Sometimes, we find ourselves in a financial fix and getting a loan facility happens to be the easiest way out of the mess.

However, getting a loan in Nigeria from regular financial institutions can be very difficult, considering the time and processes involved. But thanks to technological advancement and the rise of mobile and online loans, funds can be gotten when needed without squabbles, and within minutes.

so i guess you would have got a student loan in Nigeria like we do here ? alas you do not realize getting the loan is an opportunity many in Nigeria would never have.

— King Bee (@BeeShaiban) August 13, 2018

All you have to do is submit an application to your lender via your mobile phone. Upon approval, you are provided with the loan contract and should you agree to it, the funds are transferred into your bank account. Simple and easy!

So are you caught in a fix and need a loan to help you out, here are 5 apps designed to do so.

Paylater

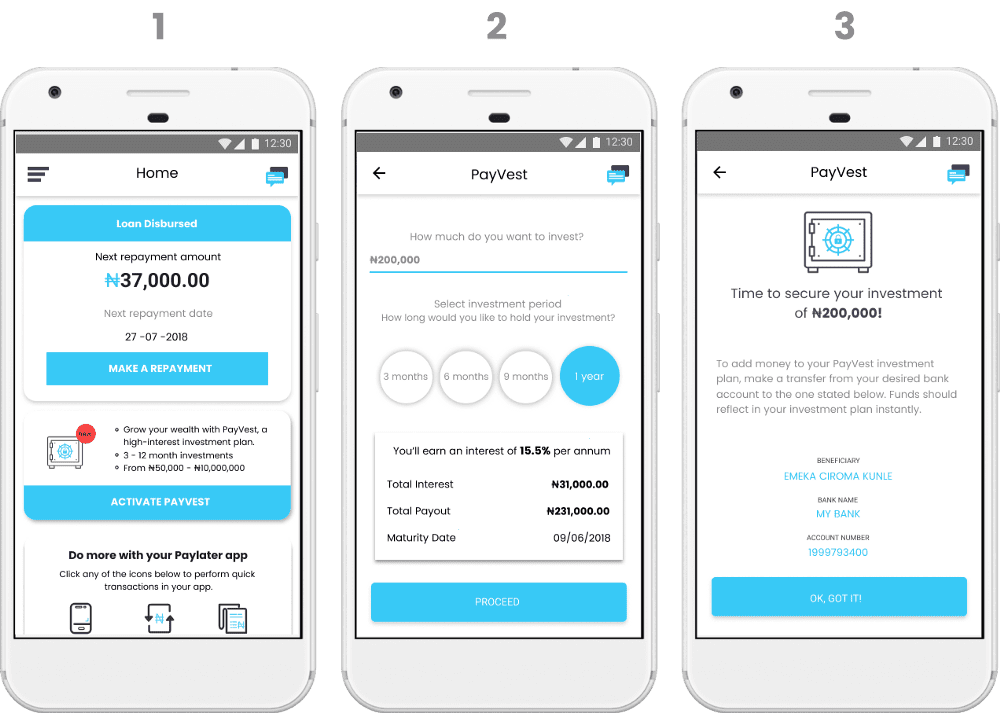

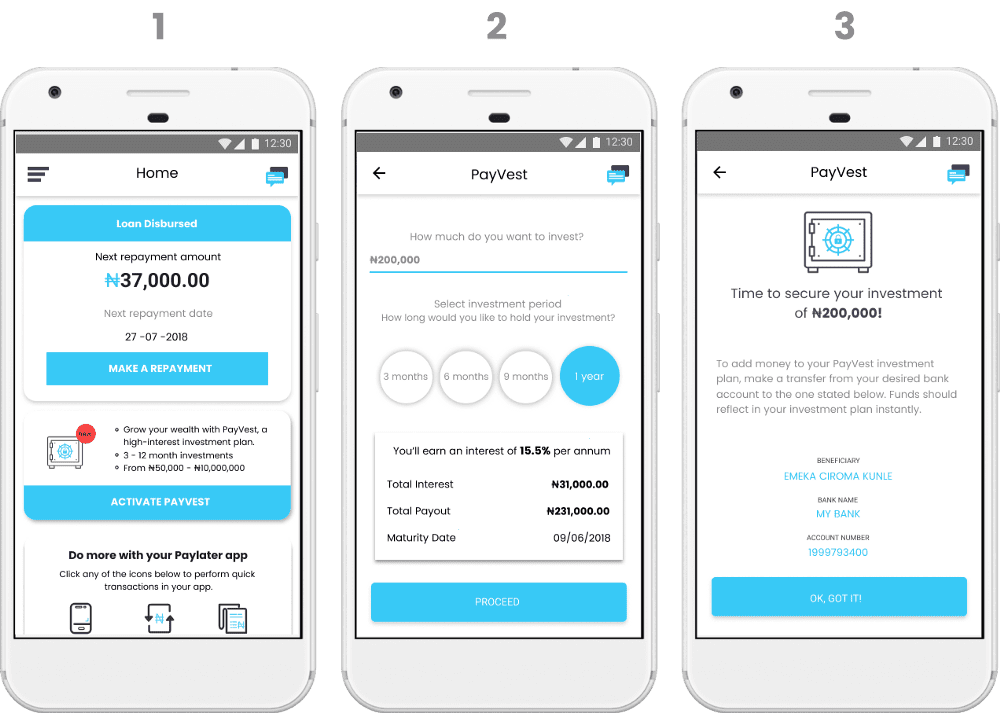

As an easy-to-use website and app online borrowing system, Paylater makes small loans available round the clock with no need for paperwork, collateral, or guarantors and the loans can be approved within minutes.

