Mobile banking apps have continued to grow as important financial tools. According to February statistics released by the Nigeria Interbank Settlement System (NIBSS), the volume of transfers via mobile apps has reached an all-time high.

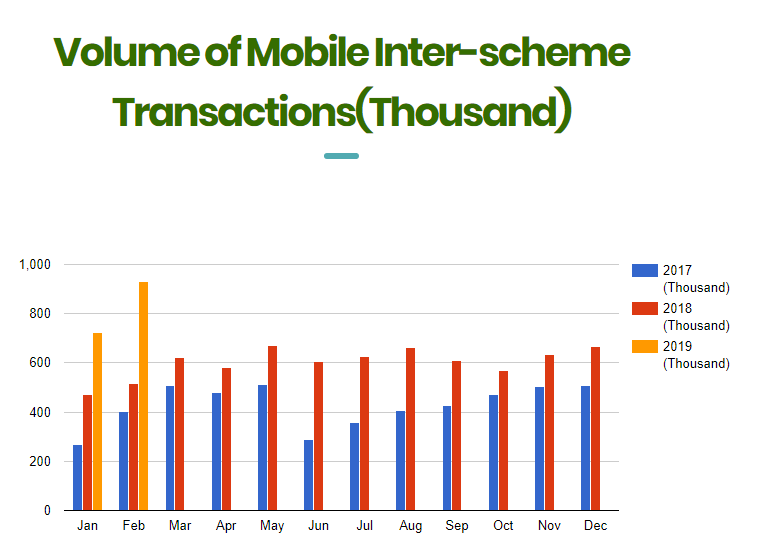

Statistics show that 932,355 mobile transfers were completed in February 2019, representing a huge 80.8% year on year increase. It is also a 28.6% increase over the 724,803 recorded in January 2019.

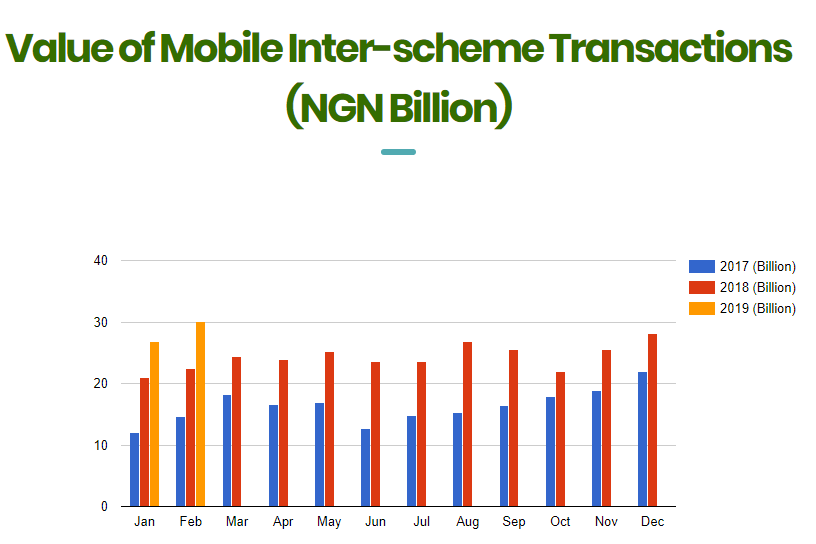

The value of mobile transfers has also hit a new all-time high. While the value stood at N26.8 billion in January 2019, February transactions grew to N30.028 billion, representing 12.1% growth. Meanwhile the February figure is a 34.4% growth over the N22.4 billion recorded in February 2018.

These are pretty impressive growth figures and they are testament to how important apps have become to the banking world.

Apps have helped to simplify transactions for users and they are also helping to reduce the overhead incurred by banks.

For instance, with the growth of digital solutions and other online options, cheque transactions dipped considerably in February 2019. Cheque transactions declined from 784,659 in February 2018, to 640,497 in February 2019. This is a steep 18.3% drop.

Due to transaction limitations placed on banking apps by most banks, cheques still remain a popular medium for large transactions.

However, banking apps are gradually changing that.

Nevertheless, the core benefit of apps for banks is the fact that when properly done, it reduces the need for more physical locations across the country. This reduces operational costs and helps banks invest in more critical digital infrastructure and other growth enablers.

The benefits from this is being amplified by the growing trend towards more sophisticated banking apps and the creation of full blown digital-only banks, like Wema Bank’s ALAT.

While in the short term, cheques will continue to remain important, its volume will continue to decline. Mobile transfers on the other hand will continue to reach new highs.