Disrupt Africa has released its tech startup funding report for 2017. The report disclosed that Nigeria, South Africa and Kenya are the top three destinations for startup investments in Africa. Egypt and Ghana were also close contenders as they had a high number of deals and total amount of funding.

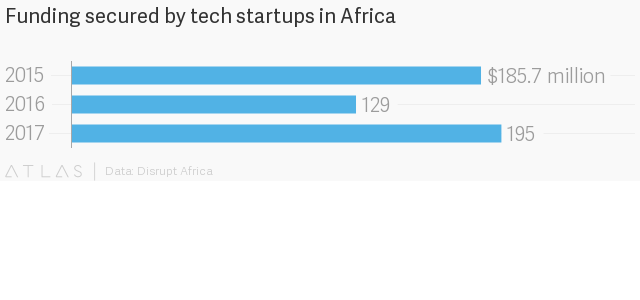

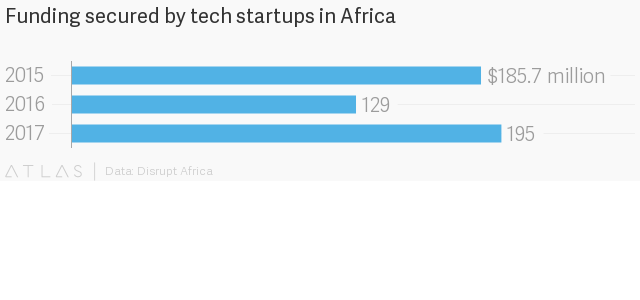

The report further revealed that over $195 million was invested in African startups in 2017; which represents a 51% increase from 2016. And the number of startups that received funding also rose to 156.

Fintech rakes in the most funding

When sorted according to sectors, the report shows that Fintech was the most attractive sector for investors. The sector received a third of all funding in 2017. It was closely followed by investments in e-commerce. Investment in e-commerce was much higher in 2017 than it was in 2016.

The high investment in Fintech startup is really something, as banking penetration is low. In 2014, the number of bank accounts relative to population was 34% in Africa.

In the developed world, Fintech startups disrupt traditional banking services. But on the African continent, Fintechs are trying to solve basic banking problems, like making it easier to transfer money, open a bank account, get a loan, and get insurance coverage. Rather than disrupt, Fintech startups are “building a whole new infrastructure of their own”.

Investors, on the other hand, seem optimistic that Fintech startups are capable of correcting these problems. The huge population of Africa is obviously a contributing factor.

Already, startups like Paystack and M-Pesa are tackling the key issue of simple mobile banking effectively. Flutterwave is another important Fintech startup that processes payments across Africa. In 2017 it raised as much as $10 million in its Series A funding. Flutterwave processed over $1.2 billion in payments across over 10 million transactions.

Other startups like Paylater.ng are also playing a role in the digitisation of basic financial services. Paylater.ng provides loans of up to N1 million with no collateral. It determines the credit worthiness of a user and facilitates loans quicker than banks could ever be capable of.

With the huge gap that exists in the African society, investors are confident that the innovations of these startups will tackle the problems. Their optimism is not just for the profits, but for the value these companies create.