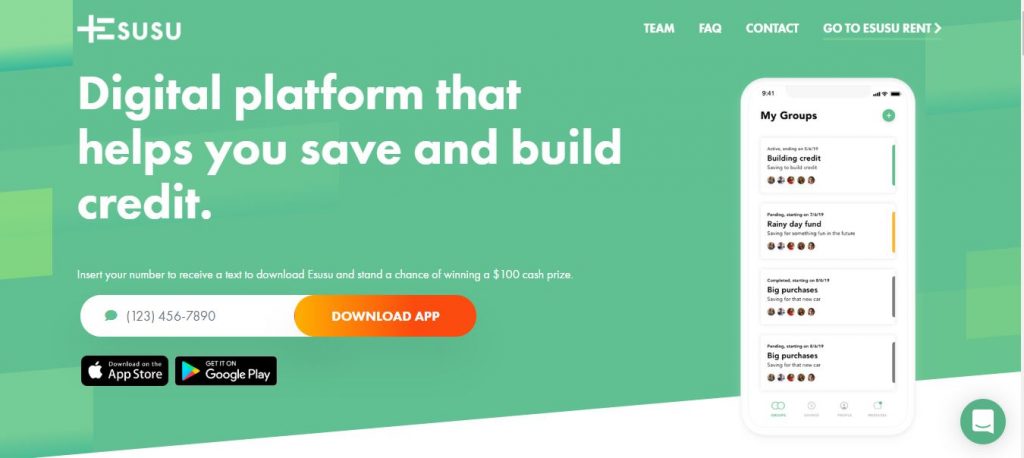

Fintech startup, Esusu Financial, has recently raised $1.6 million to further expand its operations in the United States of America. This fintech company’s name is inspired by the popular Yoruba culture of saving in bits consistently.

Esusu was launched on May 1, 2016, by Samir Goel and Abbey Wemimo, alongside founding team members Albert Owusu-Asare (Chief Technology Officer) and Robert Henning (Chief Financial Officer).

According to CrunchBase, Esusu raised a seed round of $1,600,000 in August, in a round led by Acumen and six other ventures interested in using an entrepreneurial approach to solve financial problems.

As impact investors focused on improving the financial health of all Americans, we look for entrepreneurs who are tackling frictions in the financial services industry that are adversely affecting both sides of the market.”

Eliza Golden, Portfolio Manager of Acumen.

The funding will be used to improve on Esusu’s existing rent platform that allows people to record the instances when they pay their rent and build credit on the esusu platform as a result.

The fintech startup’s focus is on empowering lower-income and historically credit-challenged consumers with credit-building. And co-founders Samir and Abbey say they are excited by Esusu’s vision to transform access to wealth-building.

With the support of our strategic investors and partners, Esusu is poised for unprecedented growth and ready to scale to serve the millions of Americans struggling to save and create a financial identity.

Abbey Wemimo, Co-founder of Founder

With the funding raised, Wemimo and his team are closer to their vision of reducing the number of vulnerable Americans who do not have financial security or money set aside for rainy days.

Talk about creating homegrown solutions!