Online lending platforms are some of the biggest Fintech platforms operating in the Nigerian market. However, many a digital lender approach digital lending exactly the same way. You get the app, request for a loan, get the loan and then pay back some time in the future. Simple right? Well, CredPal is making it even easier.

The company is approaching lending in a more utilitarian way which definitely takes the ease of lending to another level.

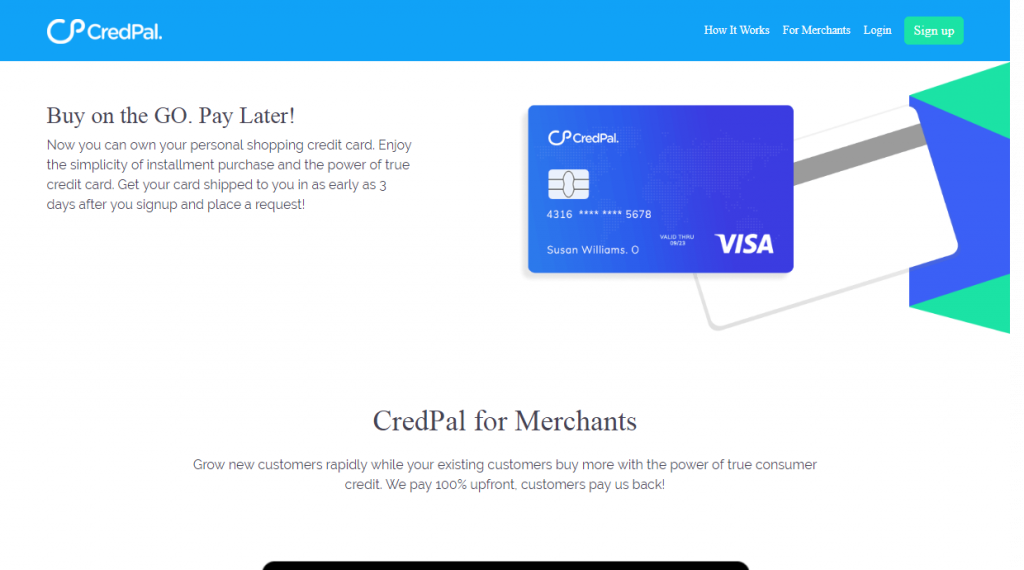

CredPal is a digital lender, but unlike the others, CredPal provides quick loans to users and allows them to make repayments in instalments. Interestingly, the platform does one better, it provides users with ATM cards which serve as credit cards.

These cards allow users to access instant credit for purchases across both online and offline retail points of checkout.

Frankly, this sort of service is probably the first of its kind for the large Nigerian market. Despite the presence of large financial institutions, Nigeria has never had a credit card solution, at least one available for a large number of people.

Yet CredPal has found a way to enter the market and offers its services to a large number of people. The company is working closely with a card company, Visa, to provide credit cards directly to users.

The company is also working with a host of merchants and retail platforms including Konga, Pointek and Shopili to make credit payment available for shoppers.

When shopping online on these platforms, users can select CredPal as a payment option on the checkout page. Once purchases are approved, CredPal covers the cost on behalf of the user.

Sounds pretty cool, right?

For repayments, the digital lender requires users to input their bank card details on its app. After inputting the details, users can either choose to pay a lump sum, or repayment can be done in instalments.

Founded in 2017, by Fehintolu Olaogun and Olorunfemi Jegede, CredPal is the closest thing Nigeria has to a full credit card service. The company uses proprietary technology to perform risk analysis processes such as identity verification, credit checks, address verification and other credit determinants. Once these parameters are obtained, the startup sets a cap on how much a user can borrow.

Although CredPal has been in business for two years, it is still in its growth stages. Numbers are scarce about its growth and customer base.

Nevertheless, the company has risen in reputation since 2018. In March 2018, the Fintech was selected as a cohort for the YCombinator program. Its entry into the YCombinator program helped it raise $150,000 investment and in return, the startup gave out seven per cent equity stake. This sum followed a $20,000 seed funding in March 2018.

It’s such a privilege spending the last three months with these amazing league of founders at #ycombinator w19 batch.

— Olorunfemi Jegede (@olorunfemi01) March 25, 2019

More than ever before it’s such an amazing time to be active in the building of a better Africa for us all. #fintech #CredPal pic.twitter.com/DyGh1eR6Iq

And in July 2018, the company was one of three startups announced as winners of the Visa Everywhere program. That win provided the company with an additional $25,000 funding and a stronger partnership with Visa.

Now, however, the digital lending space is receiving greater focus in recent times. From the $170 million investment raised by Branch two months ago to the rebranding of Paylater to Carbon, the digital lending space is seeing some interesting developments.

Nigerian startup companies CredPal & Zowasel emerged as winners in the first ever Sub Saharan Africa (SSA) Merchant Payment and Financial Inclusions Challenge, at the Visa’s Everywhere Initiative. #EverywhereInitiative #visainnovates pic.twitter.com/BO1BRprOUd

— Visa Nigeria (@VisaNigeria) July 25, 2018

And CredPal offers an even more unique solution to the existing market. Hopefully, it won’t take much longer for the company to score major investments and gain more traction.