The GSM Association (GSMA) has released its eighth annual State of the Industry Report on Mobile Money. It explains in details the state of the global mobile money market for the year 2018.

The report provides a comprehensive analysis of mobile money adoption and usage, most especially those of emerging markets.

The report shows that by the end of 2018, there were more than 866 million registered mobile money accounts from across 90 countries. This indicates a 20 per cent increase from 2017. The report also shows that in 2018, the global mobile money industry processed transactions worth $1.3 billion daily.

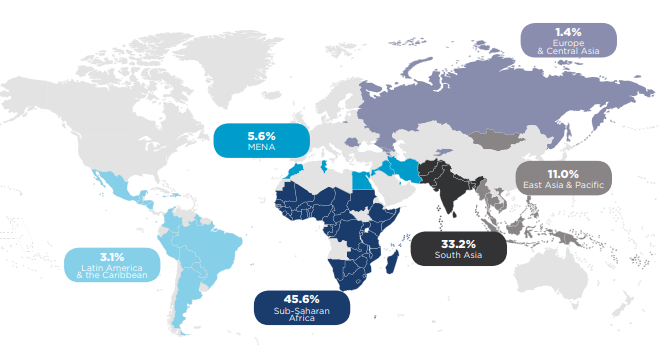

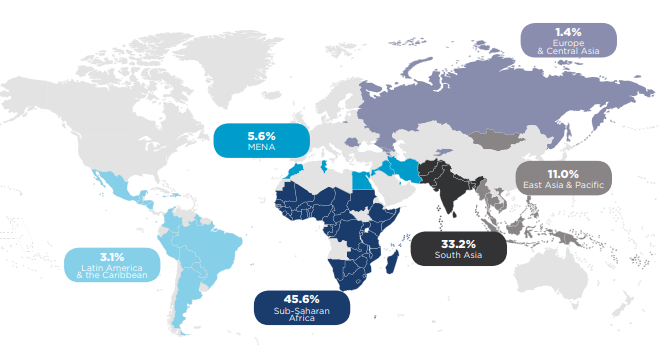

Sub-Saharan Africa which has long been the epicentre of mobile money growth shows no sign of slowing down. The region had 395.7 million mobile money accounts, which is 45.6% of the global figure.

60 per cent of the adult population in Sub-Saharan Africa is said to have a mobile money account.

The region is followed by South Asia with 33.2%; East and Pacific with 11%; the Middle East and North Africa 5.6%; Latin America and Caribbean 3.1%; and Europe and Central Asia 1.4%.

Of the 395.7 million mobile money accounts, 145.8 million of them are active.

According to the Nigeria Inter-Bank Settlement System statistics, Nigeria had 8.5 million mobile money customers in 2018. This represents over 100% increase from the 3.84 million customers in 2017. But despite this growth, the GSMA report suggests there is limited availability of mobile money services and low rates of financial inclusion in the country.

However, the report recognises Nigeria’s potentials when it projected that Nigeria, along with Egypt and Ethiopia, are expected to start a wave of adoption over the next 5 years. This wave could lead to more than 110 million new mobile money accounts being added.

This basis of such increase is the regulatory reforms introduced in Nigeria and Egypt as well as an ambitious financial inclusion strategy in Ethiopia.

Key Trends

This year’s State of the Industry Report also looked at key trends that accelerated the growth of mobile money market in 2018. These include:

Better customer experience owing to increased smartphone adoption and the growth of bank-to-wallet interoperability.

Diversification of the payments ecosystem.

Introduction of increasingly complex regulation.

A shift towards “payments as a platform” business model which connects consumers with a range of third-party services – e-commerce, enterprise solutions and credit, savings and insurance.

With these, the opportunity to increase, diversify revenue streams and reach broader customer bases with new digital services is huge. For example, providers offering credit, savings or insurance products reported a better customer activity at 46 % compared to the 26% of providers without such offerings.