Here are excerpts from an interview by Financial Technology Africa with Austin Okere, Founder of CWG Plc, the largest ICT Company on the Nigerian Stock Exchange & Entrepreneur in Residence at CBS, New York.

Q: You propounded “Austin’s Five Forces Model” of Fintech that is becoming a major force in Fintech space in Nigeria. How relevant are theories to the development of Fintech in Nigeria?

The Austin’s five forces model is not just about a theory. It provides an experiential way to analyze the future of banking (as against banks). The consistent complaint about banks has reached a crescendo in recent years. Is this justified?

After centuries of conservatism in receiving deposits and making loans, there are two main issues stirring the yearning for change:

- The first being that it is a very difficult Club to join as a customer, and hence the large population of unbanked adults.

- Secondly, even for the members of this elite club, the relationship is acutely skewed in favour of the banks

They have carried on as protected monopolies with no serious challenge or competition, resulting in very little innovation over the centuries.

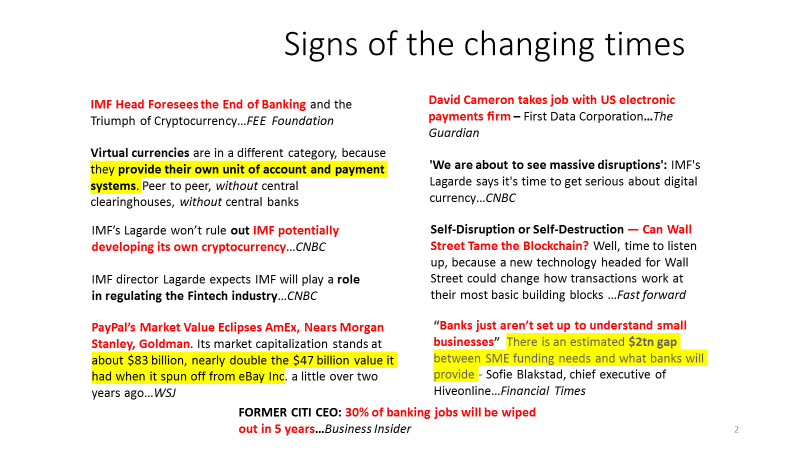

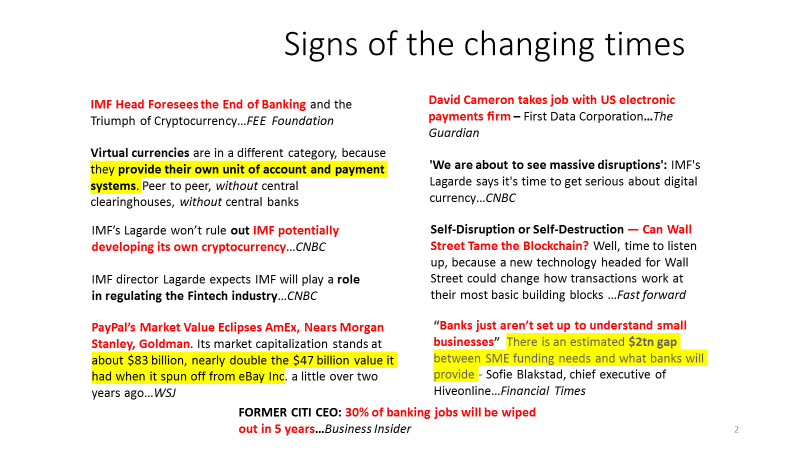

The biggest threat to the banks has been precisely their seeming success. Centuries of relatively significant higher returns, even during economic downturns that adversely affect the real sectors, has engendered an attitude of invincibility and pomposity, characterized by a loss of touch with their customers.

Considered too big to fail, they take it for granted that they will be bailed out with taxpayers’ money in the event of any missteps – this is a perfect set-up for disruption.

Today, there has emerged a powerful force of a challenge from Financial Technology companies or FINTECHs as they are more popularly referred to. The promise of Fintech is great. It is shaking up a stodgy banking system and helping to build a more efficient one, especially for consumers and small businesses.