Available for all Nigerians, paylater is developed for people who have immediate expenditures and can lend an individual up to N1 million at a go. The registration and details submission is done on the app, and when concluded, the money is transferred straight to your account within 5 minutes.

If you are in need of a quick loan without worrying about collaterals, Paylater is there to help out.

Social Lender

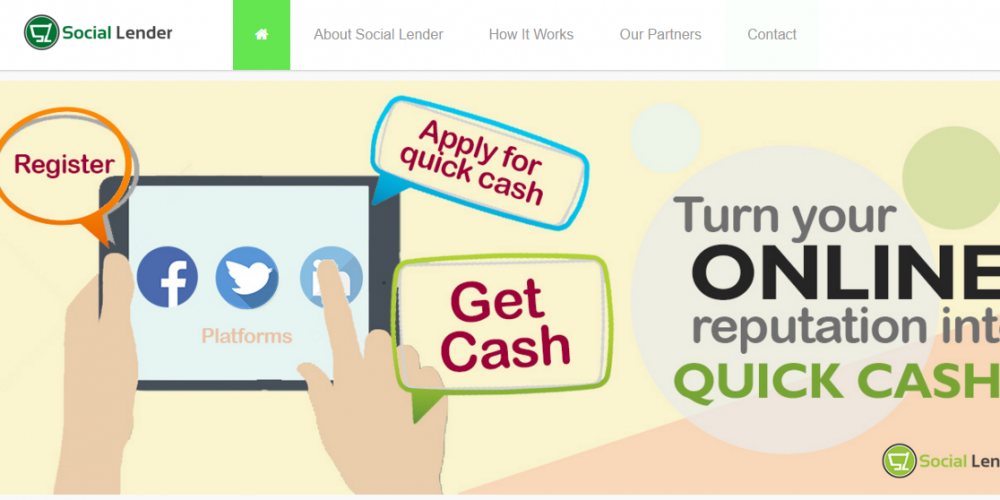

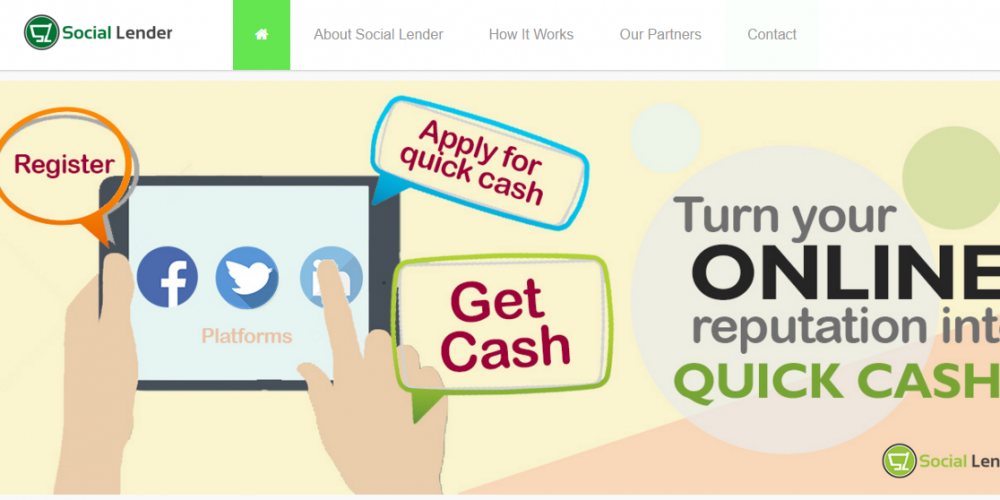

Your social media presence is definitely not a waste with this social lender. The app is a lending solution by Fintech startup and it’s suited to provide you with loans quickly, using a customer’s own social reputation to ascertain creditworthiness.

It runs on an algorithm that pulls information from the user’s various social media platforms (access would be granted by the user) to generate a Social Reputation Score. Every user is given a Social Reputation Score in percentage. Based on the user’s credit score, the loan request would be approved and received by the user within 10 minutes.

