Nigerian fintech startup, Kuda (formerly Kudimoney), has raised $1.6m in a pre-seed funding round to allow it launch in Nigeria.

The pre-seed round was led by investor Haresh Aswani with participations from Ragnar Meitern and a host of other angel investors. And according to reports, this investment will see Mr Haresh take a position on Kuda’s board.

This round of funding marks a huge milestone for the young startup.

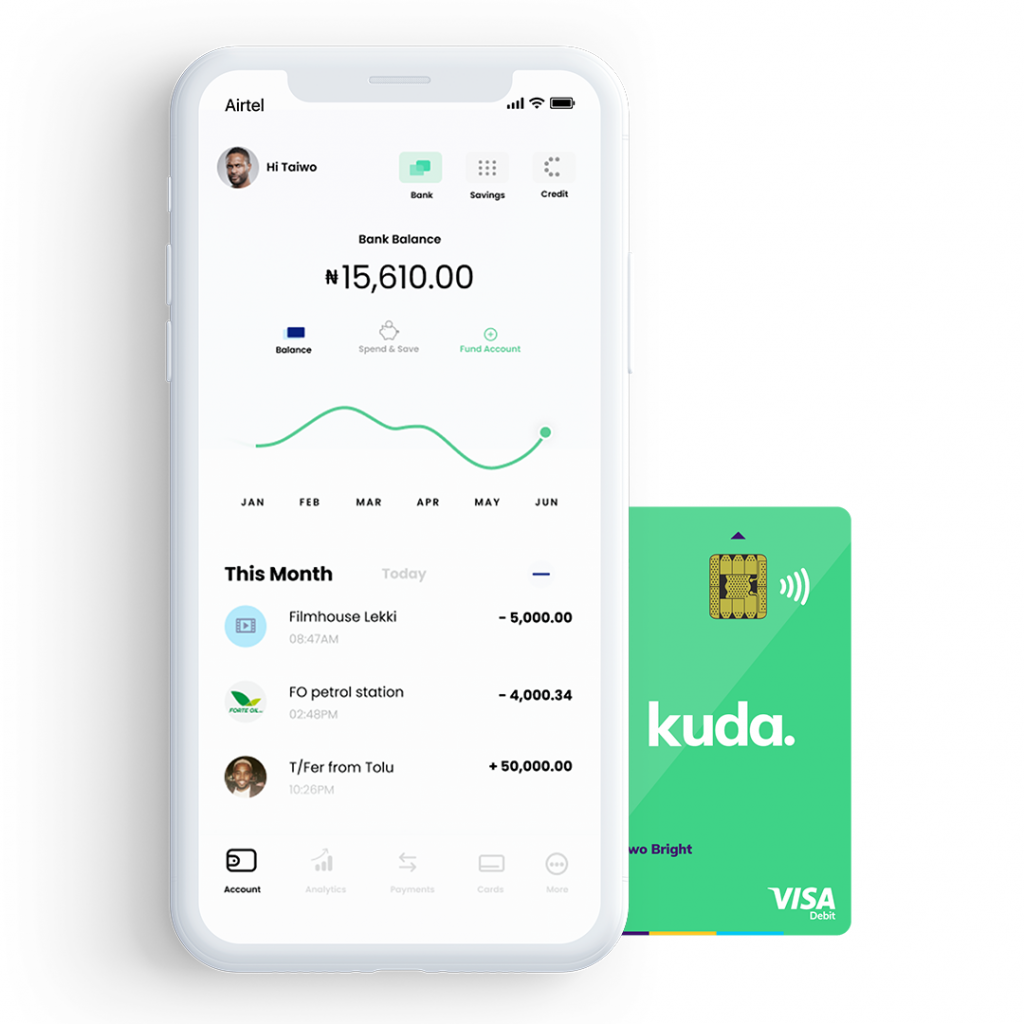

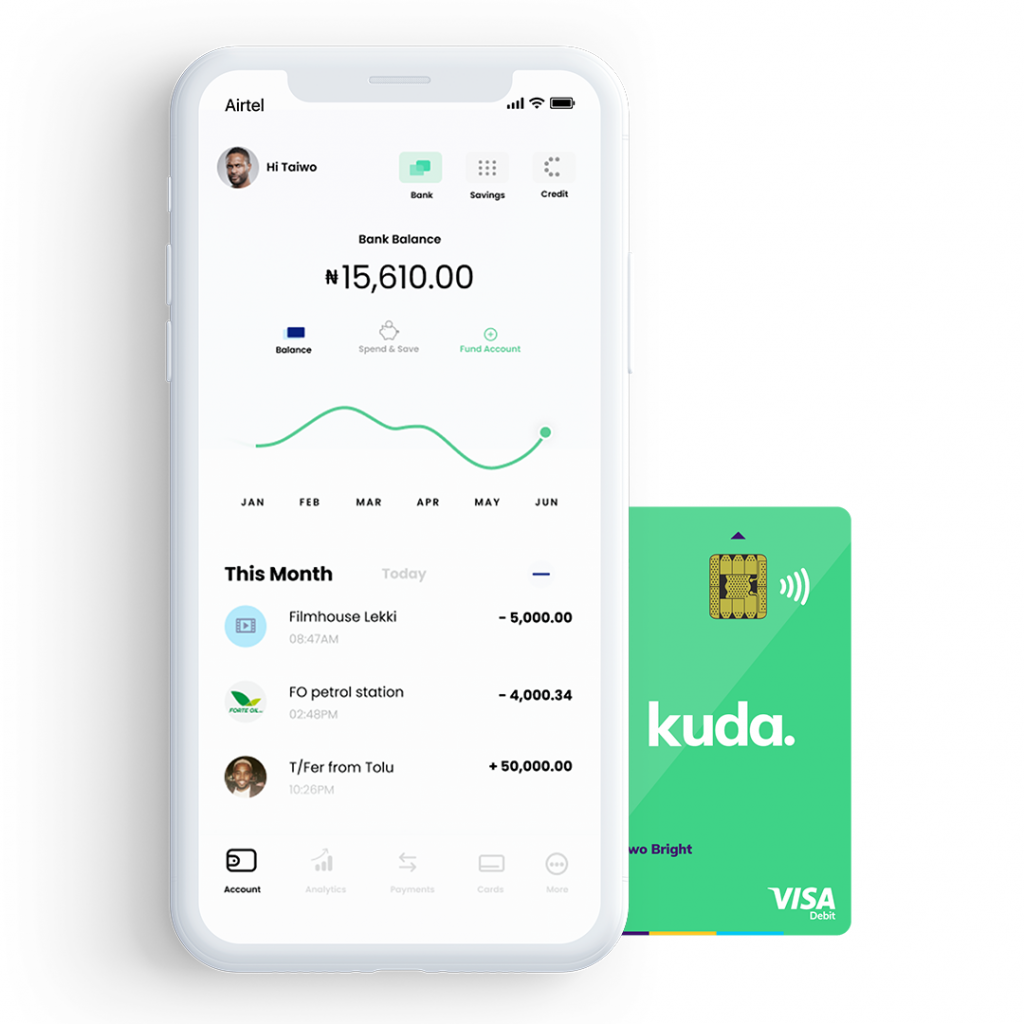

Founded by Babs Ogundeyi and Musty Mustapha, Kuda operates as a digital-only retail bank providing customers with reliable financial transactions at an acclaimed cheaper rate.

It was initially launched as Kudimoney, but earlier in June, the startup received its Microfinance banking licence from the Central Bank of Nigeria. This makes Kuda the first digital bank in Nigeria with this licence and enables it to offer current accounts, P2P payments options, as well as debit cards to customers.

Following the issuance of this licence, Kudimoney rebranded as Kuda launched the beta version of its online full service digital ‘No-Fee’ bank.

So over the last couple of months, the startup has been at the pre-launch phase as its services were only offered to a small group of alpha users.

Now with this new funding, Kuda plans to go from beta stage to fully launch its digital bank services in Nigeria. And this will be taking place in the fourth quarter of 2019, a different timeline from the 3rd quarter previously announced.

Kuda is the first digital-only bank in Nigeria with a standalone licence. We’re not a mobile wallet or simply a mobile app piggybacking on an existing bank. We have built our own full-stack banking software from scratch. We can also take deposits and connect directly to the switch (referring to Nigeria’s Central Switch, that controls bank communication and settlements).

Babs Ogundeyi, Co-founder, Kuda told Techcrunch.

The startup will also build the tech of its banking platform, as well as a support for its developer team located in Lagos and Cape Town.

Already the startup has put plans in motion to help it scale in Nigeria. These include partnering with three of Nigeria’s largest financial institutions: GTBank, Access Bank and Zenith Bank. These banks will serve as physical points for Kuda users to pay in money or withdraw without any fee while generating revenues from leveraging its bank balances.

Although the proposed launch is for Nigeria only, the startup is not giving up on its dream to launch across Africa and become a “Pan-African digital-only bank.”