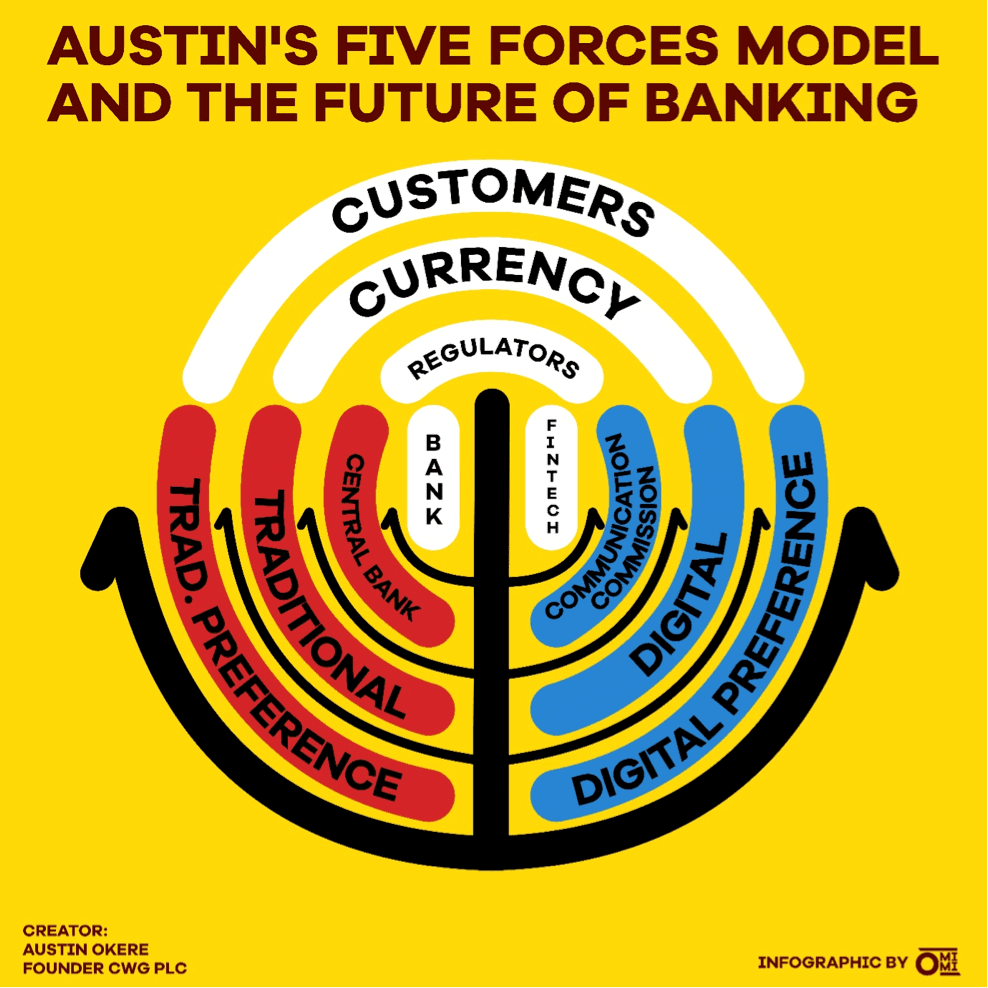

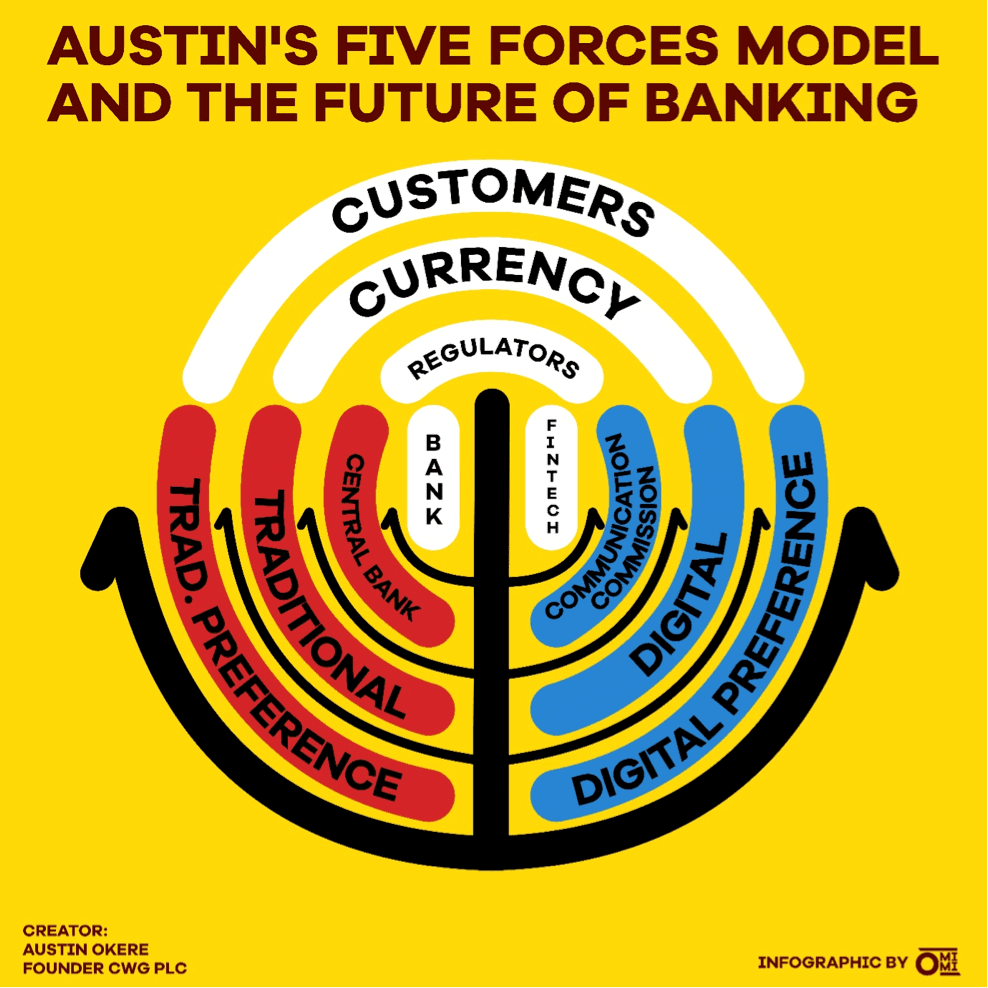

Austin’s Five Forces Model and the future of Banking:

In the face of the fierce challenge facing banks, I developed a model for analyzing the future of banking called the Austin’s Five Forces Model. There are indeed five major forces at play here:

- The banks – traditional and established, best with cash and ancillary instruments

- Fintechs – the new kid on the block, disrupter, mostly telecom roots, best with digital currencies and mobile services

- Regulators – Central Banks, regulating traditional banks; and Communication Commissions, responsible for telecoms regulation (and thus Fintechs)

- Currencies – traditional, such as cash and cheques; or Digital, including Bitcoin or other cryptocurrencies

- Customers, and the weight of their new-found voice. Typically, they clamour for whatever will give them convenience and lower costs.

Customers are the most significant force and represented by the outermost sector of the concentric circles. As they tend more towards a preference for digital currencies, the Fintechs will tend to assume a more prominent role in the new face of banking, and the Regulatory regime will inadvertently tend towards the Communication Commissions under whose purview the Fintechs fall.

This will introduce a regulatory imbroglio, as future ‘Huge Banks’ may fall outside the regulatory ambit of Central Banks as seems to be the case with the MPESA n Kenya.

Safaricom, the telecoms promoter of MPESA ironically falls under the regulation of the Communications Authority of Kenya rather than the Kenyan Central Bank.

If the customers, however, maintain a strong appetite for traditional instruments of financial transactions such as notes & coins, cheques etc. then the current status quo will remain. The face of banking will thus be more of the same, and the regulatory authority will continue to be Central Banks.

Between these two positions may be many variants, depending on the appetite and preferences of customers, and the pace at which they are willing to embrace change. And also the willingness of banks to cooperate with Fintechs to jointly provide superior customer value.

According to Sofie Blakstad, chief executive of Hiveonline, “Banks just aren’t set up to understand small businesses.” There is an estimated $2tn gap between SME funding needs and what banks will provide.

Q: Ausso Academy has been established. How will it address skillsets that are deficient in financial technology space in Africa?