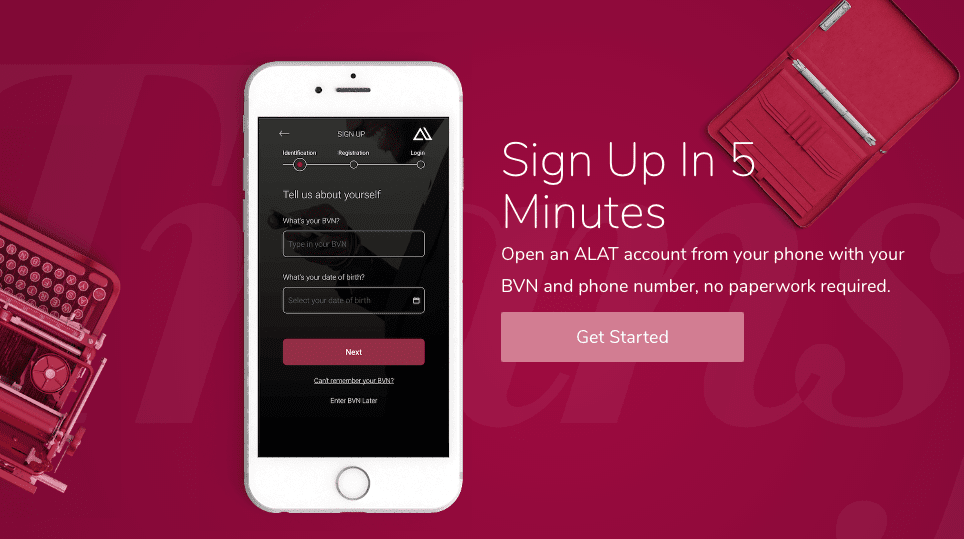

ALAT by Wema

Nigeria’s first fully-digital bank, ALAT by Wema, also offers a loan feature for its users tweaked to fit the average Nigerian and without the usual stress of queuing up in a physical bank. It also eliminates the usual paperwork involved in getting a loan as all necessary documents can be uploaded via the app.

ALAT now offers LOANS!!! Exciting features now available on the stores…upgrade to v2.4 quickly #BeALAT @alat_ng @CeBIHNG @wemabank pic.twitter.com/DUPK9w8Von

— Dele Adeyinka (@Dele_Adeyinka) January 29, 2018

The digital bank also grants, upon approval, these loan facilities of up to ₦200,000 within ten minutes. This is without the regular physical visit to the bank, collateral or paperwork.

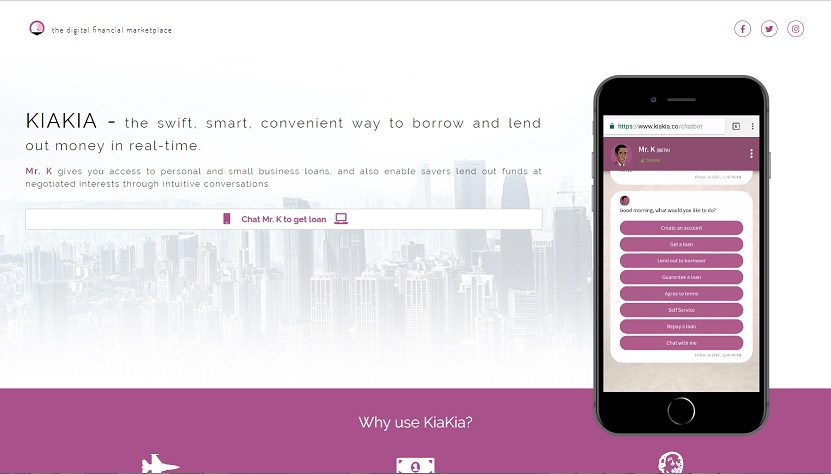

KiaKia

Just as in local parlance, KiaKia means Quick-Quick and this is not so different from the service it renders. A digitized funds lender created for SME’s in Nigeria, the platforms provides you access to personal and small business loans, and also enable savers to lend out funds at negotiated interests through intuitive conversations.

Using data bulk, computer forensics, psychometry, and machine learning, the platform performs credit rating and enable repayment risk evaluation algorithm in order to guarantee direct individual and business credits.

Users can borrow up to N5 million with a repayment period of 6 months for regular users and 30 days for new users on KiaKia.

Lidya

Lidya is an online platform that provides SMEs access to loans. The platform offers small and medium-sized businesses with unsecured loans of between $500 and $15,000.

Using technology and algorithms to assess the risk before granting the loans, Lidya allows customers access the capital they need to fulfill their potential. All users have to do is open an account with Lidya, apply for a loan and upon approval, get it within 72 hours.