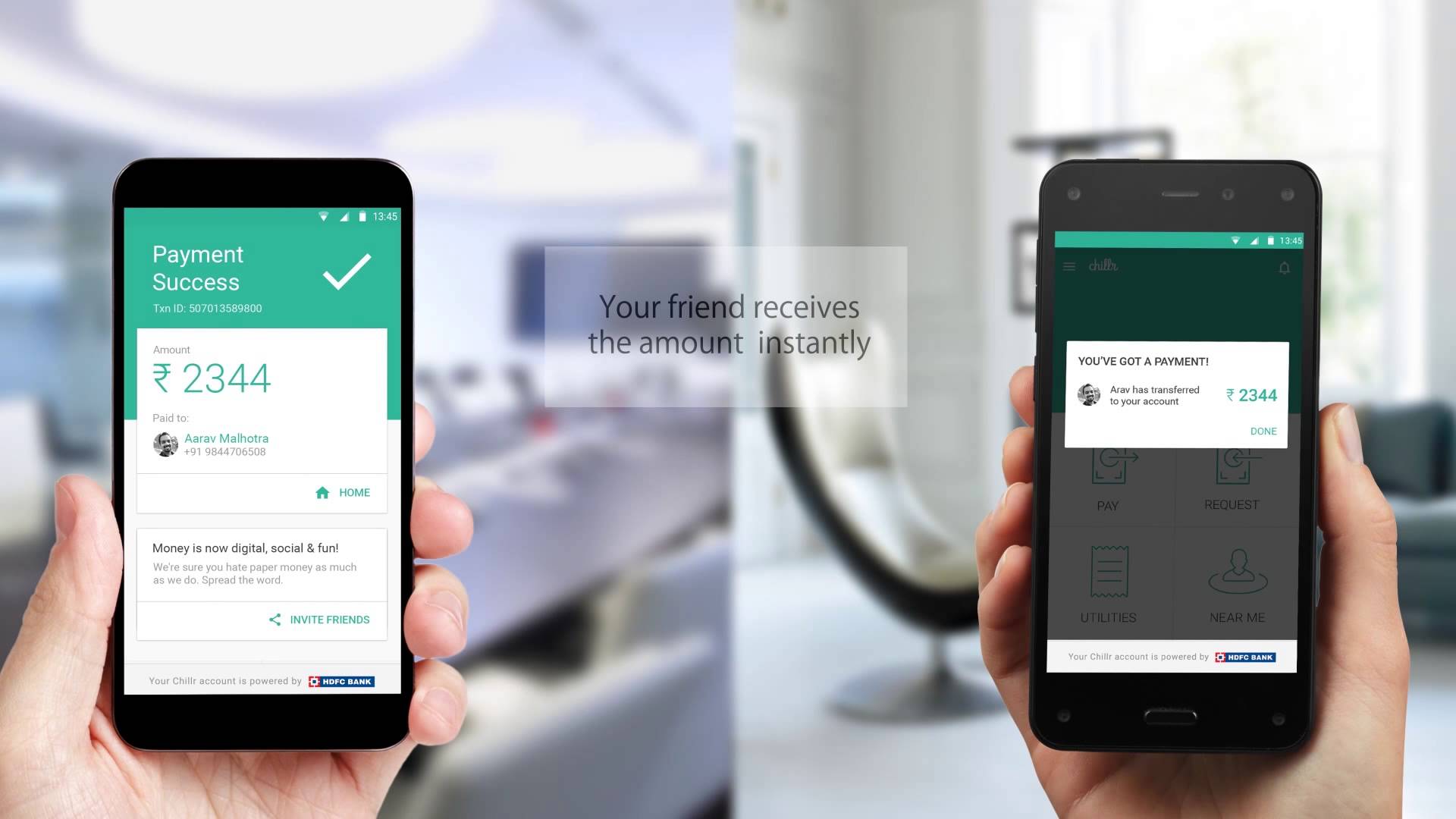

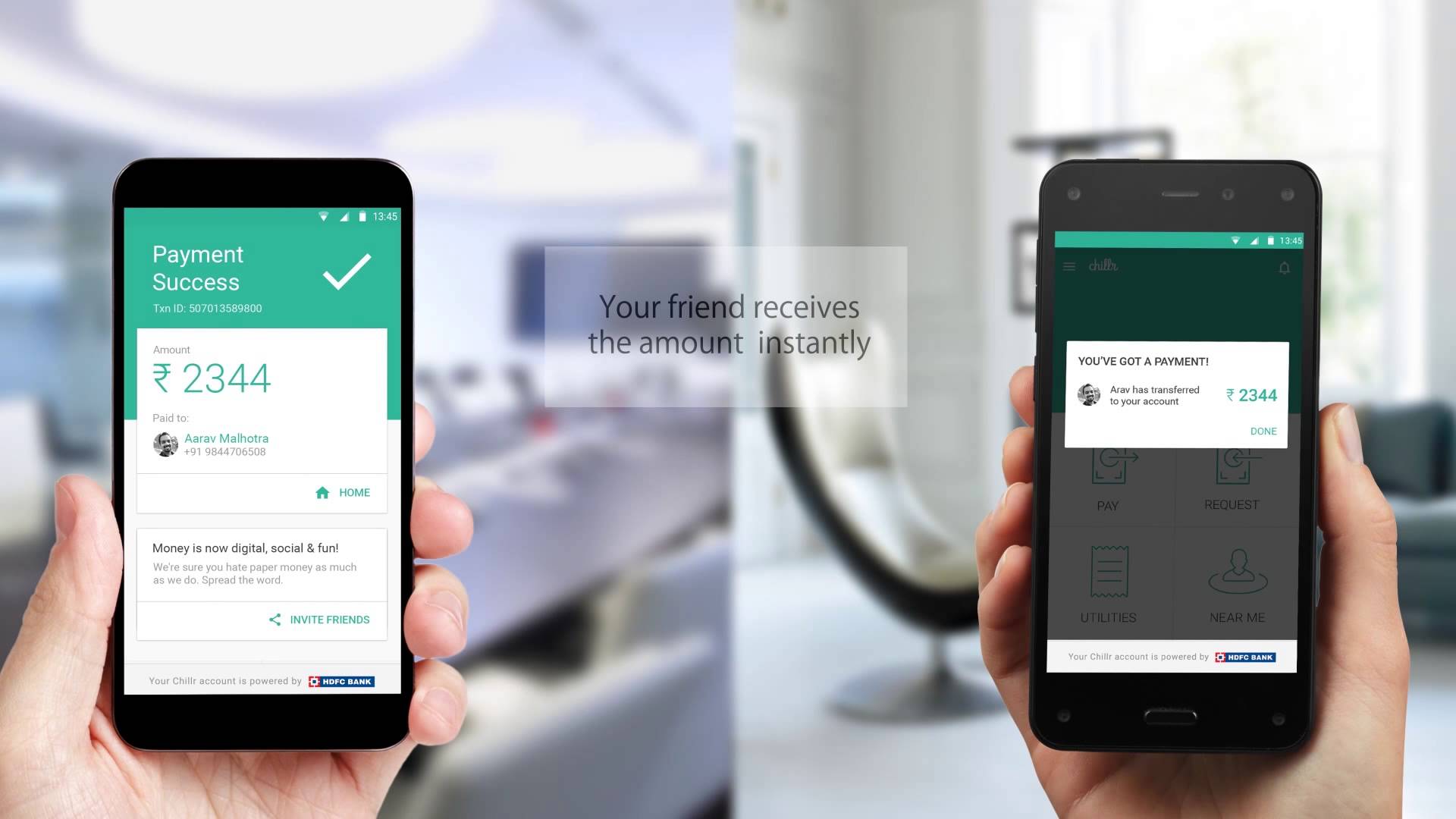

Popular caller identification app, Truecaller, is making inroads in its quest to become a mobile payments service. The company just announced that it has acquired Chillr, an Indian multi-bank payments app.

Welcome to the team, Chillr! The team of Chillr joins #Truecaller for our newest payment feature for India, Truecaller Pay! Quickly send money to friends, pay bills, recharge, and more! https://t.co/UNHzQBOblw pic.twitter.com/5m9FcGRzA5

— Truecaller (@Truecaller) June 13, 2018

Launched in 2014, Chillr allows users to transfer money to any contact in their phone book. Now, Truecaller is set to leverage the app’s technology to scale up its own digital payments services.

