Businesses in similar industries usually have competitive relations and instincts. But when they work together, the possibilities are limitless. This has proven key in the successful relationship between two Nigerian fintechs: PiggyBank and Flutterwave (An update on this partnership was posted here).

Both companies have been players in the Nigerian tech scene for quite some time. Actually, they have been partners since 2017.

A key part of their alliance is that they complement each other. But how?

Piggybank.ng: Who are they?

Launched in 2016, Piggybank.ng is a fintech startup founded by three young entrepreneurs. The company has the ambitious goal of improving the savings culture amongst Nigerians.

As its practice, the startup thrives on combining discipline and flexibility in helping people improve their saving habits and better manage their finances.

It does this by providing a digital wallet for each user. Users can load up the wallet with funds from their banks. PiggyBank then secures the funds and holds them until users desire to make a withdrawal.

Quite similar to traditional banks, right? Well, not exactly.

Piggybank gives users access to their funds once, every four months. However, users can set a custom date for their withdrawal. In 2017, PiggyBank saved over N1 billion for its customers; up from N21 million in 2016.

To make the withdrawal slick and easy, Piggybank relies on the strength of Flutterwave and PayStack.

PiggyBank partners Flutterwave

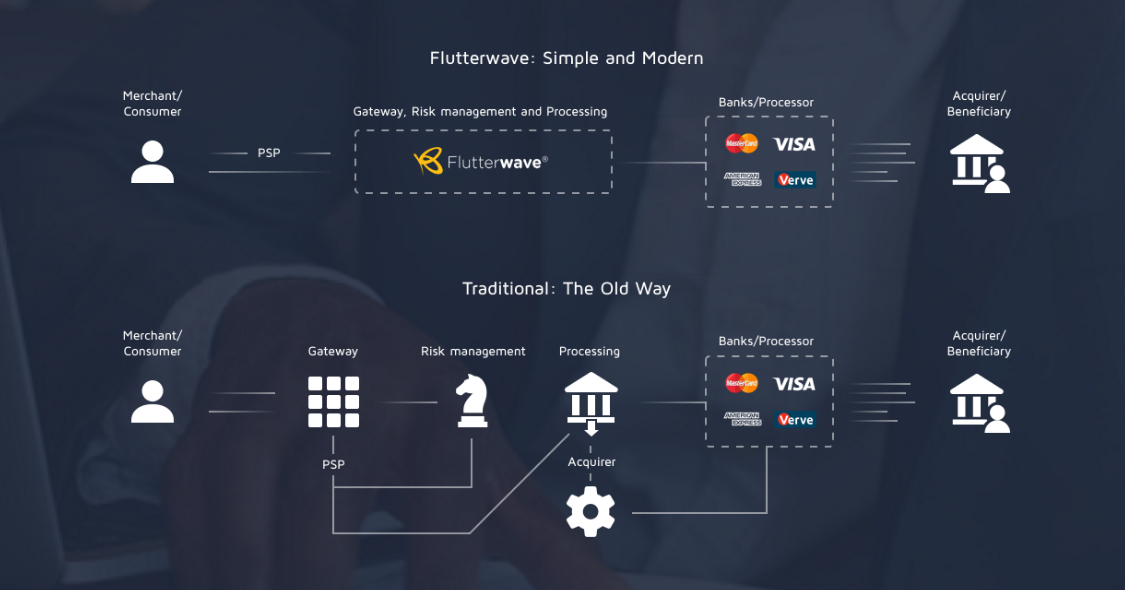

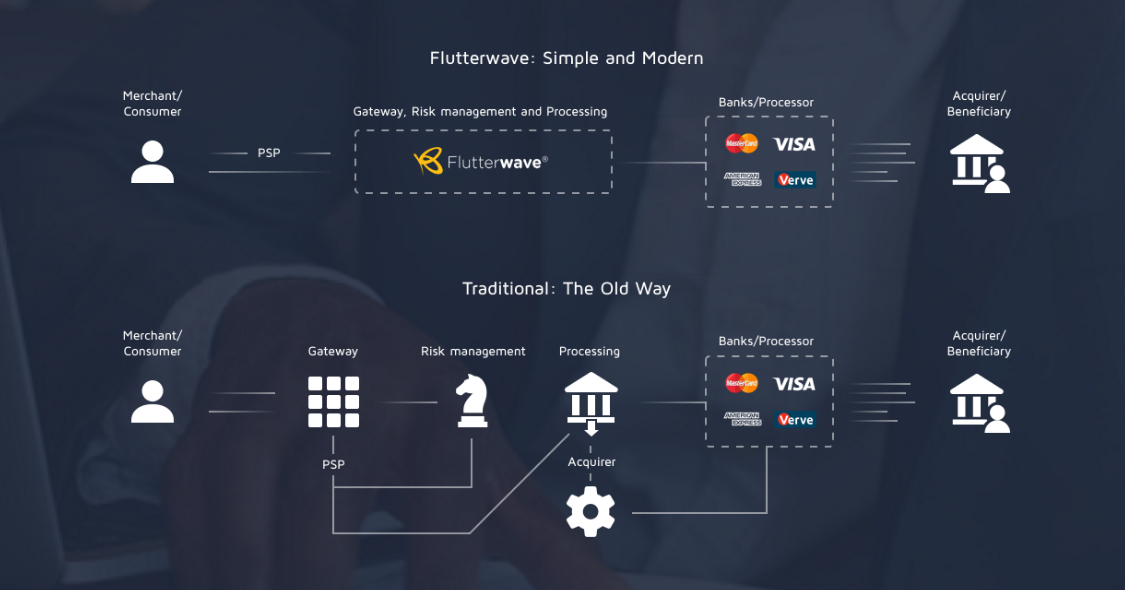

Flutterwave is already a big player in the Nigerian mobile transfer market.

As a fintech company, Flutterwave is focused on helping banks and businesses provide seamless and secure payment experiences for their customers. It has processed over $2bn since 2016.

Piggybank’s partnership with Flutterwave revolves around ensuring seamless withdrawal process for its millennial customers.