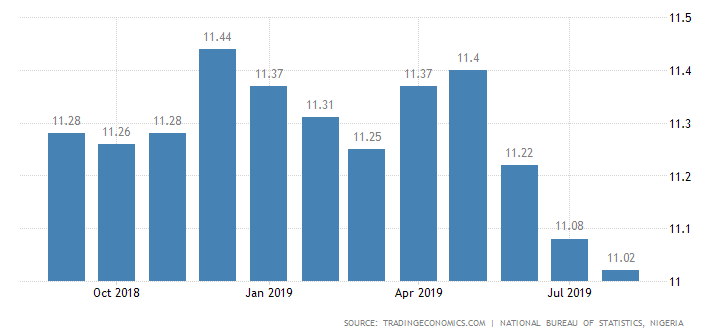

According to Trade Economics, as of August, Nigeria’s annual inflation had dropped but it was still a double figure – 11.02.

With inflation rates and naira devaluation being a recurring problem, the addition of charges could negatively impact the livelihood of many average Nigerians. A significant percentage still lacks the financial literacy to understand that cashless policy.

With the new charges, many Nigerians – for instance, traders who run high volume cash-based businesses – will incur exorbitant service charges for every 500,000 they save in the bank.

That said, it is hoped that the new charges will encourage more Nigerians to adopt alternative business models. Fintech startups like Paga, Paystack, TeamApt, Kudi and Kuda now have an opportunity to attract Nigerians with cheaper, easier and effective alternatives to make transactions.

The expected benefit of the CBN’s cashless policy like increased convenience, reduced risk of cash-related crimes, access to credit and financial inclusion are clear gains. But if the policy is not made accessible to the larger percentage of the country’s population, the charges could create an undesired effect.