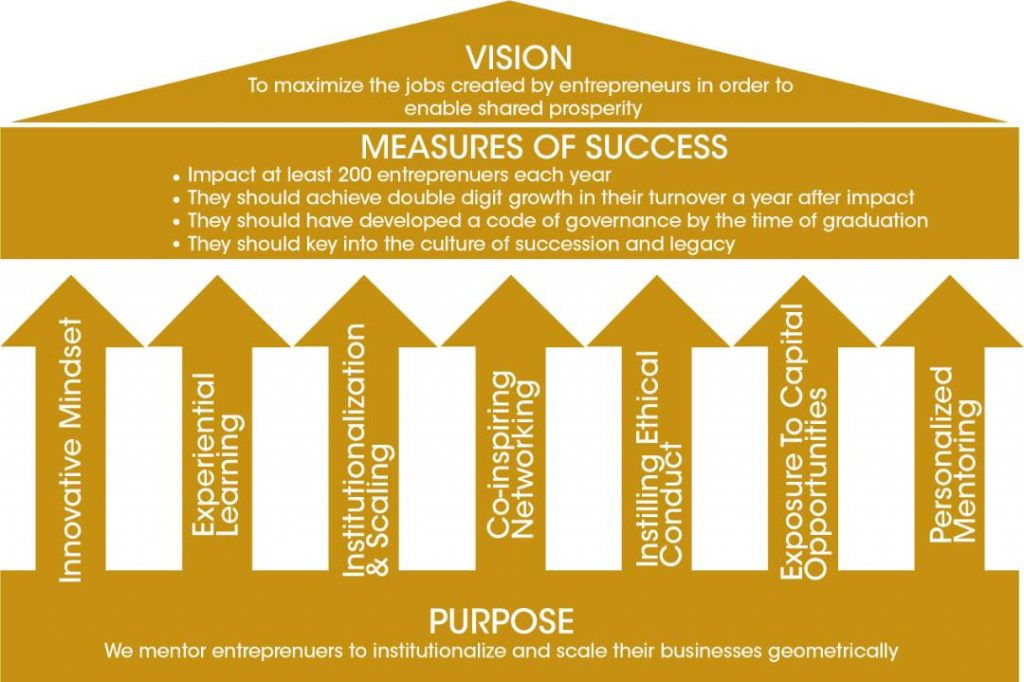

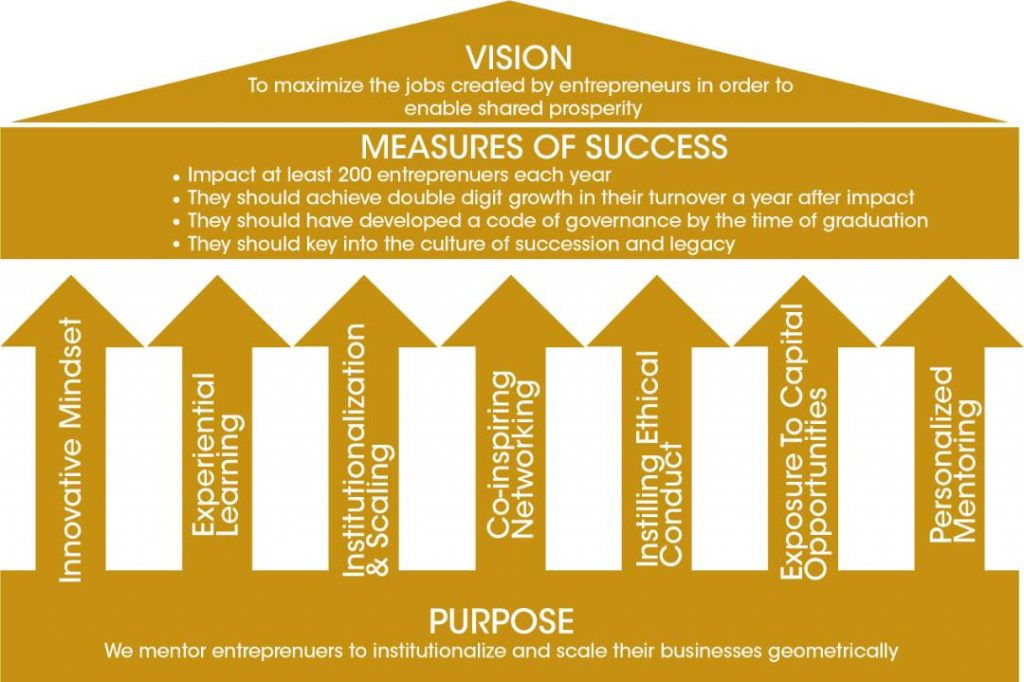

There is a huge leadership gap between the visionary entrepreneur cadre and the next management layer required on the journey of a sustainable business in Africa. The Ausso Leadership Academy fills this huge vacuum by making practical and democratizing entrepreneurial and business mentorship through experiential skill transfer, emphasizing what has worked and the pitfalls to avoid.

