Even though cryptocurrencies such as bitcoin tend to steal the limelight, it is their underlying blockchain technology that is proving to be of practical benefit. This technology, which goes beyond the financial application, is expected to disrupt global supply chains by boosting transaction speed across borders and improving transparency.

Essentially, the blockchain is a shared virtual public ledger where encrypted transactions are confirmed by outside parties. Confirmed transactions are placed in a “block” and added to the chain, hence the name blockchain. It is this technology that the Fintechs are leveraging to disrupt the traditional banks

Here in Nigeria, blockchain can help immensely unlock the immense capital locked in land assets that are not enumerated because of an antiquated system of land administrated that is very ripe for disruption.

The most disruptive application of the blockchain technology, however, is in the Financial Sector; and this will form the focus of my discourse. The consistent complaint about banks has reached a crescendo in recent years. Is this justified?

Should Banks be changing?

After centuries of conservatism in receiving deposits and making loans, there are two main issues stirring the yearning for change:

- The first being that it is a very difficult Club to join as a customer, and hence the large population of unbanked adults.

- Secondly, even for the members of this elite club, the relationship is acutely skewed in favour of the banks

They have carried on as protected monopolies with no serious challenge or competition, resulting in very little innovation over the decades.

The biggest threat to the banks has been precisely their seeming success. Centuries of relatively significant higher returns, even during economic downturns that adversely affect the real sectors, has engendered an attitude of invincibility and pomposity, characterized by a loss of touch with their customers.

Considered too big to fail, they take it for granted that they will be bailed out with taxpayers’ money in the event of any missteps – this is a perfect set-up for disruption.

Fintech – the new kid on the block

Today, there has emerged a powerful force of the challenge from Financial Technology companies or FINTECHs, as they are more popularly referred to. The promise of Fintech is great. It is shaking up a stodgy banking system and helping to build a more efficient one, especially for consumers and small businesses.

Emerging Markets showing the way in Fintech

For years, emerging economies have looked up to developed countries for ideas about how to manage their financial systems. When it comes to Fintech though, the rest of the world will be studying the experience of the emerging markets, embodied by the widely successful MPESA mobile money system, championed by Safaricom in Kenya.

MPESA today has more than 60% of Kenya’s 33 million mobile users and in 2015 transacted $28m on her platform – equivalent to a whopping 44% of their GDP. Similar applications have metamorphosed across Africa, and Mobile Money services are today generating 6.7% of Africa’s GDP.

Nigeria is no exception with Fintechs such as Interswitch, CWG, Paystack and Flutterwave holding sway. Take for instance, Diamond bank with 7m accounts after 23 years was able to add an additional 6m accounts in just one year after the launch of the Diamond Yello Account in collaboration with CWG and MTN.

China is the undisputed World leader in Fintech

By just about any measure of size, China is the world’s leader in Fintech. It is by far the biggest market for digital payments, accounting for half of the global market, according to the Economist Magazine. A ranking of the world’s most innovative Fintech firms gave Chinese companies four of the five top slots in 2016. The largest Chinese Fintech company, Ant Financial, has been valued at about $60b, at par with UBS which is Switzerland’s biggest bank.

