It is no longer news that Diamond Bank Plc will officially be merging with Nigeria’s tier-1 lender, Access Bank Plc, to form possibly Sub-Saharan Africa’s biggest retail bank.

According to reports, details of the merger entails Access Bank acquiring the entire issued share capital of Diamond Bank. In exchange, they remit a combination of cash and shares in Access Bank via a Scheme of Merger to a tune of about 260% premium offer according to the closing market price of N0.87 per share of Diamond Bank on the Nigerian Stock Exchange (NSE).

As it stands, Diamond Bank would be absorbed into Access Bank. The bank will cease to exist under the Nigerian law without actually going into liquidation. This development has raised some fears about the job security of the large staff strength.

Beyond the human collateral damage, it is important to look at the effect of the acquisition on the Tech initiatives of the dead bank.

Diamond Bank TechFest

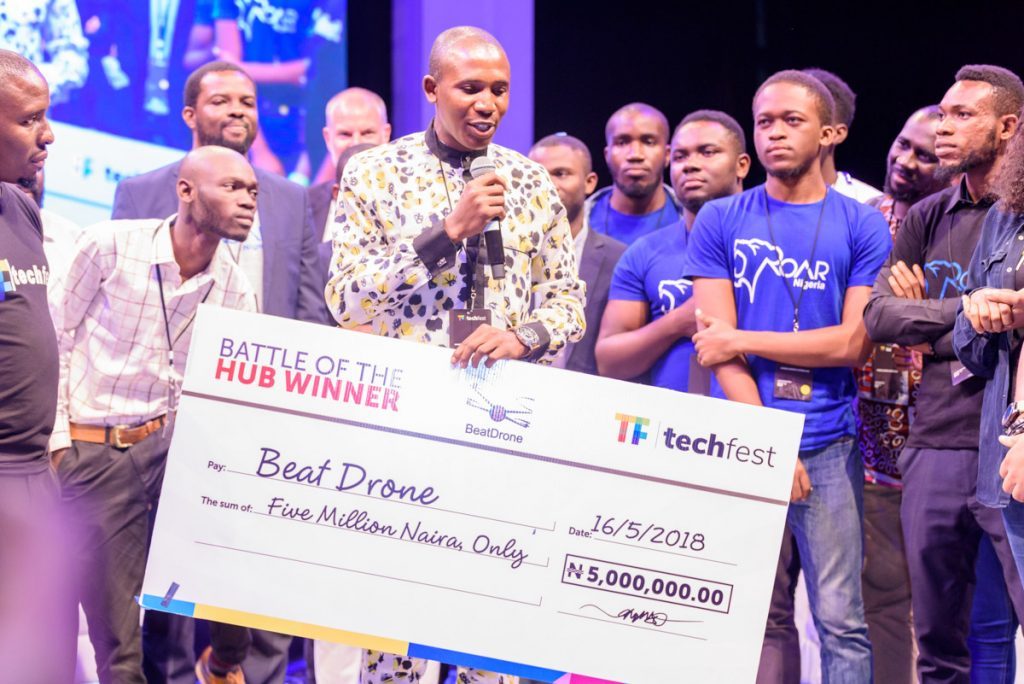

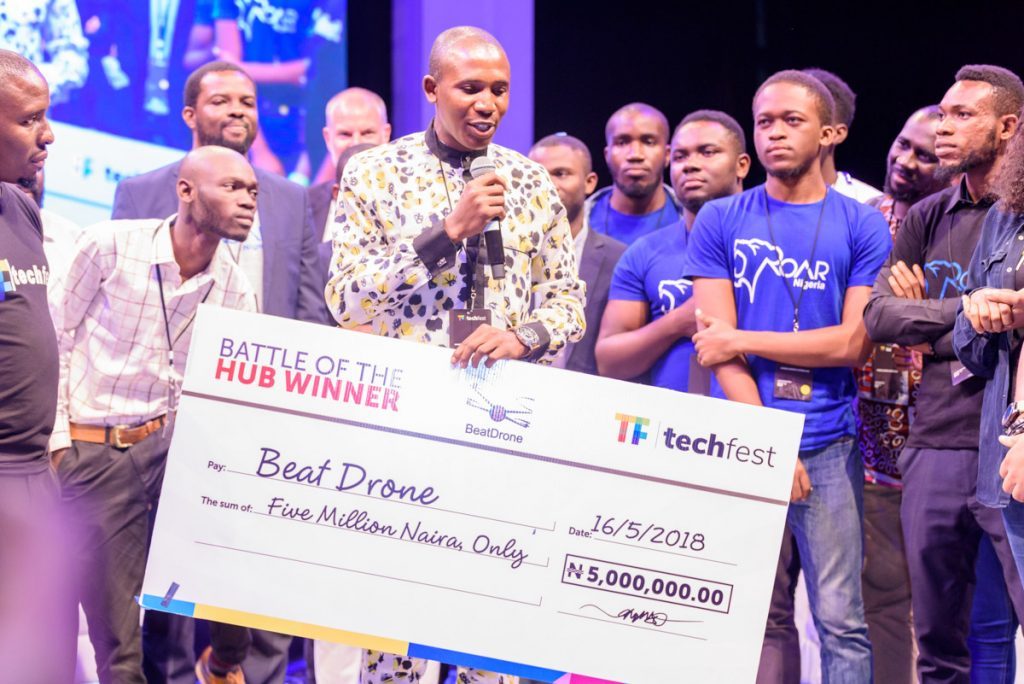

The premier edition of the Diamond Bank TechFest was organized in partnership with MTN, Deloitte, and Visa in May. The event brought together a community of liked minded participants to showcase Nigeria’s best talent, ideas, and businesses with a focus on technology.

Aside from the networking prospects, the event featured a startup competition where startups from pre-selected hubs around Nigeria pitched to win a N5 million prize. In the end, Beat Drone, a startup that provides tech solutions using drones and data, was named the winner.

If Access Bank chooses to let the idea die, that means we will not witness Techfest 2019. That means no 5 million Naira for grabs for some startup. That means one less platform for industry leaders to share experiential ideas on the fast-paced world of digital media and opportunities available to creators, investors and other players in Nigeria.

This will likely be the case because Access Bank has Re:Code Nigeria Hackathon, an event organized in partnership with Africa Fintech Foundry (AFF) to cater to the same niche.