The huge success of the technology entrepreneurial ecosystem in Silicon Valley is largely due to the deep mentorship regime. This is the model that the Ausso Leadership Academy is replicating in our environment.

The Ausso Leadership Academy was set up to mentor entrepreneurs and business leaders to optimize the jobs they create to enable shared prosperity, through institutionalizing and scaling their businesses geometrically. The goal is to create an Expanding Oasis of Outstanding Businesses through impacting at least 200 Entrepreneurs each year.

The need for resourcefulness and an innovative mindset to reinvent oneself when disruption knocks is a key skill every business needs to survive present market realities. This is what the Ausso Leadership Academy provides to complement what is taught at Business Schools.

The faculty consist of business leaders and entrepreneurs with practical experience and a proven track record, imparting knowledge through experiential learning. They are complemented by Champions of Business and Entrepreneurship, who come to share the stories of their journeys, and how they overcame adversities in building their businesses.

The Ausso Leadership Academy has recorded remarkable success with two Cohorts and positive feedback of delegates’ outstanding performances upon returning to their companies and businesses.

Q: With what you have seen in the Western world in propagating technological prosperity and advancement, why is it difficult for Nigeria to match technology innovation?

Emerging Markets showing the way in Fintech

You are right that for years, emerging economies have looked up to developed countries for ideas about how to manage their financial systems. When it comes to Fintech though, the rest of the world will be studying the experience of the emerging markets, embodied by the widely successful MPESA mobile money system, championed by Safaricom in Kenya.

