A US-based fintech startup that facilitates access to credit in emerging markets, PayJoy raises $20m in a Series B funding round.

The new round was raised from venture capital firm, Greylock Partners. Other investors like Union Square Ventures, EchoVC and Core Innovation Capital also participated in the funding round.

This new round brings PayJoy’s total funding so far to $71 million from across 8 rounds.

This new investment will be used to develop new technologies as well as launch it into six more countries through new partnerships with local companies. The target countries include Mutual in Brazil, Waynimovil in Argentina, MyBucks in South Africa, Panacredito in the Dominican Republic, Omnipagos in Honduras and COINFIN in Colombia.

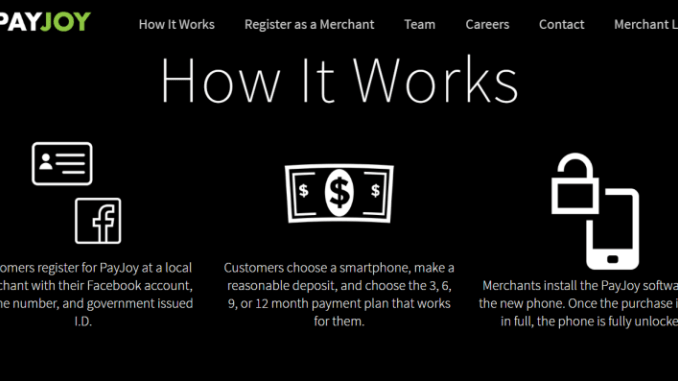

Launched in 2015, PayJoy provides payment plans for people with limited or no access to credit to purchase smartphones. The startup was built on the fact that smartphones are gaining popularity as financial tools in addition to their many other applications.

Which is why the startup is providing its services to those in developing economies, who have access to the internet but not the finances to afford a smartphone.

So PayJoy utilises the consumers’ willingness to access the phone, which in turn helps keep default rates in check.

Payjoy’s technology allows consumers to finance a new smartphone purchase by using the smartphone as collateral. Retailers use PayJoy’s technology to enable consumers to pay-as-you-go for their phone. Once a customer defaults, PayJoy’s technology restricts the phones functionality limiting the users to make only emergency calls, until the payment is made.

Once a consumer pays off their smartphone, they can use the credit history they have aggregated to get an additional cash loan – should they need it.

Currently, PayJoy Operates in more than 10 countries including Mexico, India, Indonesia, Nigeria, Kenya and Guatemala. And in most of these markets, the startup does not provide the finance itself, but partners with retailers and credit providers such as Telefonica, Vodacom, d.light and Orange SA.

The startup recently partnered with MTN Nigeria to provide a scheme for Nigerians from all walks of life to own high-end smartphones by paying in flexible instalments.