Austin’s Five Forces Model and the future of Banking

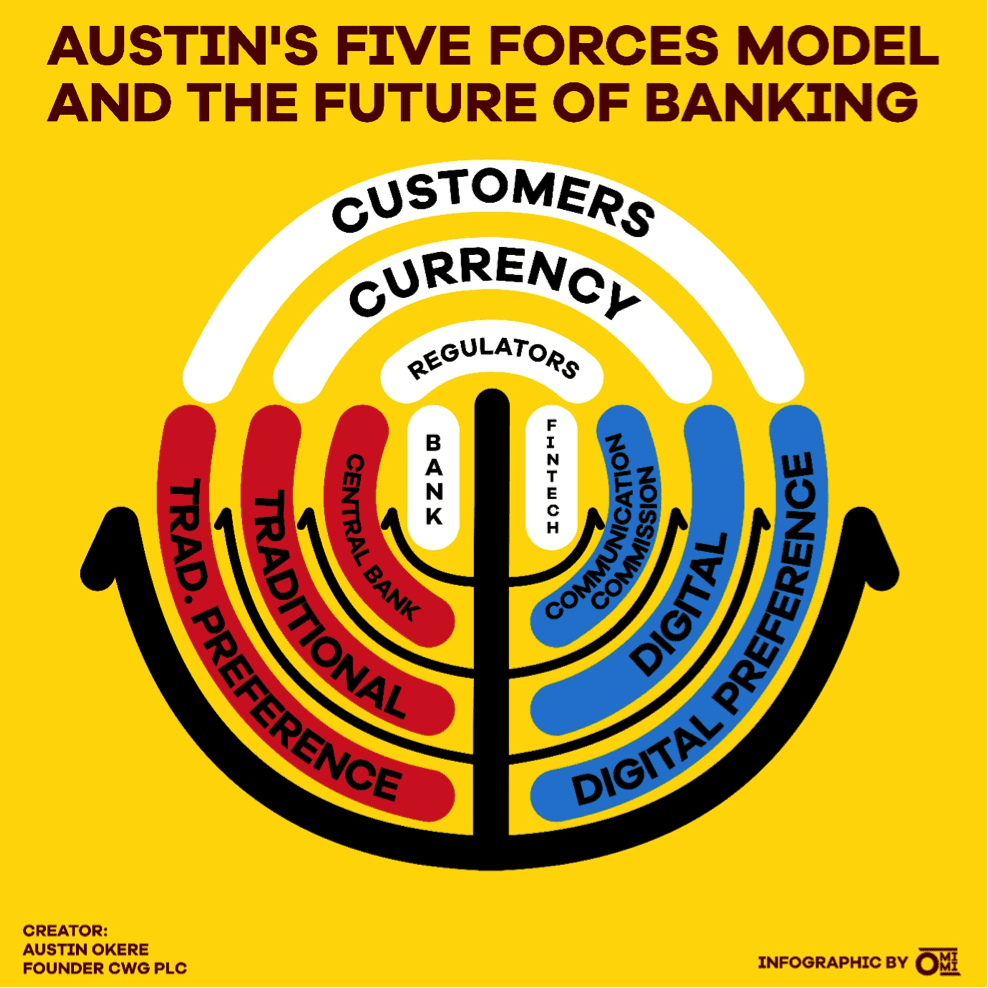

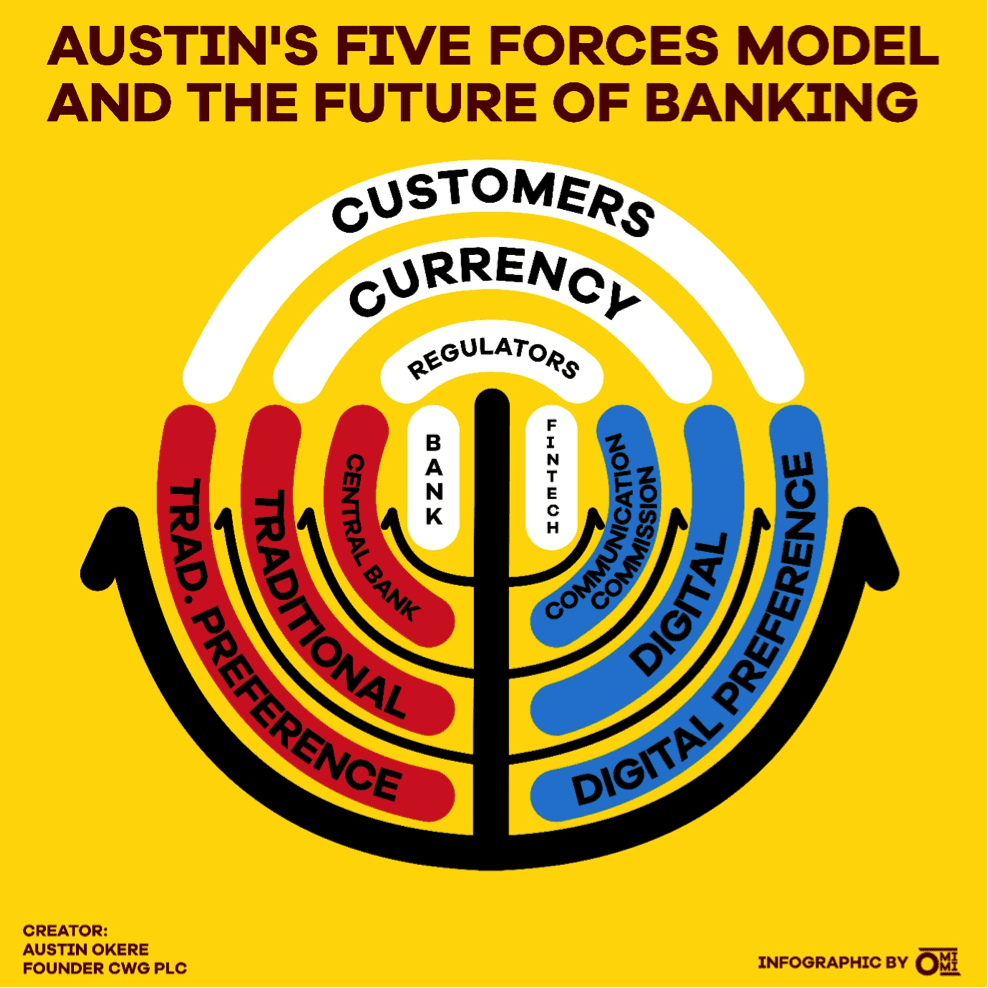

In the face of the fierce challenge facing banks, I developed a model for analyzing the future of banking called the Austin’s Five Forces Model. There are indeed five major forces at play here:

- The banks – traditional and established, best with cash and ancillary instruments

- Fintechs – the new kid on the block, disrupter, mostly telecom roots, best with digital currencies and mobile services

- Regulators – Central Banks, regulating traditional banks; and Communication Commissions, responsible for telecoms regulation (and thus Fintechs)

- Currencies – traditional, such as cash and cheques; or Digital, such as Bitcoin or other cryptocurrencies

- Customers, and the weight of their new-found voice. Typically, they clamour for whatever will give them convenience and lower costs.

This will introduce a regulatory imbroglio, as future ‘Huge Banks’ may fall outside the regulatory ambit of Central Banks as seems to be the case with the MPESA.

Safaricom, the telecoms promoter of MPESA ironically falls under the regulation of the Communications Authority of Kenya rather than the Kenyan Central Bank.

If the customers however, maintain a strong appetite for traditional instruments of financial transactions such as notes & coins, cheques etc. then the current status quo will remain. The face of banking will thus be more of the same, and the regulatory authority will continue to be Central Banks. Between these two positions may be many variants, depending on the appetite and preferences of customers, and the pace at which they are willing to embrace change.

Retailers are jumping into Financial Services

Fintechs are not the only ones challenging traditional banks for turf. Retailers are also jumping into the financial services fray. For instance, Amazon has launched Amazon Cash, a way to shop its site without a bank card. This product is meant to appeal to the those who get paid in cash, don’t have a bank account or debit card, and who don’t use credit cards.

Banking is going Mobile

In most emerging markets and developing countries, the current formal financial system only reaches a minority of the working-age adult population. Smallholder farmers, self-employed households, and micro-entrepreneurs have to rely on the age-old informal financial mechanisms such as rotating savings clubs (Isusu or Ajoo). These mechanisms can be unreliable and very expensive.

The digitization of retail payment systems and financial services has become an important economic development priority. It offers the prospect of reaching far more people at far lower costs with the broader range of financial services they need to build resilience and capture opportunities. This speaks to inclusiveness

What will be the scale of change of the Blockchain technology?

The changes coming with Blockchain will be as large as the original invention of the internet, and this may not be overstated. Who would have imagined a decade ago that e-commerce, championed by Amazon and Alibaba will be displacing high street retailers, or that ride-hailing will be dominated by UBER, a technology platform?