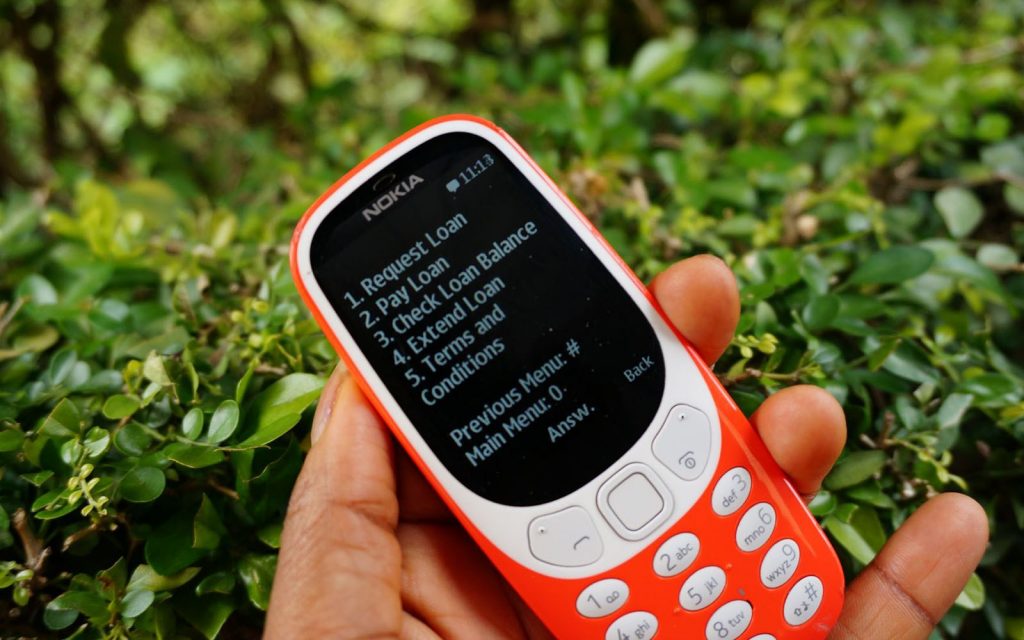

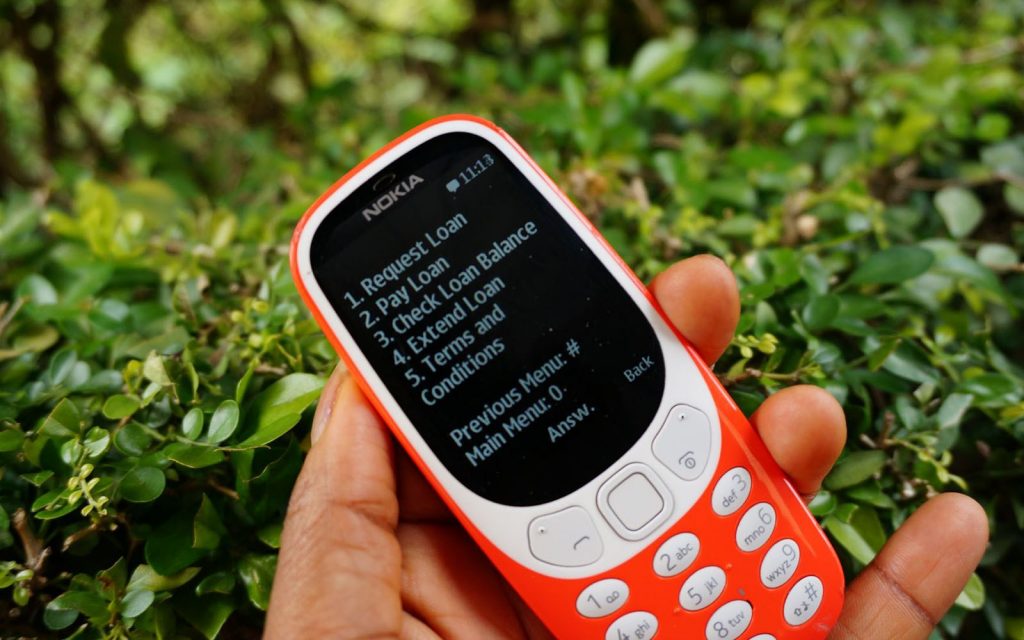

MPESA today has more than 60% of Kenya’s 33 million mobile users and in 2015 transacted $28m on her platform – equivalent to a whopping 44% of their GDP. Similar applications have metamorphosed across Africa, and Mobile Money services are today generating 6.7% of Africa’s GDP.

Nigeria is no exception with Fintechs such as Interswitch, CWG Plc, Paystack and Flutterwave holding sway. Take, for instance, Diamond bank with 7m accounts after 23 years was able to add an additional 6m accounts in just one year after the launch of the Diamond Yello Account in collaboration with CWG and MTN.

China is the undisputed World leader in Fintech

Today, digital payments account for nearly two-thirds of non-cash payments in China, far surpassing debit and credit cards. Peer-to-Peer (P2P) lenders in China grew from 214 to over 3,000 in 2015, and P2P loans increased 28-fold from 30b yuan in 2014 to 850b yuan in 2016. This shows what is possible in Nigeria.

Q: Europe and North America have embraced Open Banking system for different reasons and adopting different models. How would you describe Open Banking and how should the Nigerian banking industry approach this phenomenon?

My quick answer to Open Banking is that it may be too early for Nigeria to fully embrace; I will advise a cautious approach. Let us recall that The Second Payment Services Directive (PSD2) came into force in the UK only on 13th Jan 2018. Even then, five of the nine regulated banks expected to pioneer Open Banking had applied for and been granted extensions in implementing the mandated changes to achieve Open Banking.

- The use of Open APIs that enable third-party developers to build applications and services around the financial institution.

- Greater financial transparency options for account holders ranging from Open Data to private data.

- The use of open source technology to achieve the above

Open Banking, as a concept could be considered as a subspecies to the Open Innovation concept, a term promoted by Henry Chesbrough. It is linked to shifts in attitudes towards the issue of data ownership illustrated by regulations such as GDPR (General Data Protection Regulation) and concepts such as the Open Data movement.

In October 2015, the European Parliament adopted a revised Payment Services Directive, known as (PSD2). The new rules included aims to promote the development and use of innovative online and mobile payments through open banking.

In August 2016, the United Kingdom Competition and Markets Authority (CMA) issued a ruling that required the nine biggest UK banks to allow licensed startups direct access to their data down to the level of transaction account transactions.

