Financial technology company, Kudimoney has received a Microfinance banking licence from the Central Bank of Nigeria (CBN), a significant leap in its launch of a full service digital No-Fee bank.

The Fintech startup is seeking to challenge the existing banking system that is riddled with tales of often inefficient services coupled with ridiculous charges to millions of customers.

In 2018, the top 11 Nigerian banks charged their customers a total of N143 billion as account maintenance fees. Of this sum, the CBN recovered over N65 billion charges wrongfully deducted from customers’ deposits as transaction fees.

Kudi is Kinda Free

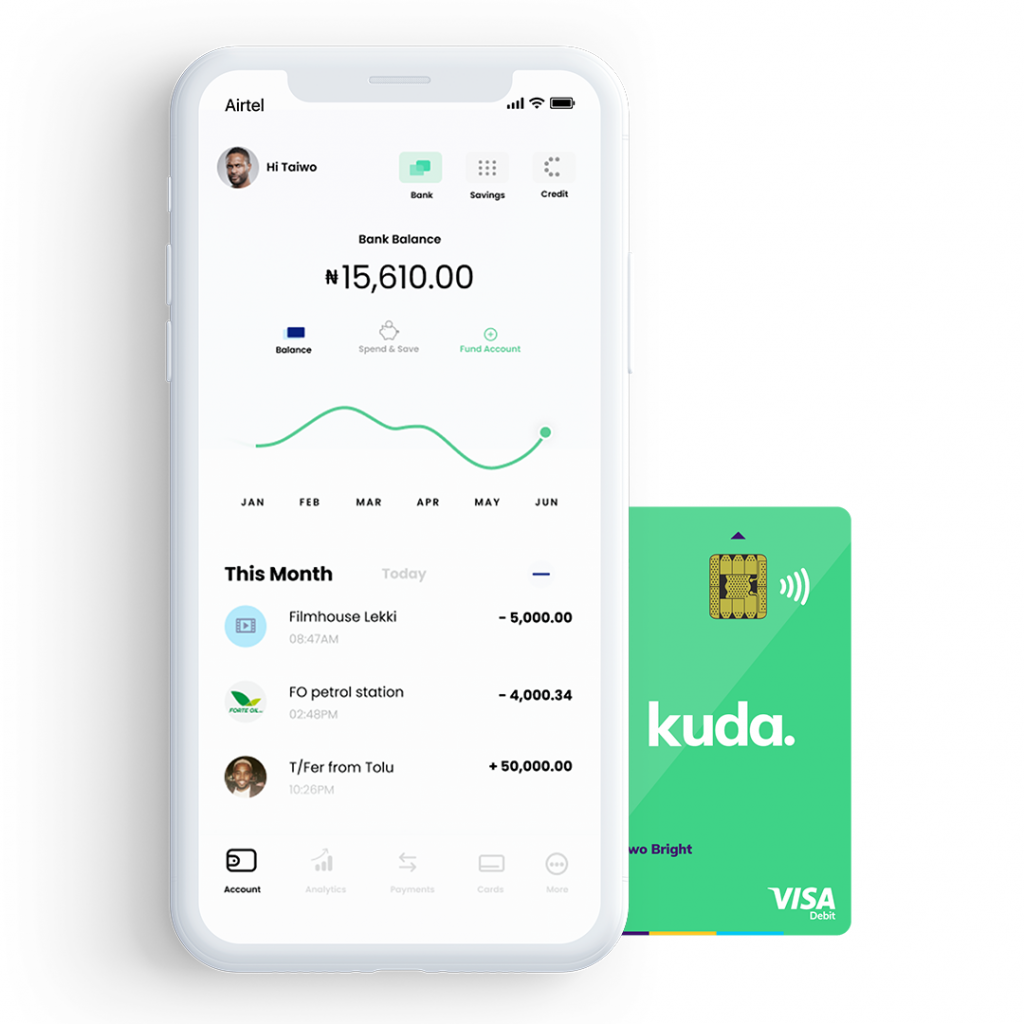

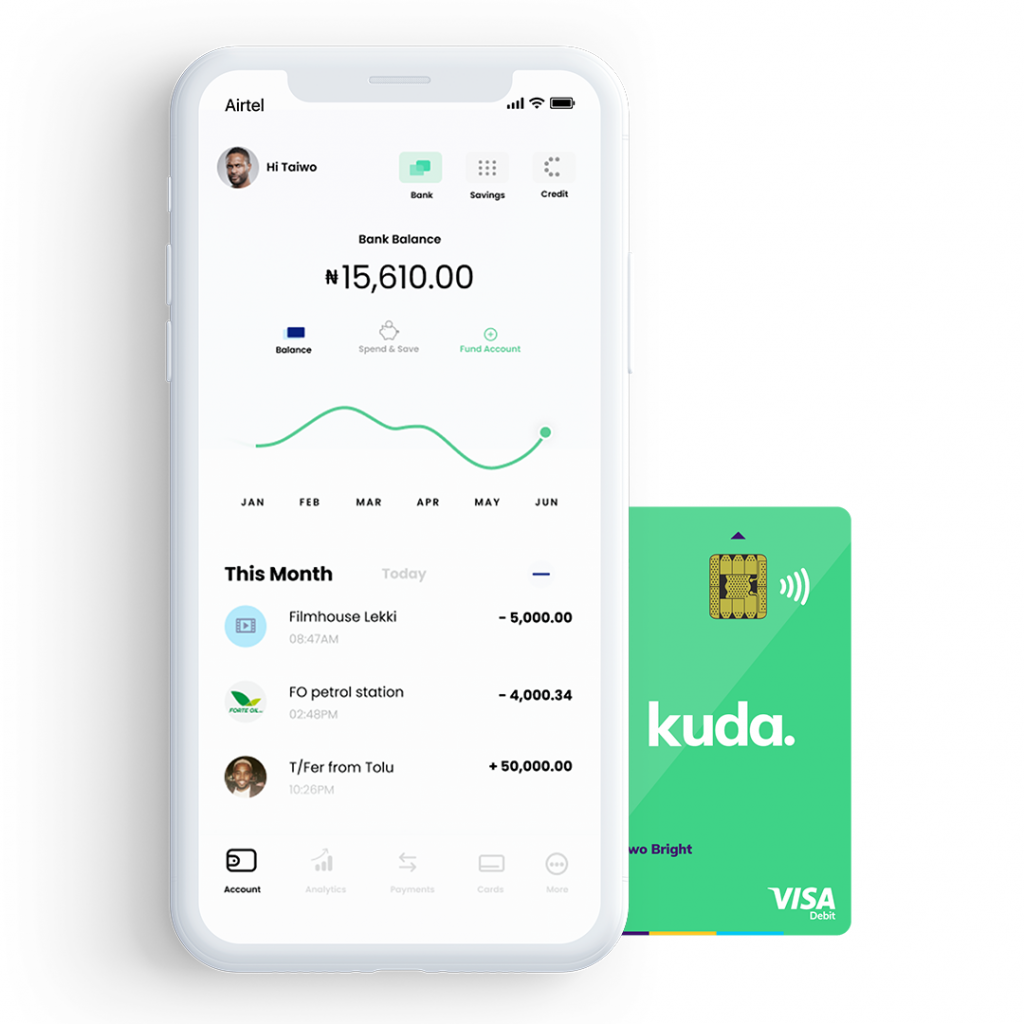

Kuda is offering free banking model instead. Benefits of this model include: runs predominantly on smartphones, charge a lot less than other banks do (as contradictory as it can sound, right?), insights, secure and reliable transactions.

The banking license will enable Kuda to offer current accounts as well as debit cards. The new bank has announced that it will be at the pre-launch phase for the next couple of months, offering services to a small group of alpha users.

The rollout will initially consist of a few thousand cards and launch in the third quarter of 2019.

Speaking on the development, Babs Ogundeyi, Co-founder said: “We’re excited to usher in a new era in consumer banking and serve the many Africans, who we believe are frustrated with traditional banks Starting with Nigeria, we’ll launch a new kind of bank with a continued focus on improving our members’ financial lives rather than trying to burden them with hidden fees and excessive charges”

Why Kuda?

The Kudimoney team explained their choice was forced by a frequent adoption of their previous name “Kudi” by other FinTech startups, “although we were in love with the name “Kudimoney”. The new direction was just a perfect excuse for a name change.

“In hindsight, we should not have been surprised it became the name of choice amongst FinTech startups, because in our launch region (Nigeria) Kudi means money”, they said.

This way, they are fully in the same Turf with Alat and Rubies Bank. We will see how it goes.