Regulators are now helping Fintechs

Fintechs are getting a lot of support from Regulators, believing that Fintech firms are small enough for any problems to be manageable, and on the other hand, might produce useful innovation (the sandbox approach). The intention is to lower market entry barriers for fintech companies. For instance, France’s Central Bank has announced opening up a new innovation lab, aiming to collaborate with blockchain startups.

In December 2015, Nasdaq executed its first trade on a blockchain, through its Linq ledger. The exchange said the blockchain promises to expedite trade clearing and settlement – all the steps needed to transfer the asset from seller to buyer including recording the transaction — from three days to as little as 10 minutes. That’s because the trades remove many manual processes and bypass third parties.

As such, “settlement risk exposure can be reduced by over 99%, dramatically lowering capital costs and systemic risk,”. Other stock exchanges tinkering with the blockchain include Australia, Germany, Japan, Korea, London,Toronto and Myanmar.

The Future of Fintechs

The future of Fintech seems bright. Accenture recently released a report which found that investment in Fintech around the world has increased dramatically from $930 million in 2008 to more than $12 billion by early 2015. The Fintechs employ Artificial Intelligence, Big Data and Machine Learning to glean the credit habits of customers from their mobile usage, and so have mitigated against the risk of default.

These are innovative services that seek to fill important niches in the credit markets. They enable people who have historically been shunned by banks to get loans in order to expand their businesses.