Support for the concept is not unanimous. Mick McAteer, of the UK Financial Inclusion Centre, thinks that only the tech-savvy will benefit. He says that Open Banking is “a daft idea”, which will lead to more financial exclusion for those on low incomes. He says it is naïve of regulators to expect consumers to own their data and be able to get better deals from banks, and points out the danger of consumers being exploited, either by businesses offering new types of expensive payday loan, or misuse of data and personal information that people have revealed in places such as social media.

While I do not fully agree with Mick McAteer, I will advocate a cautious approach to Open Banking. Let it first stand the stress test in an environment with very mature and strong regulatory principles and enforcement and go through the requisite fine-tuning before we take steps to adopt it.

Q: Technology leaders in most developed economies work with governments to shape policies in key areas such as skill development, digital economy and businesses. Why is this not so in Nigeria?

Technology Leaders working with governments to shape policies in skills development and the digital economy is not new and certainly not restricted to developed economies.

Here in Nigeria, the pioneer Minister of Communication Technology, Mrs Omobola Johnson set up an Advisory Council comprising top technology operators to provide policy advice and feedback in charting the course of the digital economy. I would say she blazed a great trail, especially in broadband penetration, and built a solid foundation; some of the fruit of which we are benefiting today.

The similar initiative with the National Competitiveness Council of Nigeria (NCCN) comprising top business leaders also recorded steady progress especially in the areas of Human Capital Development and Primary Healthcare. The engendering of a healthy competition between the states akin to the World Bank and World Economic Forum’s competitiveness indices ensured that the States kept their eyes on the ball.

In 2017, President Muhammadu Buhari created an Industrial Competitiveness Advisory Council in order to enhance industrial policies and performance in the country.

As part of the council, on June 11, 2018, Vice President Yemi Osinbajo, inaugurated a 50-man Advisory Group on Technology and Creativity which consists of ministers, heads of agencies as well as players in the technology and creative space in order to boost a public-private partnership. Private players in the tech space included in the group are founders of innovation hubs across Nigeria, investors and tech entrepreneurs.

There may be a need to correlate their inputs with a narrative of milestone achievements for better transparency and appreciation.

Q: Regardless of how it unveils, a revolution in finance has already started and regulations are the biggest obstacles that Fintech innovators face today. What is your assessment of the current regulatory environment and suggestions for improvement?

Regulators are now helping Fintechs

As customers increasingly embrace Fintechs for seamlessly providing convenience at low cost, Fintechs will tend to assume a more prominent role in the new face of banking, and the Regulatory regime will inadvertently tend towards the Communication Commissions under whose purview the Fintechs fall.

This will introduce a regulatory imbroglio, as future ‘Huge Banks’ may fall outside the regulatory ambit of Central Banks as seems to be the case with the MPESA and Safaricom in Kenya. Safaricom, the telecoms promoter of MPESA ironically falls under the regulation of the Communications Authority of Kenya rather than the Kenyan Central Bank.

Fintechs are now getting a lot of support from Regulators, believing that Fintech firms are small enough for any problems to be manageable, and on the other hand, might produce useful innovation (the sandbox approach). The intention is to lower market entry barriers for fintech companies. For instance, France’s Central Bank has announced opening up a new innovation lab, aiming to collaborate with blockchain startups.

As such, “settlement risk exposure can be reduced by over 99%, dramatically lowering capital costs and systemic risk,”. Other stock exchanges tinkering with the blockchain include Australia, Germany, Japan, Korea, London,Toronto and Myanmar.

Fintechs are also avoiding the regulatory hassles by launching on hard-to-police platforms such as WhatsApp. Here in major banks are launching their chatbots on WhatsApp. Considering that WhatsApp reaches more than 1.5 billion people in over 180 countries, this could be a giant step for Fintechs in transcending many regulatory jurisdictions in one fell swoop.

The changes coming with Blockchain, and especially Fintech will be as large as the original invention of the internet. Who would have imagined a decade ago that e-commerce, championed by Amazon and Alibaba will be displacing high street retailers, or that ride-hailing will be dominated by UBER, a technology platform?

Austin Okere is the Founder of CWG Plc, the largest ICT Company on the Nigerian Stock Exchange & Entrepreneur in Residence at CBS, New York. Austin also serves on the Advisory Board of the Global Business School Network, and on the World Economic Forum Global Agenda Council on Innovation and Intrapreneurship. Austin now runs the Ausso Leadership Academy focused on Business and Entrepreneurial Mentorship