Tech Turks

Tech Turks is an interview show anchored by Uzoma Dozie, Diamond Bank’s CEO on Diamond TV. The show features passionate players in the Nigerian tech space.

Some of Mr Dozie’s guests include Shola Akinlade of

Despite his glowing appraisal, we are not sure if Uzoma has plans to keep the show on his own bill. Neither do we know whether Access bank will be willing to carry this on. What we know is that Access Bank has Accelerate Tv.

Perhaps they will adopt this show with a new flavour. Only time will tell.

Meet Ada

Ada Zainab Ajayi is an Artificial Intelligence (AI) Chatbot launched early this year by Diamond bank in partnership with

Ada was launched at the same time the industry witnessed the rise of AI/messenger banking solutions by Nigerian banks. Recall that UBA launched Leo within the same period.

The chatbot made it easy for customers to initiate loan requests, cheque confirmations, bill payment, account freezing and get instant notifications on transactions via Facebook Messenger with no extra cost.

What is uncertain now is if Access Bank will be willing to keep the solution or even transform it into whatever suits their brand perception (maybe rename it AIG or something else). In any case, the bank’s antecedent shows its deep interest in leveraging technology.

Recall that Access Bank launched its Whatsapp banking service in August (joining other banks like GTBank, UBA Bank, and First Bank) to provide easy banking experience to its customers. You can read about the solution here.

Whatever may betide, what we are sure of is that Ada will not remain the same. She will be sorely missed.

Conclusion

What is evident is that when we lose one corporate entity, under whatever guise, we are bound to lose many other things. Think about the prospects the above-listed initiatives bear for staff members, vendors, consultants and very many other service providers whose services will no longer be needed.

It is painful that a tech-loving bank like Diamond has been lost to the tides. We just hope many great trees grow out of its ashes.