Truecaller Continues to Push into Digital Payment Processing

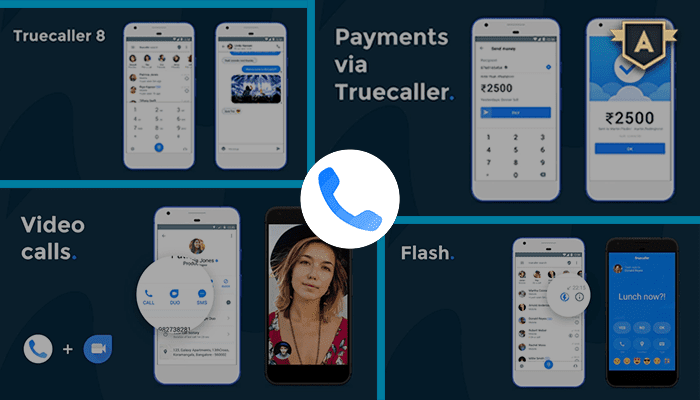

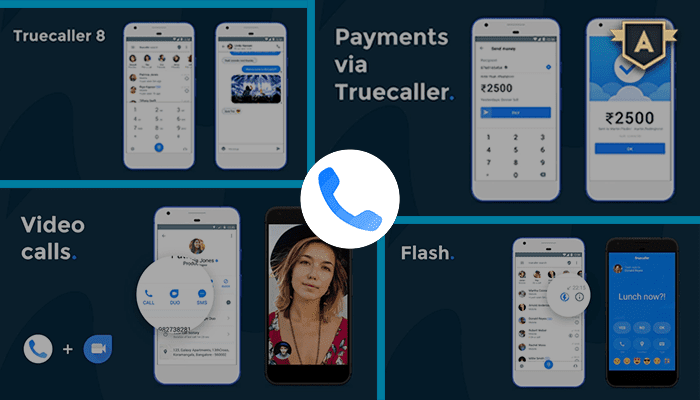

Truecaller, the Sweden-based startup, originally earned a name for itself as a utility mobile app that helps people filter out unwanted phone calls and messaging. But it has recently begun expanding into new domains, such as video calls and messaging.

Its romance with FinTech services is also new; it began with India last year. In March 2017, the company launched Truecaller Pay in India.

Truecaller Pay enables you to create an UPI ID & send money to another ID or number registered with the BHIM app. https://t.co/XA68GH4Ys7 pic.twitter.com/XeRxipAcVJ

— ICICI Bank (@ICICIBank) May 6, 2017

Created in partnership with the Indian bank, ICICI Bank, the feature enables peer-to-peer payments between Truecaller users. The bank controls the technology behind the service and uses India’s Unified Payments Interface (UPI) to enable interoperability, allowing customers of any Indian bank to use the service.

As a result, it appears the bank holds licenses for the service.

Chillr Acquisition Strengthens Truecaller’s Financial Services Ambitions

However, the starup has plans to go deeper into mobile payments and financial services. Over the next months, the company will to integrate with third-parties to provide services such as loans, financing, micro-insurance and more. This makes the acquisition of Chillr all the more important.

“We’ve acquired a company that is known for innovation and leading this space in terms of building a fantastic product,” Truecaller co-founder and CSO Nami Zarringhalam told TechCrunch.

Initially courted as a partner to provide third-party services, Truecaller realised Chillr had more potential.

“We realized we shared synergies in thought processes for caring for the customer and user experience,” Zarringhalam said.

With the acquisition for an undisclosed fee, Chillr’s core features will become part of Truecaller pay. Also, Chillr’s entire 45 employees will join Truecaller Pay, while Chillr CEO Sony Joy will become vice president of the digital payment service.

Truecaller acquires Chillr; brings mobile payments to its core with Truecaller Pay 2.0, which has been launched with new features and bigger integrations; more than doubles its team size in India; Sony Joy to be the Vice President of Truecaller Pay.

— Pradeep Nair (@bpradeepnair) June 13, 2018

“By acquiring Chillr, we are reaffirming our commitment to mobile payments and strengthening our plans to increase its adoption amongst our user base,” Nami Zarringhalam, co-founder and chief strategy officer of Truecaller, said in a media statement.

Expanding Truecaller Pay to Other Global Markets

For now, Truecaller’s Fintech Technology is focused on India. This is understandable; India is its biggest market. However, the company is not restricting itself. The startup is looking to delve into more markets globally. The idea is to however, is to localise its offerings based on the models it develops for India.

“It could be based on acquisitions or partners, time will tell,” Zarringhalam said. “But our plan is to develop this for all markers where our market penetration is high and the market dynamics are right.”

So it won’t be surprising if Truecaller Pay becomes a thing in the Nigeria ecosystem anytime soon. However, its success in any other country depends on India. With its existing multiple payments offerings, its success in India would be key to any growth elsewhere.

Evidently, Nigeria won’t an easy market to break into. However, it is interesting to note that most payment companies in the country focus too heavily on ecommerce transactions. Meanwhile, Truecaller Pay focuses on peer-to-peer transfers.