You can now purchase Treasury Bills directly from your Smartphone, thanks to the new mobile app, ‘i-invest’. The app was developed by Sterling Bank in partnership with Parthian Partners, a pan African inter-brokerage services company.

The mobile app broadens the use of mobile technology beyond money transfers, utility bill payments and airtime purchases to investment opportunities.

Just found out that i can invest for only KShs 10 with @OldMutualKenya 's i-Invest mobile app!! Amazing. #MutualChat

— Miss Rachel (@RakeriSays) February 26, 2014

Now, in case you didn’t know, Treasury Bills are short-term debt instruments issued by the Federal Government through the Central Bank to provide short term funding for the government. They are by nature, the most liquid money market securities and are backed by the guarantee of the Federal Government.

T-Bills are usually issued at the primary market auction held fortnightly by the Central Bank of Nigeria with no fixed interest rate but fluctuates based on demand and amount offered by the CBN.

About the i-invest Mobile App

The mobile app simplifies the investment in Treasury Bills and other fixed income products process, and eliminates limitations such as lack of education and information to make smart investment decisions and let’s you trade from the comfort of your home like a professional.

According to the Parthian Partners Boss, Oluseye Olusoga:

The mobile app broadens the choice of money market products available to new and experienced retail investors in the Nigerian money market to include Treasury Bills. Potential investors require only a Smartphone with a functional mobile phone line and data subscription to use I-invest.

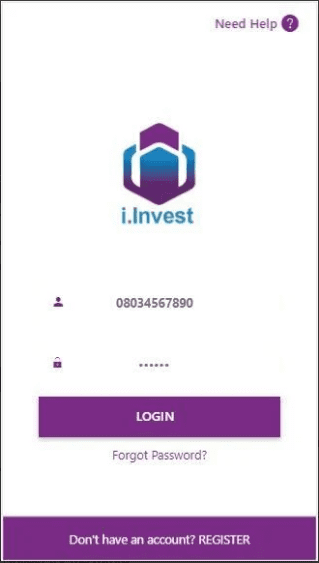

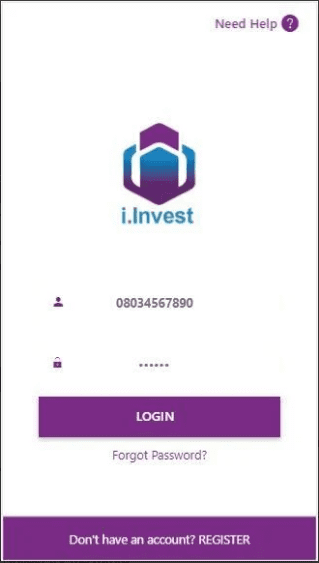

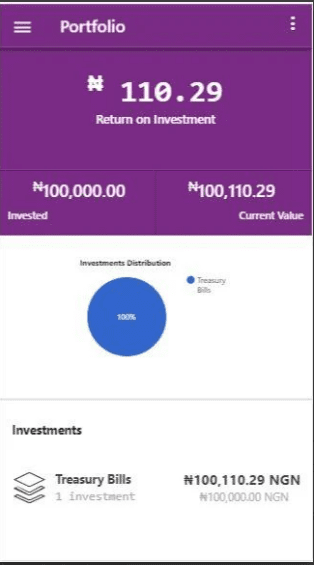

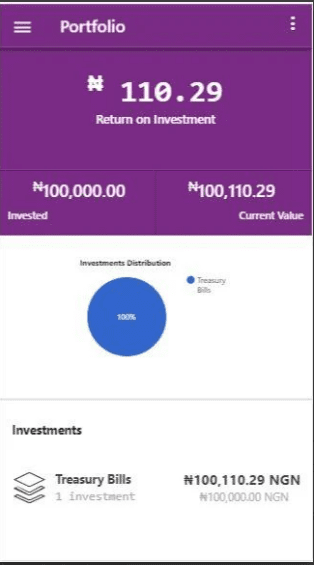

With the i-invest mobile app, you can register and start investing in T-bills within five minutes and also monitor the growth of your investment real-time and liquidate it at any time into your cash wallet. You no longer need to visit banks to fill forms for Treasury Bills anymore.

With a friendly user interface, the mobile app allows account holders to fund their account using their mobile banking platform or using their debit card.

The minimum investment is 100,000 Naira and your interest begins to accrue daily. The investment amount and interest will be credited to the customer’s account on maturity.

With over a 100 download already, the mobile app is available on the google play store.