Telco giant, Safaricom and commercial banks in Kenya are in talks with the Central Bank of Kenya (CBK) to end the zero-rated policy on mobile money transactions which was introduced amid the COVID-19 pandemic.

The telecom company and banks are seeking a deal with the CBK that will see the regulator consult them if it decides to extend free mobile money transfers beyond December 31. Safaricom CEO, Peter Ndegwa did not give details on the matter.

We are not ready at this stage to announce when the free cash transfers end as we are still in engagements with the CBK.

Peter Ndegwa, CEO Safaricom

CEO of Kenya Commercial Bank (KCB) Group, Joshua Oigara revealed that the bank was consulting with the CBK to restore charges on certain mobile money transactions.

“We are having engagements with the CBK at the moment. We are optimistic that maybe some transactions will go back to where we were before and maybe others continue under the current waiver,” he said.

The new development comes after Safaricom recorded a decline in net profit year-on-year for the first time since 2012.

In March, the CBK had announced free charges for person-to-person (P2P) mobile money transfers below KSh1,000. Also, the central bank waived all charges by mobile money operators and commercial banks for transfers between mobile money wallets and bank accounts.

According to the CBK, these measures were introduced to facilitate increased use of mobile money services instead of cash as part of efforts to contain the spread of COVID-19 and help Kenyans pull through the pandemic.

Later in June, the CBK extended the zero-rated policy from July till December 31. While this increased mobile money subscribers by over 1.6 million, operators and banks have suffered a huge dip in revenues as a result of the directive.

Safaricom’s M-Pesa Revenue Falls by $56 million

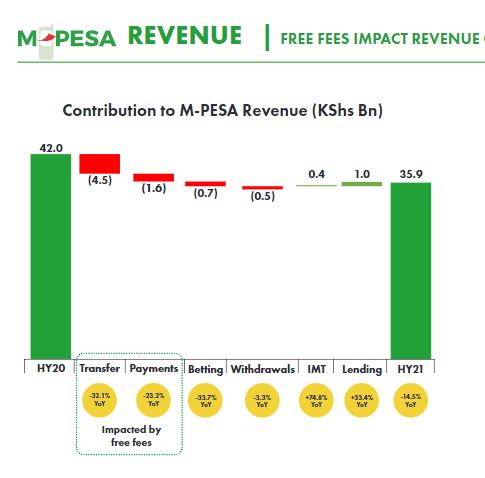

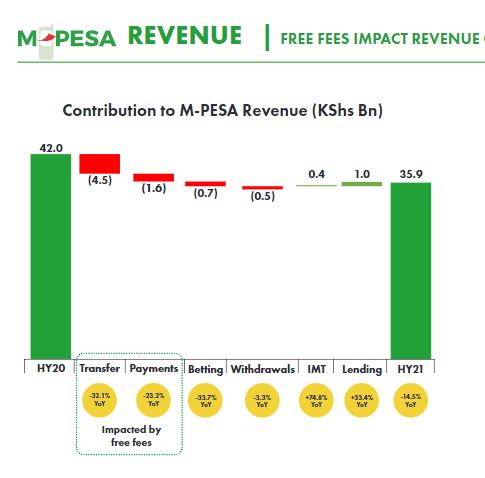

Safaricom recently published its unaudited financial results for the six months ended September 2020. Going by data from the H1 2021 report, M-Pesa’s revenue declined Y-o-Y by 14.5% from $385 million to $329 million.

The fall in M-Pesa revenue was largely brought about by Safaricom’s compliance with the free mobile money transfer directive by the CBK.

Although M-Pesa transaction value grew Y-o-Y by 32.9% to $82.9 billion, the value of transfers and payments reduced year-on-year by a combined 55.3% amounting to $55.96 million.

Zero-rated transactions on the mobile money platform were valued at $16.14 billion, the US dollar equivalent of KSh1.76 trillion.

But this did not yield much transfer revenue for M-Pesa as all P2P transfers under KSh1,000 as well as wallet to bank transactions were processed free of charge between April and September ending. For context, transfers below KSh1,000 accounted for over 80% of mobile money transfers in Kenya during that time.

Prior to the zero-rating directive, these band of transfers would have attracted charges between KSh11 to KSh49 depending on the amount.

KCB Profits Drop by 43.1%

The Kenya Commercial Bank (KCB) reported that its net profit had dropped by 43.1% in the nine months ending September 2020.

According to the bank, it has incurred losses of up to $13.8 million from the free bank to wallet transfers on mobile money platforms.

Before the zero-rating policy was introduced, bank to M-Pesa transactions attracted fees between Sh30 and Sh197. Waiving all these fees meant that banks could not realise any revenues from every bank to M-Pesa transfer conducted since the CBK directive was issued.

In summary, Safaricom and KCB appear to have been the biggest casualties of the free mobile money transfer implemented by the CBK. Owing to the significant decline in profits for both companies, it was perhaps expected that they would push against any further attempt by the CBK to extend zero-rated transfers beyond December 31.