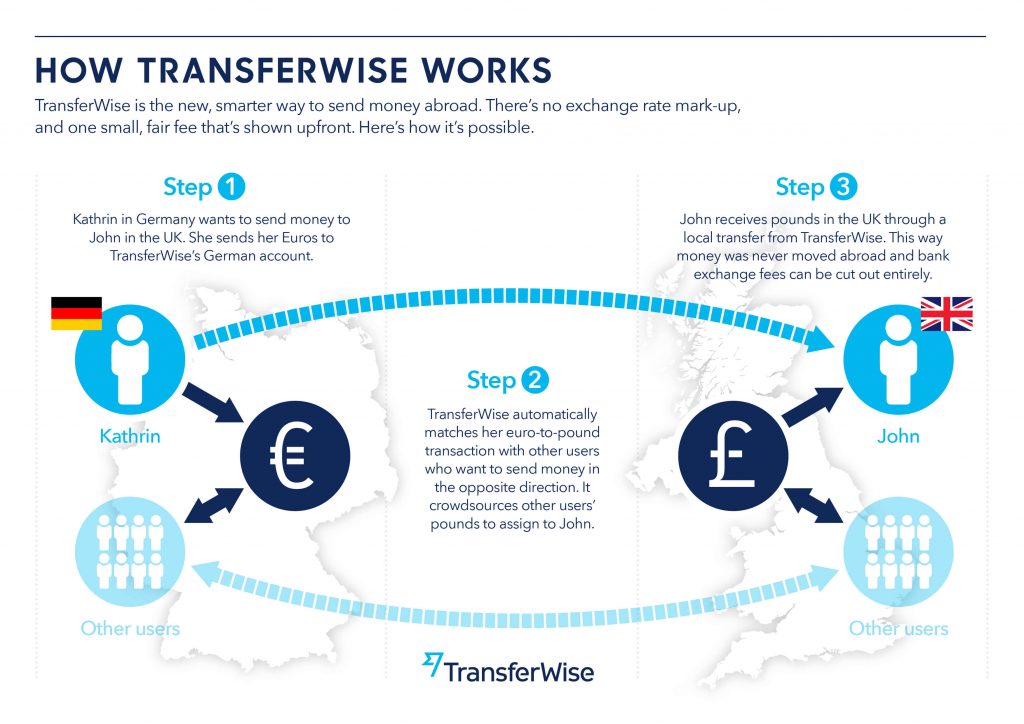

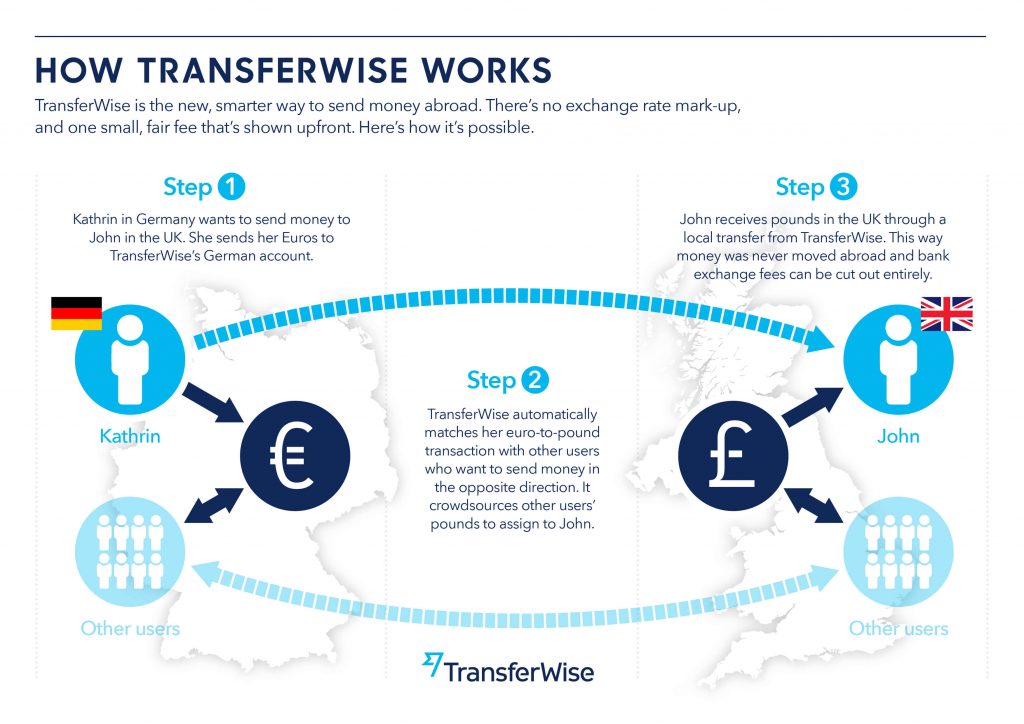

The lucrative Transfer market will be significantly impacted

The lucrative global transfers markets are major targets by Fintechs. International money transfers, which have long been a thorny issue, are getting easier. For smaller transactions, services like PayPal automatically convert currencies, so it’s easy for a customer to purchase goods from anywhere in the world.

In this exorbitant regime, Western Union and HSBC typically earned $600m and $800m per annum respectively in profits from only transfers. These huge contributions to their bottom-line will be dearly missed when displaced by TransferWise and their co-travellers. In Taavet’s view Fintechs will command about 40% of the global Financial Services market in the next 10 years.

Banks and Fintechs’ collaboration for mutual benefit

Fintech companies in emerging markets have shown that with blockchain technology, it is possible to leapfrog to new forms of banking.

Truth be told, Banks are best placed to continue to influence the future of Financial Services because of their huge branch network, solid reputations, and risk controls, as well as years of customer cultivation and loyalty. They, however, have to radically change the mindset of ‘we win when you lose’.

The big take away

The ubiquity of broadband and the pervasiveness of mobile phones, along with breakthrough technology such as Artificial intelligence, Big Data and Blockchain are expanding the frontiers for business models in ways that were hitherto not possible, and levelling the playing field in the process.

Any bank that does not read the signs and join the innovation train will definitely be disrupted and left behind. Remember that there was a time when the Post Office was at the center of our lives. When was the last time you visited a post office?

Thank you and God bless you

Austin Okere is the Founder of CWG Plc, the largest ICT Company on the Nigerian Stock Exchange & Entrepreneur in Residence at CBS, New York. Austin also serves on the Advisory Board of the Global Business School Network, and on the World Economic Forum Global Agenda Council on Innovation and Intrapreneurship. Austin now runs the Ausso Leadership Academy focused on Business and Entrepreneurial Mentorship